State of the Industry Report and Survey 2016

Challenges Remain, but Unremarkable Sales Figures Don’t Reflect the Growth, Innovation That’s Moving the Roofing Industry Forward

Pictured is Trent Cotney of Cotney Construction Law.

Daniel Piché

Kurt Riesenberg

Laurie Spencerg

Jonathan Shephard

Trying to measure whether or not a year was successful for roofing contractors across the country is a difficult – and some would say unenviable – task. Any number of variables ranging from weather patterns and regional economics, to government regulation and available workforce can significantly impact one’s perspective.

Anecdotally, 2015 was a year of continued optimism, and for many, a period of growth when a return on previous investments started to materialize. One example is RC’s own Top 100 list, which annually ranks contractors based on self-reported revenue. In terms of overall revenue, the 100th spot on the 2015 list (WeatherSure Systems Inc.) generated $10.4 million solely as a commercial contractor, compared to the $7.4 million reported by the contractor with the same ranking (Thoroughbred Contractors) just a year earlier.

Manufacturers and distributors also told us that record attendance in 2015 at leading trade shows like the Western Roofing Expo, and industry events like RC’s Best of Success, were visible signs of companies looking to broaden their reach and stay at the forefront of industry innovation.

Most manufacturers indicated that they predicted overall roofing to grow slightly — in conjunction with an uptick in new construction starts, and that the year unfolded pretty much as planned. There also were significant mergers and acquisitions within the industry – the impact of which won’t be fully measured until this time next year.

In the meantime, Roofing Contractor decided again to reach out to multiple segments of the industry to share more than just anecdotes that put the past year in focus. With the help of experts at BNP Market Research – the research wing of BNP, RC’s parent company – and GAF, we were able to mix raw data with the insights of influential people from some of most important companies in the business.

Tune in for our State of the Industry webinar February 11th.

The How

For the eighth consecutive year, RC conducted a national survey to gauge the status of the commercial and residential roofing markets for the next 12 months, and following three years — all from the perspectives of roofing contractors.

Keeping in mind our continued goal of providing and sharing information that will help contractors improve their business, the survey is designed to identify and evaluate the current issues and future trends in the roofing industry. The survey also revealed key problems roofing contractors are currently facing, and explores what should be top of mind heading into 2016.

Specifically, the study aimed to identify sales volumes for 2015; anticipated sales volumes for 2016 and at least the next three calendar years; emerging trends among different product categories; and key challenges ahead for the industry as a whole.

Participants in this web survey were randomly selected from Roofing Contractor’s domestic readership and from members of Allied Building Products Group and GAF. Full disclosure: RC provided 10 $50 American Express gift cards to randomly selected respondents that completed the entire survey.

The Who

Roofing contractors from the residential and commercial markets were included in the survey, and the majority of respondents in either market listed their job title as corporate or executive management (56 percent for residential and 47 percent for commercial). More than half of the respondents from each market identified themselves as having the authority to approve purchases (70 percent residential and 56 percent for commercial).

Sampling was divided down residential and commercial lines. Companies had to report at least 70 percent of their annual revenue either coming from residential or commercial work to qualify as a residential or commercial respondent. Those that reported less still qualified and were placed in the category with the fewest respondents.

On average, about two-thirds of business revenue was generated from roof replacement, with nearly half (44 percent) of survey respondents coming from the residential sector. About a quarter of respondents (24 percent) identified themselves in the commercial replacement category, and another 11 percent were in new construction of commercial properties.

Residential Profile

Consistent with years past, roof replacement was again the key revenue driver in the residential market, followed by repair (7 percent) and then new construction (5 percent).

Roughly 85 percent of residential roofing contractors used steep-slope asphalt, with metal a far second place (65 percent). Low-slope asphalt (61 percent), single-ply roofing (58 percent) and wood shakes (39 percent) rounded out the top five. Less than a quarter of respondents said they incorporated concrete tile, solar, SPF spray foam and vegetative roofing in their line-up of offerings.

On average, steep-slope asphalt constitutes more than half (53 percent) of sales, according to respondents, followed by low-slope asphalt (13 percent), single-ply (10 percent), metal roofing (9 percent) and concrete tile (4 percent).

And they expect that trend to continue. Sixty-six percent said they anticipate steep-slope asphalt sales to grow in 2016. Interestingly, despite accounting for 10 percent or less of sales last year, about half said they expect metal (54 percent) and single-ply (48 percent) to increase in 2016.

