ARMA Q3 Report Shows Double-Digit Declines in Asphalt Product Shipments

Shipments of asphalt roofing products are down in the third quarter of 2021, a painful reminder that the industry’s supply shortage crisis is far from over.

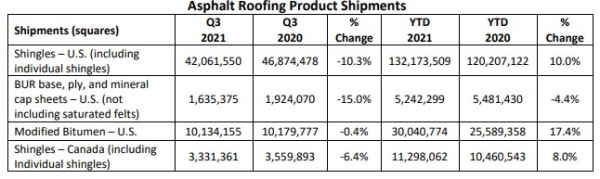

The latest Quarterly Product Shipment Report from the Asphalt Roofing Manufacturers Association (ARMA) indicates that shipments in all products the report tracks — shingles, modified bitumen and BUR base, ply and mineral cap sheets — all saw drops when compared to the second quarter of 2021.

Shipments of U.S. shingles are down by 10.2%, while Canadian shingle shipments have declined by 12.8%. BUR products saw the largest decrease at 15.2%, while modified bitumen shipments shrank by 6%. This is a stark contrast from the second quarter report that showed improvements in nearly every product when stacked against Q1 shipments.

The data is just the latest indicator of the roofing industry’s supply shortage, which is affecting nearly every type of product in both residential and commercial sectors. The global pandemic caused the initial shortages, which were only exasperated by natural disasters like Hurricane Ida and record-breaking shipping freighter delays. It’s an unprecedented crisis that prompted the National Roofing Contractors Association (NRCA) to recently send a letter to the Department of Energy asking for help.

“Without federal assistance, the key material components needed to provide shelter to hundreds of thousands of Americans and businesses could be delayed for many months,” the letter states.

Asphalt shipment numbers aren’t any better when comparing the third quarter to the same time last year. U.S. shingle shipments dropped by 10.3% in that span, 6.4% for Canadian shingles and 15% for BUR product shipments. Modified bitumen only decreased by 0.6% when compared to Q3 2020.

“It does appear that roofing seems to be impacted more greatly by the supply challenges than some of the other vertical markets or construction areas that we participate in," said Brian Whelan, executive vice president of SIKA North America, during an NRCA telephone town hall. “I think a big part of that is we make, and you folks install, a complete roof system — so it’s not one component, and if we’re missing one component out of the roof system, unfortunately it just messes up everyone’s schedules.”

The report’s findings aren’t all dire, as year-to-date shipments for U.S. shingles are up 10% compared to last year. Modified bitumen is up as well, with 17.4% more shipments taking place this year.

Price Increases Will Continue

The crisis is not only causing delayed jobs, but price increases on the supplies that are available. According to an analysis of Bureau of Labor Statistics data by Associated Builders and Contractors (ABC), construction input prices are 18.9% higher than in September 2020.

“Despite the monthly decline in construction input prices, contractors should expect elevated and likely rising prices for months to come,” said ABC Chief Economist Anirban Basu in a written statement. “In addition to ongoing, global supply chain disruptions, which in many instances are worsening, transportation costs are surging due to rising fuel prices and insufficient capacity.”

With this grim forecast in mind, Basu offers a word of advice to contractors: use greater care and caution with respect to contractual obligations than in the past.

“Input prices are likely to remain volatile, and shortages of key materials and equipment will continue to result in project delivery delays,” Basu said. “Accordingly, contractors need to be especially focused on limiting their financial and legal exposure during a period sure to be associated with price volatility and supply chain challenges.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!