Supply Chain

ARMA Q3 2023 Report: Asphalt Product Shipments Drop in Third Quarter

Third quarter shows expected decreases from Q2 while year-to-year comparisons indicate mixed news

The ARMA Bronze Award was presented to Wedge Roofing for the Hardy Residence of Dillion Beach, Calif. Photo: Ralph Wedge.

Shipments of asphalt roofing products in the United States and Canada followed the years-long trend of slowing down in the third quarter, with 2023 potentially experiencing the lowest number of shipments in years for certain products.

The Q3 2023 Quarterly Product Shipment Report from the Asphalt Roofing Manufacturers Association [ARMA] revealed the amount of shipments for shingles, built-up roofing [BUR] and modified bitumen dropped in the third quarter. Like the previous two years, shipments decreased compared to a strong Q2, with most of the decreases in the double-digit percentages.

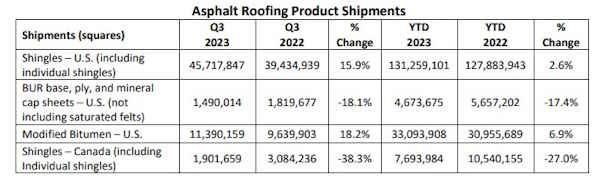

The following shows how Q3 2023 shipments compared to Q2 2023 (reported in squares):

- U.S. Shingles: 46 million, down 11.6%

- BUR Base, Ply and Mineral Sheet Caps: 1.5 million, down 17.5%

- Modified Bitumen: 11 million, down 5.6%

- Canada Shingles: 1.9 million, down 20.8%

The decreases are relatively close to what the asphalt industry experienced this time last year, indicating supply chain issues influenced by material price increases, inflation, labor, and new and on-going conflicts across the globe may not have returned to pre-pandemic levels. Industry headwinds have not calmed, said Associated Builders and Contractors Chief Economist Anirban Basu, when commenting on construction backlogs.

“Interest rates are still edging higher. Political dysfunction in Washington persists. Rising worker compensation costs and lingering supply chain issues are still frustrating industry performance and profitability," said Basu in a written statement. "The U.S. economy appears poised to slow further. If the past is any indication, that will eventually catch up to construction in the form of dissipating demand."

Economists have prophesized a recession for more than a year, yet the construction industry still shows forward movement, says Basu, with the exception of contractors unable to secure enough skilled workers. He noted labor issues will not change anytime soon and could "only be countered by a sharp downturn in construction activity.”

ARMA reports from the pre-pandemic year of 2019 show from Q2 to Q3 2019, U.S. shingles were down 13.4%, BUR down by 2.9%, mod bit down by 0.9%, and Canadian shingles by 21.6%. In 2018, though, all shipments were down by single-digit decreases with the exception of mod bit.

Since ARMA’s first report in 2018, the only year to buck the trend of all shipments decreasing in the third quarter is 2020. That quarter-to-quarter comparison saw increases in U.S. and Canadian shingle shipments, likely caused by millions of people working from home due to pandemic-related restrictions and seeking out home improvements.

Not all is doom and gloom. In terms of volume, Q3 2023 saw a record number of mod bit shipments when compared to previous third-quarter shipments. The number of mod bit shipments was reported at 11 million.

The same can’t be said for the remaining products, most notably Canadian shingles, which had its worst third quarter in the history of ARMA's reports.

Year-to-Year Shows Record Shipments

According to ARMA’s data, comparing Q3 2023 to the same time last year shows a mixed bag of news.

- U.S. Shingles: Up 15.9%

- BUR Base, Ply and Mineral Sheet Caps: Down 18.1%

- Modified Bitumen: Up 18.2%

- Canada Shingles: Down 38.3%

This year-to-year comparison is slightly better than what the asphalt industry saw in Q3 2020 to 2021, where all four product categories fell in shipments.

ARMA also calculates the year-to-date totals in its reports, showing the overall number of shipments made as of the end of Q3 2023. With the exception of mod bit, which is 1.8% higher, all year-to-date shipment totals are down when comparing 2022 and 2023 (see the chart above).

Overall, 2023’s year-to-date totals are a mix of record highs and lows. BUR’s totals are the lowest in the report’s Q3 history at 4.6 million, as are Canadian shingles at 7.6 million, but mod bit is at its highest year-to-date Q3 total. If the numbers continue as they have, 2023 might be the lowest shipping amounts for BUR and Canadian shingles in the history of the reports.

Year-to-date U.S. shingle shipments have fared better than last year’s totals, up by 2.6%, while mod bit is up by 6.9%.

Roofing product shipment data is collected from participating manufacturers by an independent third party, Association Research Inc., and aggregated to create ARMA's reports.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!