State of the Industry Report and Survey 2016

Challenges Remain, but Unremarkable Sales Figures Don’t Reflect the Growth, Innovation That’s Moving the Roofing Industry Forward

Pictured is Trent Cotney of Cotney Construction Law.

Daniel Piché

Kurt Riesenberg

Laurie Spencerg

Jonathan Shephard

No Longer Yesterday’s Roofing Industry

By Robert Tafaro

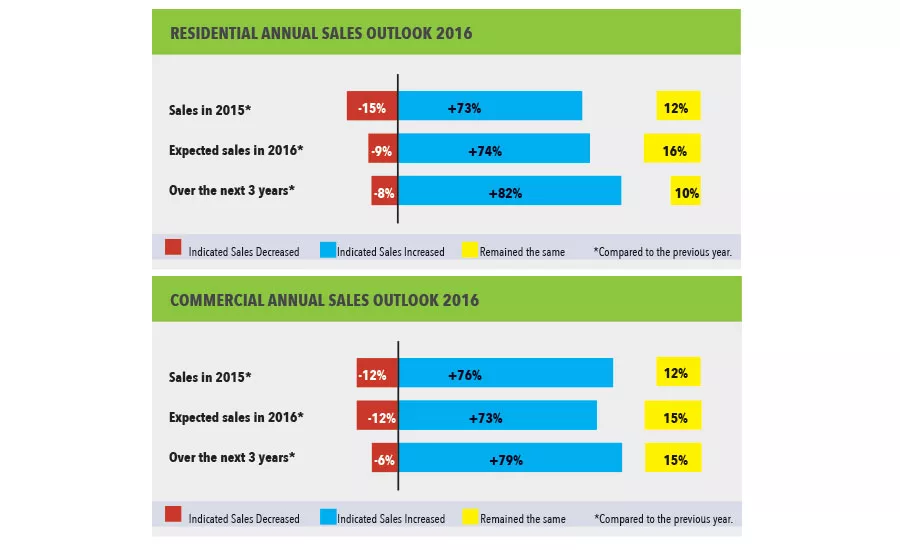

At first glance, if you relied on traditional metrics, you might be tempted to conclude that 2015 was an unremarkable year for the roofing industry. Sales of asphalt shingles remained mired at low levels. Whether due to a sluggish economy or soft storm activity, volumes settled roughly 30 percent below 2005 totals, and roughly flat with 2014. On the commercial side, while some segments of the market are humming, overall growth has been modest as new non-residential construction hovers approximately 20 percent below its long-term average.

However, looking beyond the headline numbers, you discover an industry awash in change. It’s no longer yesterday’s roofing industry. Advancements in technology, rising competition, and shifting consumer preferences are shaking up the roofing business in fundamental ways. From manufacturing, to lead generation, to in-home selling, we are all being challenged to raise our game. Those who fail to adapt risk being left behind, while those who embrace change and develop creative solutions will be positioned to thrive.

By moving away from the longtime practice of “winter buys,” the industry is starting to adapt to changes in manufacturing technology that enable plants to ramp up production. For decades, manufacturers loaded the distribution channel with heavily discounted inventory before roofing season kicked into high gear. However, in recent years, the pre-buy did more harm than good. For example, the buildup of large inventories in early 2014 inflicted severe pricing damage later in the year throughout the supply chain as volumes failed to meet expectations. By leveling out production and matching shipments to distributors more closely with end-user demand, both manufacturers and distributors are now running smoother operations.

Even more consequential are the ongoing shifts in the market share of competing roofing products. During 2015, highly reflective single-ply membranes continued to grow in the North American commercial market. As of the third quarter, TPO accounted for 33 percent of the overall market, up from just 8 percent in 2005. Moving forward, the combination of strong performance, energy efficiency, and cost effectiveness is likely to propel single-ply membranes even higher, as well as drive the fast, earlier stage growth of liquid-applied roofing.

In residential, stagnant median incomes and growing wealth disparities are reshaping homeowner preferences. The onus is on manufacturers and contractors to deliver innovative products and solutions for homeowners at both the high and low ends of the income spectrum. Whether it’s a cost-effective, lower end shingle with improved durability and aesthetics, or a premium shingle with the unique dimensionality to differentiate a home, the industry must have answers for these consumer tendencies.

Yet the greatest driver of change in our industry is the proliferation of information throughout the marketplace. Decision-makers are doing more research than ever before, much of it online. A whopping 93 percent of consumers say they’re very likely to use Internet research to support future home improvement purchase decisions. Meanwhile, the use of electronic media (websites, social media, apps) to hire a paid professional for a home improvement project has more than doubled since 2009.

