ARMA Q4 Report: Asphalt Product Shipments Continue to Decline

Asphalt-based roofing products saw up to 17% declines in shipments in the final quarter of 2021, though year-to-date comparisons are hinting at improvements in the supply chain crisis.

Data from the Asphalt Roofing Manufacturers Association’s (ARMA) Quarterly Product Shipment Report indicates shipments in shingles, BUR and modified bitumen all decreased when comparing the third quarter and fourth quarter.

According to the report, shipments of U.S. shingles dropped by 11.9% from Q3 to Q4 in 2021. Shingle shipments in Canada saw a similar decrease of 12.4%. U.S. modified bitumen shipments and BUR (not including saturated felts) dropped by 17.8% and 17.7%, respectively.

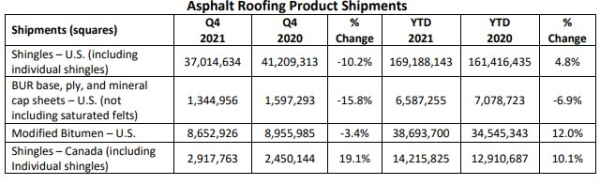

When comparing Q4 2021 to the same time last year, shingle shipments in the U.S. are down by 10.2%, while BUR declined by 15.8% and modified bitumen by 3.4%. Shingle shipments in Canada, however, had an impressive 19.1% increase when compared to Q4 2020.

The numbers aren't a surprise to anyone who has been paying attention to the supply chain in the past year. What started as minor supply disruptions in late 2020 and early 2021 transformed into a full-blown crisis in the past year, causing delays, price hikes and lost revenue across the industry. Raw material shortages forced a slowdown in production while a lack of transportation and supply chain workers delayed shipments even further.

What is surprising is that these decreases aren’t as devastating as they appear. When examining the shipment numbers from Q3 to Q4 in 2020, the decreases are similar. U.S. shingle shipments dropped by 12% while modified bitumen only dropped 5.3%. BUR, however, saw a 25% drop at the time, while Canadian shingles saw a 31% decrease.

Year-to-date comparisons offer some hope that the industry is slowly making its way out of the supply chain shortage quagmire. The total number of U.S. shingle shipments are up by 4.8% compared to Q4 2020, as are Canadian shingle shipments (10.1%) and modified bitumen (12%). Only BUR saw a decrease from 2020 with a drop of 6.9% in shipments.

Fighting the Supply Shortage

On the low-slope side of the industry, Jennifer Ford-Smith, director of marketing and product management at Johns Manville, told RC that 2021 was one of the most challenging years not only for Johns Manville, but the entire industry.

“By March of 2021, we had suppliers of ours putting us on allocation. So even if our plants had line time and labor, there wasn’t enough raw materials to push through the process,” said Ford-Smith. “Beyond the allocation, came transportation issues, so even if a supplier could get us product, they struggled to find rail and/or trucks to transport it in our facilities.

“I think the positive outcome was that it brought us even closer to our customers,” she added. “The key was communication and transparency, which can only be done through the long-standing relationships that JM has been able to establish with our customer base.”

Earlier this month, Owens Corning issued a letter saying the company is planning significant investments this year and next, including a multi-million dollar effort to increase capacity across its network of shingle plants.

“We invest every year in process improvements and automation to increase the throughput at our manufacturing sites, but … we need to accelerate increased production capabilities to support growing demand for Owens Corning roofing products,” Owens Corning President Gunner Smith wrote.

Jeff Williams, director of marketing and branding for IKO North America, said the pandemic and supply shortages affected his company as well, but noted it also caused companies to adapt for the better.

“Many things that were only done face to face we’ve now established can still be accomplished from across a closed border,” he said. “It’s going to make us better and more responsive in the long run, even when there are technical challenges.”

Johns Manville, Owens Corning and IKO are members of ARMA. The shipment report is a culmination of roofing product shipment data collected from participating manufacturers by an independent third party.

Editor Art Aisner contributed to this report.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!