State of the Industry 2020 Report and Survey

Looming concerns about an economic downturn and political strife aren’t slowing the roofing industry down…yet.

Looming concerns about an economic downturn and political strife aren’t slowing the roofing industry down…yet.

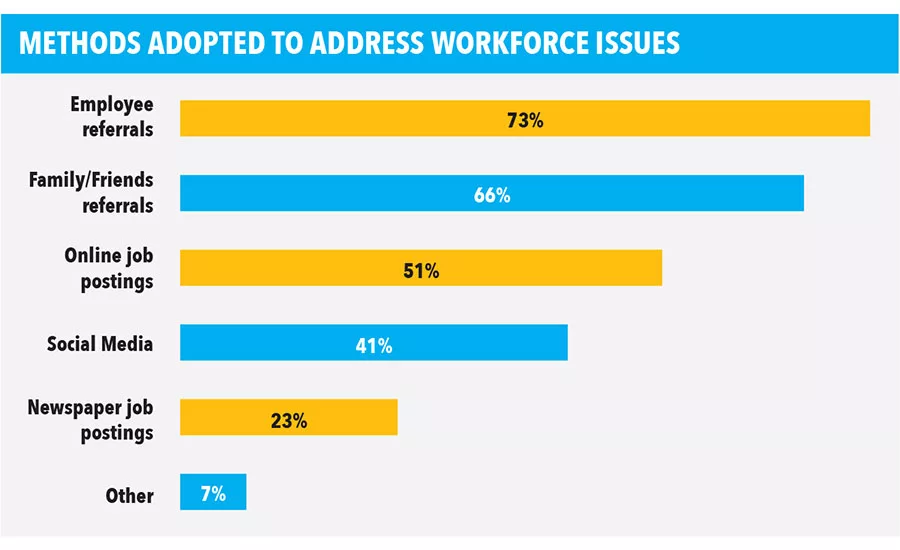

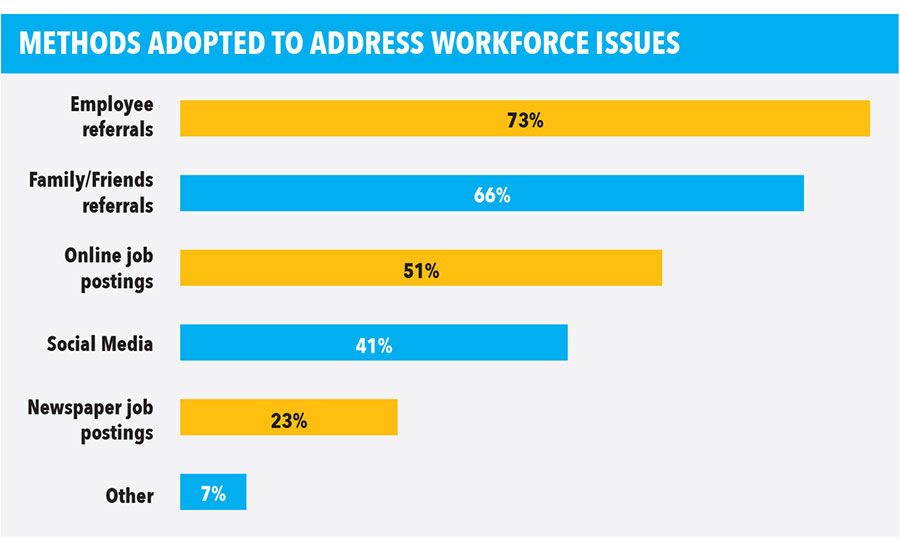

Methods Adopted to Address Workforce Issues

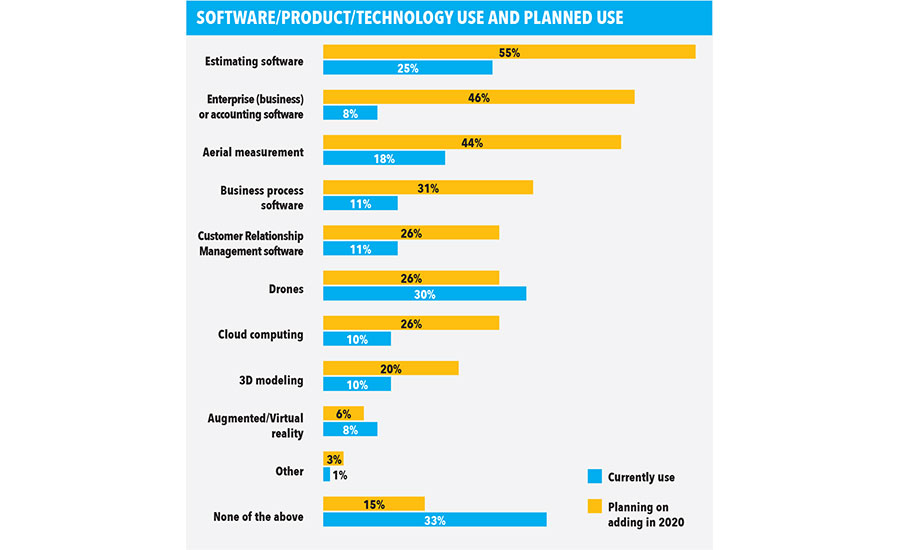

Software/Product/Technology Use and Planned Use

The start of the New Year also marked the beginning of a new decade in roofing, and for the most part, roofing contractors from across the United States are feeling optimistic about the state of the industry, according to RC’s exclusive annual survey.

As we have for the past dozen years, RC and Clear Seas Research — the survey and research arm of RC’s parent company, BNP Media — reached out to roofing professionals across the country to collect their perspectives on the residential and commercial markets in 2019, and to gauge their prospects for the year ahead.

The annual RC State of the Industry research study aims to identify current issues and emerging trends in both the commercial and residential sectors by asking the men and women dedicated to the profession. This online research initiative also focused on capturing the industry perspective on 2019’s successes and challenges, while keeping an eye on the years to come.

This exclusive study took a deep dive into the residential and commercial sides of the North American roofing industry, as roofing contractors shared with us their business experiences in 2019. For this research initiative, roofing contractors were defined as those working for companies generating more than 50% of their overall annual revenue from commercial or residential projects — whether that be in roof replacement, repair or new construction.

These contractors are predominately male (86%), with a median age of 50, representing mostly residential roofing companies. The majority of them in both residential (64%) and commercial (46%) indicated they were in corporate management or executive company leadership. The data showed the companies these roofers represent were mostly from the South (38%), followed by the Midwest (27%), the Northeast (18%) and West (17%). The median reported revenue for 2019 among all responding roofing contractors is between $1 million and $1.9 million.