Whether we like it or not, buyers are sizing us up online – and what they see can make or break a potential sale. While a strong website and social media presence were once considered optional, today they are becoming essential. Consumer research often begins on a search engine, where about 55 percent of ‘clicks’ go to the top three companies (listed in terms of online presence). Companies interested in strengthening their online muscle should also consider prioritizing the most relevant content, including video and other forms of visual material. With the average adult consuming 76 minutes per day of digital video, it’s important to form strong partnerships that can provide your business access to engaging content.

The digital revolution is exposing residential and commercial buyers to a broader range of products and solutions. With greater price transparency across installers, many of our best contractors say that it’s more important than ever to articulate their value story in an effective and differentiated manner. In today’s increasingly complex world, the winners will be the contractors who understand how to uncover their customers’ underlying needs and provide tailored solutions to suit them.

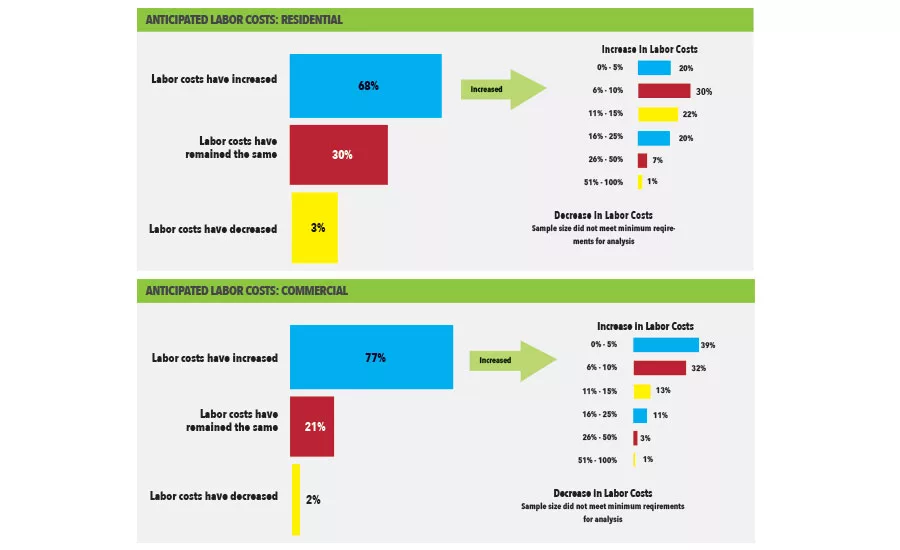

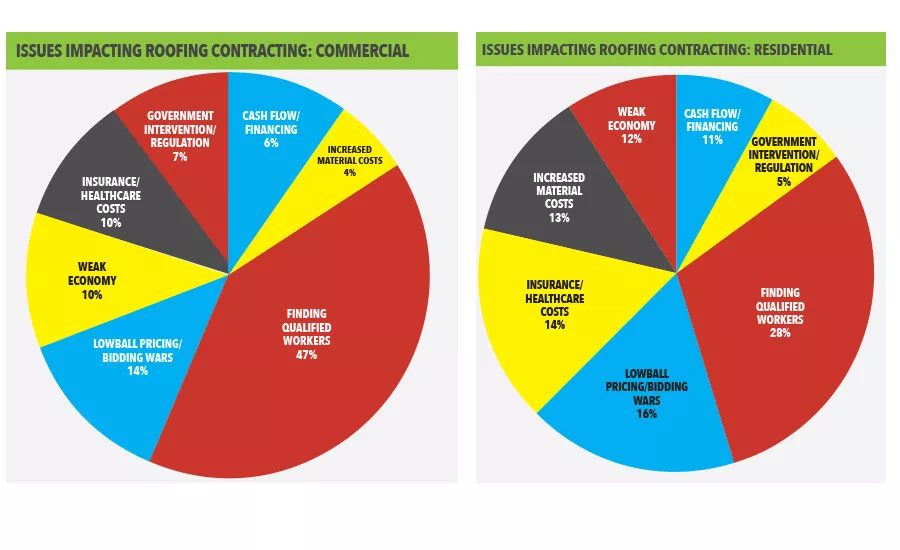

The Workforce Issue

Another key battleground ahead for the roofing industry will be the competition for qualified labor. How serious is this problem? Consider that housing starts have grown over 40 percent since 2010, yet supply of residential construction labor has fallen, in part because only 54 percent of 2007 construction workers are still in the industry. Many of our best affiliated roofing contractors have clear strategies to recruit talented employees. But once they hire the right people, they are also emphasizing retaining them by helping them build meaningful careers. Instilling training into a company culture and demonstrating an unwavering commitment to employee health and safety are two ways the most successful contractors keep their talent.

As we look ahead to 2016, it’s unclear whether overall roofing volumes will recover to historical norms. Nor can we predict exactly how the U.S. economy will perform, much less the price of commodities such as oil — which affect our industry. But what is clear is that the state of our industry remains strong. Opportunity abounds for those businesses prepared to meet the changing demands and preferences of their customers. Let us prove we are up to the challenge.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!