Sponsored by Elevate

Metal Deck Insulation Options

Image courtesy of Inland Coatings

Water leaks are an excellent motivator for plant managers, building management firms and owners to spend money and fix the roof. Why are building owners and management firms not considering the operational cost associated with energy efficiency?

Tax credits and rebates have long been available in the residential space. Commercial construction, including retrofit roofing work for existing buildings, now enjoys those same benefits through the Inflation Reduction Act.

The 179D tax credit is available to building owners for new or retrofit roofing activities. Owners may receive a tax credit between $1.88 and $5 per square foot, depending on the extent of the energy improvements associated with the work.

Two questions arise from the building owner’s perspective:

- How can I stop the leaks and lower my operating costs through energy efficiency?

- How do I show the potential for energy savings?

As contractors, we answer the first question by adding insulation to the roof deck and maybe providing an estimated savings analysis, but only dealing with the insulation upgrade. What about air leakage?

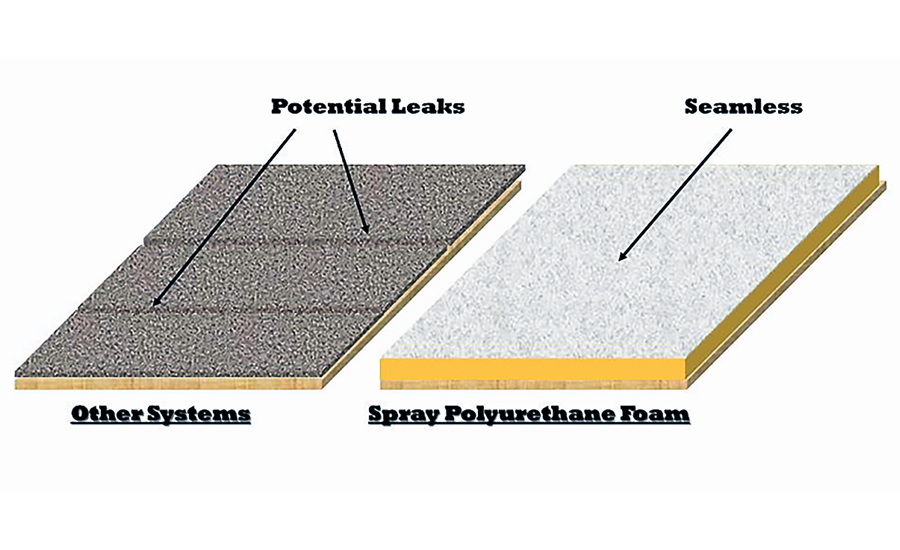

Spray foam insulation and fluid-applied coatings can provide a more long-lasting alternative. Spray foam insulation is monolithic — meaning no seams or joints — fully adhered, giving it the highest wind uplift performance.

Infographic courtesy of Universal Coatings, Inc.

Air Leakage

The U.S. Department of Energy and the National Institute of Standards and Technology has stated, “40%-60% of the HVAC cost for buildings is due to uncontrolled air leakage through the envelope.” Air leakage (and water leaks) associated with the roof and the roof/wall junction play a substantial role in that “40%-60%” figure.

In retrofit applications, air leakage control is assumed to be eliminated at the perimeter and penetrations through typical detailing. However, assuring a long-lasting seal can be problematic with sheet membranes and board insulations.

Spray foam insulation and fluid-applied coatings can provide a more long-lasting alternative. Spray foam insulation is monolithic — meaning no seams or joints — fully adhered, giving it the highest wind uplift performance; it can be applied directly to the existing insulated roof covering system in retrofit applications over metal decks.

Air sealing is the key.

Spray foam will completely seal all penetrations and eliminate air leakage at all the metal panel seams when installed above the deck. By adding SPF to the exterior of the metal deck, we "put the deck to sleep" from a thermal expansion perspective and seal the perimeter and all penetrations, eliminating bulk water and air leakage.

What about the energy savings calculation?

Energy-Saving Calculation

To qualify for the 179D tax credit, the entity must show a minimum of 25% energy cost savings over the previous year. Why this requirement is not based on consumption rather than cost is a discussion for another time.

Upgrading roof insulation generally doesn’t get us enough savings to qualify, and contractors typically don’t know how to quantify the air leakage contribution; depending on the products and assemblies chosen, it may not be there.

As the value of energy-efficient roofs is being realized and the role air infiltration plays, a revenue stream is emerging for building envelope energy auditors. Roofing contractors can play an important role as auditors should they choose to include a roof-only or whole building envelope audit in their bid submission. Or add “building envelope auditing” to their service platform.

Three revenue streams are available: the first as auditors, the second as the contractor performing the work identified in the audit, and maintenance to maintain the air barrier integrity of the building envelope.

Several training opportunities focus on general roofing good practices, roofing materials, air barriers and general insulation. Still, the combination of auditor training and a suitable calculator to calculate energy savings in dollars and environmental impact is more difficult to find.

These are early days for the 179D tax credit and the need for a “proof statement.” One program, Building Envelope Auditor Team, or BEAT, provides auditor training, a recognized calculator, a report and support to provide building owners with justified estimates of operational cost savings, financial payback and reduced environmental impact. There are a handful of others, including CanAm/ITW and BPI.

As we expand our understanding of the role roofing plays in building energy efficiency — and roofing contractors look for opportunities in commercial retrofit — I see a need for envelope auditors who understand roof construction and the envelope.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!