Diving further into product types, the study showed that roughly 75 percent of sales in the steep slope asphalt category consisted of laminate shingles and 14 percent were super heavyweight shingles. The only other sub-product type to exceed 50 percent in sales was edge metal (58 percent), which topped both architectural standing seam (46 percent) and metal tile/shake shingles (23 percent) in the metal roofing category.

Commercial Profile

Like residential, roof replacements were again the main vehicle for revenue in 2015 among respondents, with 24 percent. However, unlike residential, new construction accounted for 11 percent and commercial repairs just 8 percent.

Nearly all of the commercial contractors reported using single-ply roofing (96 percent) with metal a distant second (74 percent). TPO remained the top product, accounting for nearly half of single-ply roofing sales, followed by EPDM (27 percent) and PVC (23 percent).

“With low slope roofs, TPO continues to gain more of the market share,” said Timothy Dunlap, president and COO of CentiMark. “Pricing pressures and relative low equipment costs have enabled entry into this market, making this roof system more of a commodity. We’re constantly looking for value-added services that we can provide to this roof system installation.”

In the metal roofing category, architectural standing seam (52 percent) accounted for more than half, followed by structural standing seam (18 percent). Nearly a quarter of contractors also selected ‘other’ in this category.

Exploring further into product type, the data shows single ply roofing (55 percent), low slope (13 percent), and metal (10 percent) account for the majority of commercial contractor sales. Conversely, concrete tile, garden roofing, slate, SPF spray foam, solar and wood shakes combined for less than 5 percent of all commercial sales.

Both residential and commercial roofing contractors also stayed diversified in 2015, with many offering services beyond roof installation. Seventy-nine percent of residential contractors and 65 percent of commercial contractors indicated they offered gutters. Skylights (74 percent residential, 62 percent commercial) were the second-most popular exterior systems. Vinyl siding (54 percent) and windows (48 percent) were the next highest on the residential list. Waterproofing (47 percent) and metal cladding (36 percent) were next for commercial contractors.

Sales Forecast

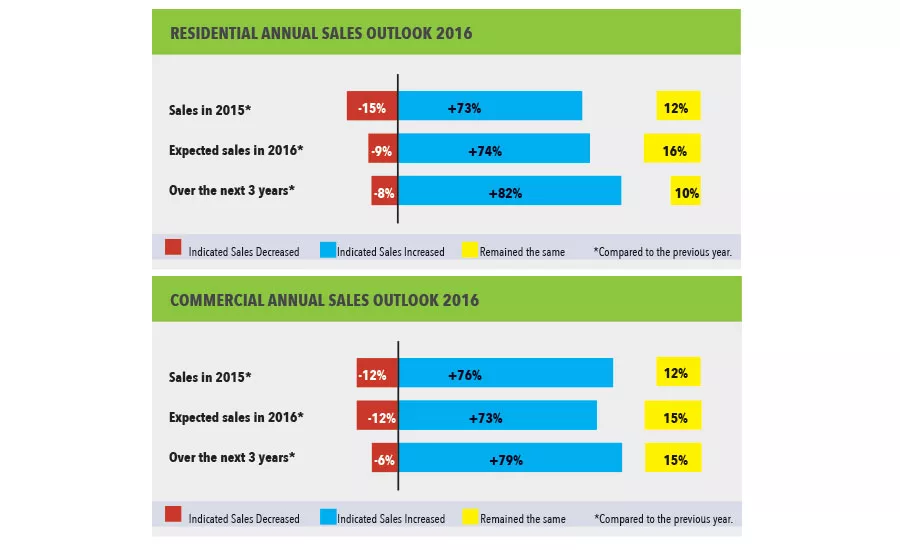

Roughly three-quarters of residential and commercial contractors said they expected their 2015 and 2016 sales volumes to increase year-over-year. A slightly-larger number projected sales volumes to increase in 2017 as well, and continue trending upward over the next three years.

Just 9 percent of residential contractors indicated they expected 2016 annual sales volume to fall from last year, and 8 percent expected their company’s total sales volume to decrease over the next three years. Only 3 percent projected a major decrease.

Residential contractors indicated solar (11 percent) and garden (2 percent) were toward the bottom of product involvement, but 52 percent of contractors that do offer solar said they experienced an increase in 2015, and 30 percent anticipated growth in product sales for 2016. Though neither made the top five products expected to see a sales increase this year, polymer and synthetic roofing did, sneaking in at 36 percent.