Each respondent received a $15 individual incentive to participate.

Sales Forecast

It’s difficult to measure the health of any industry without monitoring sales, which is where this year’s survey began. More than two-thirds of all respondents indicated an increase in 2019 sales from the previous year, and an even higher proportion said they expect growth in 2020 and the next three years.

Overall, roofing contractors in both residential and commercial sectors overwhelmingly agreed that sales were likely going to increase and they were consistent with each other. Roughly 78% of commercial roofers said total sales volumes will increase in 2020, and 82% anticipated sales growth through 2022.

About 75% of residential roofers said sales will grow in 2020, and 78% anticipate that trend to climb steadily over the next three years.

The healthy surge in sales is impacting roofing contractors in certain markets irrespective of size.

Brent Zimmerman, owner of Champion Roofing in Altoona, Penn., reported $1.1 million revenue in 2018, with 20 full-time employees. The family-owned and operated company finished 2019 on target with a projected revenue of $2.5 million and added two crews and two salesmen.

“This is an amazing accomplishment. Just proves that hard work pays off!” said Zimmerman, who said he launched a roof repair team, increased local advertising and zeroed in on customer referrals last year. “We’re a fast growing company. We’ve expanded into nine more counties, doubled all of our SEO efforts, AdWords and TV advertising.”

Coming off consecutive record revenue years in 2017 and 2018 — largely due to storm work, Wortham Bros. Inc. in Dallas experienced a slight dip last year with less destructive weather incidents. However, the company’s 200 employees still generated more than $29.5 million by actively growing market share in the new construction and roof replacement spaces.

