Construction Employment Analysis

ABC: Construction Hiring Remains Low in June 2025

Unemployment remains low, but federal policies continue to affect hiring

Graph courtesy of Associated Builders and Contractors.

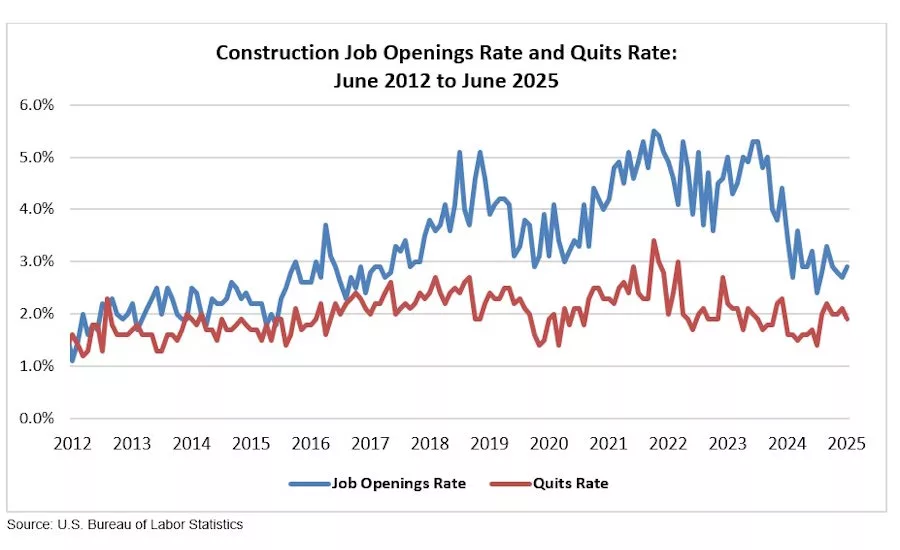

The construction industry had 246,000 job openings on the last day of June, according to an Associated Builders and Contractors analysis of data from the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey.

The survey defines a job opening as any unfilled position for which an employer is actively recruiting. Industry job openings increased by 14,000 last month but are down by 39,000 from the same time last year.

“While industrywide job openings increased in June, the share of all construction positions that are unfilled remains low by recent standards,” said ABC Chief Economist Anirban Basu. “More importantly, the hiring rate during the first half of 2025 was lower than during the first six months of any year since the start of the data series in 2000."

Contractors have been laying workers off at a historically slow pace, Basu said. As a result, employment across the industry is edging higher, but fewer job openings and reduced hiring efforts indicate a weak demand for labor.

“That said, these data likely reflect the fact that the residential segment has struggled mightily this year, while nonresidential employment data have been more upbeat,” said Basu.

He said fewer than 14% of ABC members expect staffing levels to decrease during the second half of 2025, according to the association's Construction Confidence Index. This suggests that the nonresidential side of the industry will continue to add jobs during the third and fourth quarter of 2025.

A slowdown in housing could be partly to blame. U.S. Census Bureau housing data shows June housing starts totaled 1.32 million units at a seasonally adjusted annual rate, which was flat compared to June 2024's 1.33 million units. Regarding roofing, single-family starts declined 4.6% month-over-month to 883,000 units in June, while multifamily construction (buildings with five or more units) reached 414,000 units.

A new midyear forecast and housing market report from Realtor.com shows home sales are expected to land at 4 million in 2025, just behind 2024. Meanwhile, home prices climb, but growth is expected to slow by more than 2.5%.

"In the grand scheme, housing still costs too much for many to feel like they have a fair shot at attaining homeownership," the Realtor.com report says. "We’re starting to see this in slipping homeownership rates, which we project to ebb to 65.3%."

