Trade Association Sues Florida Insurance Commissioner For Alleged Violation of State Constitution

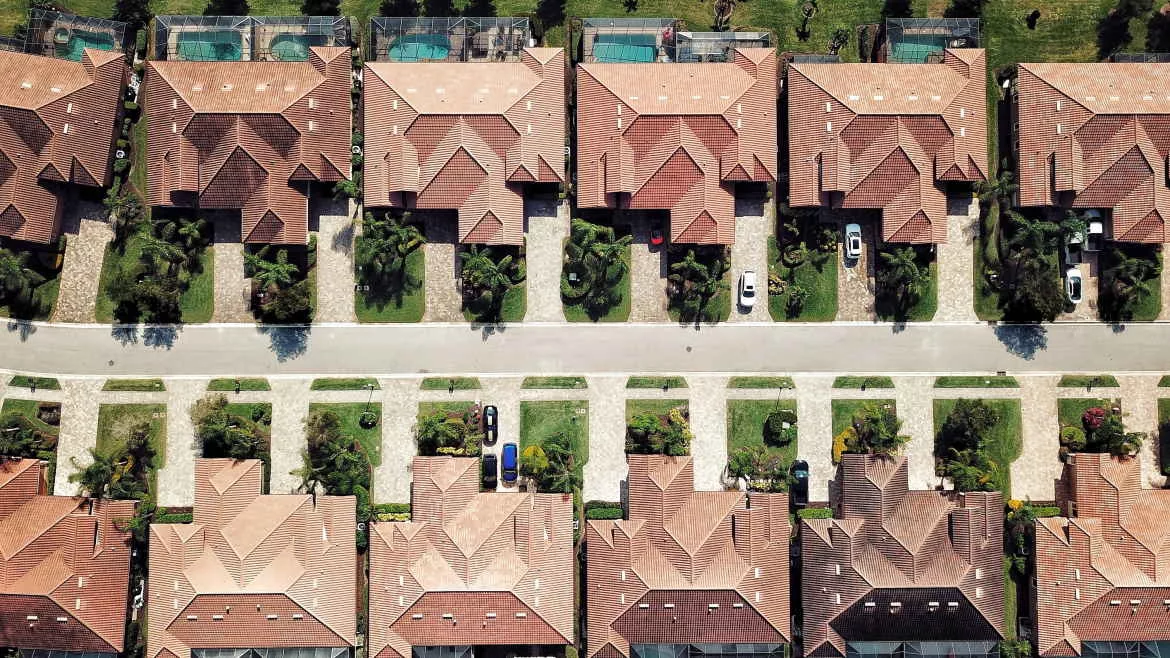

Photo by Ameer Basheer on Unsplash.

TALLAHASSEE, Fla. — With the Florida Legislature preparing to debate property insurance legislation during next week's special session, a nonprofit trade association, whose members include roofing contractors, sued the Florida Office of Insurance Regulation and two insurance companies.

The lawsuit asserts that Florida Insurance Commissioner David Altmaier improperly allowed the companies to circumvent state law in order to change customers’ policies, violating state law and the Florida Constitution.

The Restoration Association of Florida (RAF) filed suit in Leon County Circuit Court, arguing that Altmaier violated public policy established by the Legislature when he allowed American Integrity Insurance Company of Florida and Heritage Property & Casualty Insurance Company to change consumers’ insurance policies. Those changes restricted homeowners’ rights regarding repair work and violated Florida’s Homeowner Claims Bill of Rights, the lawsuit says.

“Every year, Florida homeowners and businesses pay the ever-increasing cost of property insurance premiums with the expectation that they will be covered when they need it most,” said RAF President Richie Kidwell. “It’s only then that they realize state regulators have allowed insurance companies to unjustifiably stack the deck against them and erode their ability to be made whole.”

The complaint states that insurance companies have been allowed “to mount as many barriers as possible to homeowners receiving the proceeds of their policies for lawful claims while, at the same time, reaping the benefits of policy premiums paid by Floridians.”

RAF advocates for the rights of homeowners and independent contractor businesses. The association is seeking an injunction declaring the revised insurance policies invalid and allowing its members to continue to work with homeowners to perform necessary repairs or inspection services without the threat that these important activities would be restricted by the two insurance companies’ revised policies.

Kidwell noted that insurance companies have reaped billions of dollars in profits over the last several years, even as homeowners and other property owners have suffered from escalating insurance premiums. He said home insurance-related lawsuits have reportedly declined as a result of legislation passed in 2021, but insurance companies have still refused to lower premiums.

“Insurance companies have shown a steady and repeated pattern of grabbing every dollar they can from consumers and then doing everything they can to keep that money for themselves, rather than lower rates for their customers,” Kidwell said. “This must change if Floridians want to receive relief from skyrocketing insurance premiums.”

The special session of the Florida Legislature will address the ongoing issues and high premiums with the state's property insurance marketplace. Some companies are proposing double-digit rate increases ahead of the session, asking for at least 20% increases statewide One company, Florida Farm Bureau Casualty Insurance Company, is proposing a 48.7% increase for homeowners multi-peril.

"Florida is nearing a tipping point, and our neighborhoods are in danger of losing their viability," said Sen. Minority Leader Lauren Book in a letter to Gov. Ron DeSantis. "Some insurance companies have been unable to reissue policies, are ceasing operations or are pricing renewals at unaffordable rates leaving thousands of Floridians with the unsettling surprise that they’ve lost coverage, and must scramble to protect their most valuable asset. All of these issues are clearly creating an affordability crisis for our constituents."

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!