“Roofing contractors that rely on Mother Nature to produce revenue will be very inconsistent unless they chase storms. Wortham, on the other hand, has a revenue stream if the hailstorms hit or not,” said Co-owner Jacob Wortham. “So our warranty actually means something. We won’t close our doors or move away just because a storm doesn’t hit.”

The survey data suggests there’s even more optimism on the commercial side of the industry. Commercial roofing demand in the U.S. is expected to grow by at least 1.6% per year over the next several years, with a value as high as $8 billion.

Those projections have Timothy Dunlap, president and CEO of CentiMark Corp., feeling confident about the next decade, and that the top roofer on RC’s 2019 Top 100 Roofing Contractors List ($670 million) remains on course to become the first billion-dollar roofing company in the country.

“We were fortunate to experience continued sales and revenue growth across the entire organization,” said Dunlap, who credited increasing customer share with repeat clients and organic growth of new business for the continued year-over-year revenue gains.

“We believe that 6-7% increases allow for healthy and sustainable growth to offer comprehensive services for our customers and provide best-in-class quality roofing,” he added.

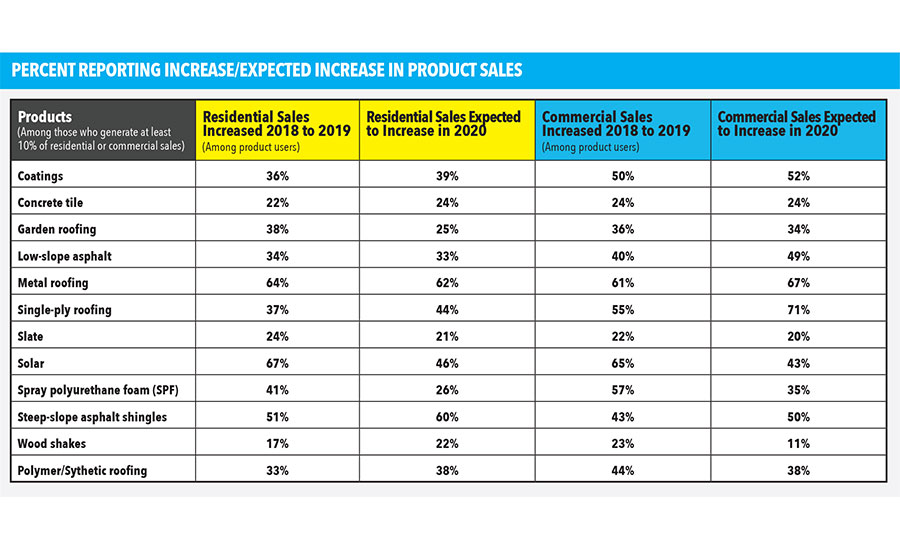

As far as products are concerned, nearly three-quarters (69%) of residential roofers said they currently install single-ply roofing systems, and 44% said they expect to see single-ply sales to grow in 2020.

Steep slope asphalt shingles continue to dominate the market, as expected, but manufacturers are paying close attention to demands for higher performance, extended or enhanced warranties and eye-catching products.

“Without a doubt, amid widespread increases in extreme weather across the continent, performance products are really driving the market right now,” said Scott Campbell, IKO Industry’s vice president of sales for the West. “The development of performance products that can withstand high-wind and high-impact weather events is an emerging trend for the industry. At the same time, customers’ desire for curb appeal has not diminished, driving demand for a shingle that demonstrates high impact and wind resistance without sacrificing its visual aesthetic.”

The same number of residential roofers (69%) said they now incorporate metal roofing into their service offerings, and 62% said they expect metal sales to grow this year. Another 39% of respondents indicated coatings sales should also grow this year.

In commercial roofing circles, 71% said single-ply sales will increase this year, and 67% singled out metal as a leading product category for growth. Coatings sales (52%), steep slope asphalt shingles (50%) and low slope asphalt (49%) rounded out the top five.

Workers Wanted

The roofing industry’s workforce woes continued throughout 2019 and show no concrete signs of slowing down this year.

The National Roofing Contractors Association (NRCA) estimates there are roughly 40,000 roofing-related positions that could be filled to meet demand, but nowhere near that amount of viable candidates to fill them.