Low Unemployment

Graph courtesy of Associated Builders and Contractors

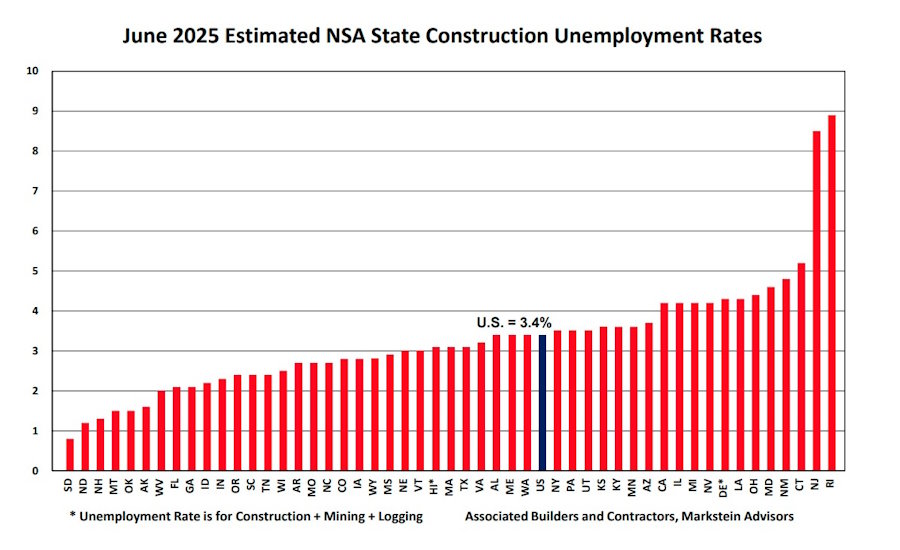

Additional analysis from ABC shows that the June 2025 not seasonally adjusted construction unemployment rate was 3.4%, a 0.1% increase from the same time last year. The analysis shows 18 states had lower estimated construction unemployment rates over the same period, while 28 had higher rates. The remaining four had the same rates. All states had construction unemployment rates below 10%.

National NSA payroll construction employment was 114,000 higher than June 2024. As of June 2025, seasonally adjusted payroll construction employment was 8.3 million, or 9.4%, above its pre-pandemic peak of 7.6 million.

“While June state construction unemployment rates continue to indicate a relatively healthy level of construction employment, uneasiness that the economy might weaken over the remainder of this year and into 2026 is producing some hesitancy among builders and developers about proceeding with new projects,” said Bernard Markstein, president and chief economist of Markstein Advisors, who conducted the analysis for ABC.

Overall, the unemployment rate is at near historically low levels and job growth remains robust, though it has slowed down from previous highs.

Federal Policies

Construction employment has both benefited and been impacted by federal policies enacted during President Donald Trump's second term. The One Big Beautiful Bill Act increases the state and local tax deduction, meaning homeowners in higher-tax states will be able to subtract up to $40,000 from their income. Realtor.com notes this is welcomed in an environment where both median assessments and property tax burdens have increased.

Federal government data shows the U.S. economy expanded more than expected, with the gross domestic product rising at a 3% annualized rate over three months ending in June. This indicates sturdy growth and that the economy has avoided a cooldown due to the tariffs. It's worth noting, though, that the GDP formula subtracts imports to exclude foreign production.

"Compared to the first quarter, the upturn in real GDP in the second quarter primarily reflected a downturn in imports and an acceleration in consumer spending that were partly offset by a downturn in investment," a report from the Bureau of Economic Analysis said.

This isn't to say tariffs aren't having an impact. In the months following Trump's "Liberation Day" tariffs, consumer sentiment has declined, and building material prices continue to rise.

“The impact of tariffs on building materials is already showing up in some prices," said Markstein. "Meanwhile, uncertainty surrounding the level of tariffs on building materials going forward and how long they will be in place hangs over the industry.

"Further, the industry continues to face elevated interest rates and higher labor costs. Although most builders are loath to lay off workers at present, they are more cautious in their hiring.”

Trade deals continue to be debated, with the European Union agreeing to a15% tariff on most goods, below the previously proposed 30%. Trump recently proposed a 25% tariff for India beginning Aug. 1, along with an addition to a "penalty" for India's purchasing of military equipment from Russia.

The administration's crackdown on immigrants illegally living in the country has also impacted employment. The roofing industry relies on an immigrant workforce to shore up its chronic labor shortage. However, the visible and contested tactics of Immigration and Customs Enforcement have led to workers quitting or refusing to work out of fear of being arrested and deported.

Increased funding for ICE and immigration enforcement efforts is expected to impact the roofing industry, with ICE receiving $75 billion from the Big Beautiful Bill.

A report from Reuters shows the impact of these raids, where a construction job near Mobile, Ala., set to be completed on time by Nov. 1, is now delayed by three weeks after ICE raids scared off half of the construction company's employees. The site superintendent told Reuters that the roof has yet to be finished, exposing the interior to rain during storm season. His company faces potentially $84,000 in extra costs for the delays, under a "liquidated damages" clause.

“The threats and the reporting of raids have caused workers to not show up at job sites, just whole crews for fear of a raid,” said Jim Tobin, the CEO of the National Association of Home Builders.

A survey of Latinos in the U.S. — a demographic that makes up a third of the roofing workforce — showed that 35% of Latino voters say employers lost workers due to fear of arrests. Around 30% say they don’t go out to eat or shop because they’re afraid of immigration enforcement.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

.webp?height=200&t=1735294415&width=200)