According to the survey results, 65% of all roofing contractors found the lack of qualified workers to be the industry’s biggest challenge. Commercial roofers appeared to feel more of an impact, as 72% said it was their top concern, compared to 62% of residential roofers. More than half of both residential and commercial roofers identified lowball pricing and bidding wars as the next greatest challenge, followed by price increases of building materials (38%), rising healthcare and insurance costs (34%) and government regulations (21%).

The shortage is also having an impact on how companies define their employees. The majority of residential contractors said more than half of all field labor is performed by full-time employees while and 37% is done by subcontractors. About 12% of work is completed by part-time workers, the data showed.

The contrast is starker on the commercial side, where 72% of work is performed by full-time workers, and 23% is completed by subs.

Overall, about 60% of all respondents said their use of subs was consistent with 2018, but 33% said they saw an increase. The reasons varied, with cost, heavy workload, specialized projects and lack of qualified full-time workers at the top of the list.

Efforts are underway to try and stall or reverse the trend (see ProCertification Update column on page 76) but they take time to implement and yield results. To their credit, roofing contractors aren’t sitting idly by. The vast majority of survey respondents said they rely on referrals from other current or former employees (73%), followed by referrals from family members (66%). Online job postings, social media recruitment and traditional newspaper advertising rounded out the list.

In order to retain employees, 62% said they incentivize with bonuses and increased wages. Another 28% said they provide benefits, and 10% identified creating a friendly work environment and ensuring enough available work as top retention tools. Providing training rounded out the top five at just 8%.

When it comes to training, 86% of all respondents said they provide in-house and on-the-job training, but less than half (48%) have a formal in-house training program. Specific to safety, more than half of all companies that responded hold weekly safety meetings, while two-thirds provide training at least once a month. About 70% of companies provide all safety equipment, while 10% indicated all safety tools are the worker’s responsibility.

Overall, the data showed roughly 44% of contractors rely on manufacturer training and another 26% utilize training from professional roofing associations and organizations.

Those numbers should get stronger as the workforce shortage forces manufacturers to focus on boosting not just the quality of their products, but overall customer engagement.

“Across the country, we’re seeing increased interest in products that can make roofing crews more efficient,” said Mike Jost, COO of ABC Supply Co. Inc. “The labor shortage is still a concern, so products and systems that can get jobs done faster or require less labor are becoming more popular.”

Playing Politics

Efforts to improve the overall perception of roofing — both within and outside the industry — are also gaining momentum. Regional and national certification efforts, like the NRCA’s ProCertification, are underway and growing. Organizers of Roofing Day III — the industry’s largest national fly-in lobbying effort — are expecting a large turnout in Washington, D.C. on April 21-22.

Participants will be advocating for progress on key industry issues like immigration reform, funding for career and technical education programs, and innovations in energy-efficient technology.

NRCA CEO Reid Ribble, a former congressman from Wisconsin, is also planning to maximize election-year interest in politics by declaring a “month of action” this August. He said the NRCA plans to invite every lawmaker on Capitol Hill to a roofing company in their district while on the campaign trail.

While much of nation’s focus will be trained on the presidential race, roofing contractors should pay attention to congressional races that could impact more of their day-to-day operations, said longtime roofing industry lobbyist Craig Brightup. He said Republicans are poised to add seats in the U.S. House of Representatives, though gaining a majority is a stretch. So too is the likelihood of Democrats flipping control in the U.S. Senate, he said.

While there’s bipartisan support for career and technical education, the volatile nature of the relationship between congress and the Trump administration will continue to hamper a deal on immigration. That could change with expected rulings from the U.S. Supreme Court later this year, as well as any dramatic changeover at the White House.

“We won’t know until Nov. 3, but if there is (a change in presidential power), it would have a major impact on the roofing industry,” Brightup explained. “The roofing industry should focus on which candidates have the most realistic platforms for economic growth and which special interest groups are supporting them.”

Regardless of the outcome in November, all of the roofing industry’s efforts combined are beginning to make a difference.

“The roofing industry has always been a great place to earn a living and build a career, but it appears that we are getting better at projecting a positive image,” Jost said. “We’re doing this by spending more time and resources on marketing and by investing in technologies that will be attractive to the workforce in 2020. This gives us hope that we’ll be able to attract even more qualified candidates into our industry.”

Talking Technology

Of all the technology available to contractors, cloud services and computing are the most used in the industry, followed by drones and on-the-job mobile devices or wearables. More specifically, the software that respondents currently use the most are estimating (55%), followed by enterprise or accounting (46%) and aerial measurement (44%).

This is a contrast to last year’s results, which showed drones being the most currently used technology. Members of the Roofing Technology Think Tank (RT3), a group of roofing professionals striving to find and promote technology solutions in the industry, believe this is a sign that companies are leaning toward increased project management and inter-company communication.

“Building envelope measurement is widely used, drone services are now common, but the true value is when all of these tools to connect with each other,” said Anna Anderson, RT3 board member. “True value comes when integrations are available through open application programming interfaces.”

Only 26% of respondents said they currently use drones. However, nearly a third (30%) said they plan on adding drones to their repertoire in 2020, making it the most wanted technology in the survey. Another 7% said they plan to adopt drone technology in the next three to five years.

Respondents use drones on an average of one-third of their projects. When using drones, they use them primarily for taking before-and-after photos and videos (94%), followed by capturing marketing photos and videos (81%). Other uses include inspections (67%), gathering measurements (44%), and thermal inspections (29%).

“We are seeing the use of aerial imagery not only become adopted throughout the entire roofing industry, but the number of uses and benefits are really bringing value,” said Ken Kelly, president of Kelly Roofing in Bonita Springs, Fla., and RT3 board member. “As this technology is just now reaching critical mass, it’s likely more innovation will continue to revolutionize the industry.”

In following last year’s trends, 56% of contractors said they don’t plan on adopting virtual or augmented reality technology, but 10% said they plan on bringing it into the fold within the next two years. This is due to roofers realizing they can use it both for marketing and training purposes.

“A specific technology that excites us is augmented reality headsets and communication apps,” said Tom Whitaker, president of Harness Software and RT3 board member. “These represent the best opportunity to leverage the experience of older workers to train and manage a new generation.”

One area that is slowly gaining traction is artificial intelligence (AI). As contractors continue to collect data using various software and CRMs, that data can be put to good use. That data, when plugged into AI, can be used for project planning, risk management, quality control, and even suggest potential clients. More than half said they don’t plan on using AI, but 12% said they’ll likely add it to their business in the next year or two.

Conversely, roofers aren’t as ready to adopt robot technology. Almost three-fourths (70%) of respondents said they have no plans to use robots in their business model, which is up from last year’s 67%. Biometrics is another area the majority of roofers have shied away from with only 6% currently using technology like fingerprint and retinal access, while 65% said they have no intentions of using it.

Overall, technology will continue to remain an integral part of the industry, and those that embrace it can expect to see continued success into the future despite battling a labor shortage.

“The reduction of an available workforce requires roofing companies to become more efficient, therefore streamlining rooftop administrative and labor processes is top priority,” said Steve Little, president of KPost Roofing & Waterproofing in Dallas. “In the end, this is still a ‘people’ business and taking care of your ‘people’ results in a sustainable business.”

Conclusion

Survey data shows there’s a lot for roofing contractors in either residential or commercial markets to look forward to this year, and a few years beyond. Fears of an economic slowdown, costs of materials, new regulations and the uncertainty with immigration policy are keeping even the most optimistic roofing professionals guarded when trying to describe what the roofing industry will look like a decade from now.

With technological innovation on the rise, and the total number of skilled workers still on the decline, 2020 may be a critical year for roofing contractors of all sizes as they anticipate changing weather patterns, political turmoil and some correction in market conditions.

The information contained within this article is comes from: Clear Seas Research 2019 Roofing Contractor State of the Industry Report.

A total of roughly 22,000 roofing professionals were invited to participate in the research which fielded from Oct. 24-31, 2019 through Clear

Seas Research. The full report includes the responses from 197 U.S. roofing contractors. To purchase your copy of this report please visit https://www.clearseasresearch.com/product/2019-roofing-state-of-the-industry/.

Clear Seas Research is a full service, B-to-B market research company focused on making the complex clear. Custom research solutions include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!