“The polymer category has been growing steadily and will likely pick up steam as the trend to high-value products continues,” said Mark Hansen, vice president of sales and marketing for DaVinci Roofscapes. “In addition, we are seeing a lot of real wood shake communities move to alternative products like polymer/synthetics.”

The results were different among commercial contractors, where roughly 12 percent said they anticipated 2016 sales volumes would drop slightly from last year. Barely one percent said sales would greatly decrease this year, and only 6 percent anticipated a consistent drop over the next three years.

CentiMark, the Pennsylvania-based roofing giant that ranked first in the 2015 Top 100 with more than $508 million in total revenue, was not one of them. Dunlap said the company experienced double-digit growth in sales, revenue and operating income last year, and saw sustained growth in all four of its regional business groups heading into 2016.

The majority of commercial contractors (76 percent) that offer single-ply saw an increase in 2015 while exactly 50 percent indicated an increase in coatings last year. Respondents said they expect that to continue in 2016, with 81 percent anticipating growth in single-ply roofing, and 54 percent anticipating an increase in coatings.

Major Mergers

The roofing industry witnessed several significant mergers in 2015 that most identified as a positive indicator for the industry. The companies involved appeared to be making investments that not only strengthened their overall position in the industry, but also tried to stay ahead of demand.

In July, Beacon Roofing Supply Inc. acquired Roofing Supply Group (RSG), in a combination cash and stock transaction valued at about $1.1 billion. The deal allowed RSG to refinance roughly $565 million in debt and widened Beacon’s reach to the Pacific Northwest. Following the merger, Beacon grew to 356 branches across 45 states and six Canadian provinces, and is expected to top $3.7 billion in combined revenue.

The following month, GAF announced it acquired Quest Construction Products. The deal almost immediately provided GAF with a leading position for coatings in the high-tech, environmentally friendly and economically efficient segment of the commercial-roofing business.

ABC Supply Inc. continued its impressive growth strategy by acquiring several distribution companies across the country in 2015. None was larger than its deal with Ohio-based Norandex, which added 103 locations to the ABC roster. The acquisition, finalized in November, pushed the Beloit, Wisc.-based company beyond the 600 location mark across 49 states.

Company officials said ABC strengthened its position in the market and that they believe that providing contractors with consistency and high levels of service will become increasingly important as construction continues to rebound from recession levels.

“We further enhanced our customers’ access to high quality products and expertise by expanding our physical footprint,” said Daniel Piché, ABC’s vice president of national business development. “Our focus was on growing our services so we could stay ahead of the thriving construction industry, and we did that in 2015.”

Manufacturers and distributors were not the only ones active in the merger-market in 2015. Commercial roofing contractor Tecta America continued its growth by acquiring Savannah, Ga.-based Metalcrafts Inc. The deal, finalized in April, helped solidify Tecta’s position along the south Atlantic coastline with operations now stretching from South Carolina down to Florida’s southern tip.

It was the company’s 25th strategic merger, bringing the total number of operating units under the Tecta umbrella to 50, comprised of about 2,500 employees during peak season.

“We look for compelling business models … and a differentiator quality with value that doesn’t have volatile margins,” said Tecta CEO and President Mark Santacrose. “Then it’s all about our local operating units doing what they do in their markets. We’re much more about the fi t for the business and the people involved.”

Some industry leaders said the number of mergers indicates that investment capital is available and large corporations are demonstrating a will to take risks as confidence in the economy grows. Overall, most respondents indicated they believe it’s a positive sign for the industry.

“I think it speaks to an expectation that we are at the beginning of a positive business cycle in our industry and in the general economy,” Hansen said.

However, some contractors — both big and small — said they follow a different strategy for sustained growth.

“While mergers continue to dot the commercial roofing contracting landscape, long-term sustained growth appears to be a challenge for merging contractors,” Dunlap said. “We believe that continued investment in the organizational infrastructure is the best path to sustained and consistent growth.”

Others in the industry are focused on improving internal processes and efficiencies, and in some cases, expansion.

“We are planning for long-term growth, and we are continuing to make progress with our plan for a new shingle plant in Hillsboro, Texas,” said Keith Lowe, vice president of U.S. sales for IKO. “With a focus on the Southwest region, IKO’s ninth North American shingle plant will complete the company’s national footprint and put us in an even better position to serve the marketplace.”

Labor and Workforce

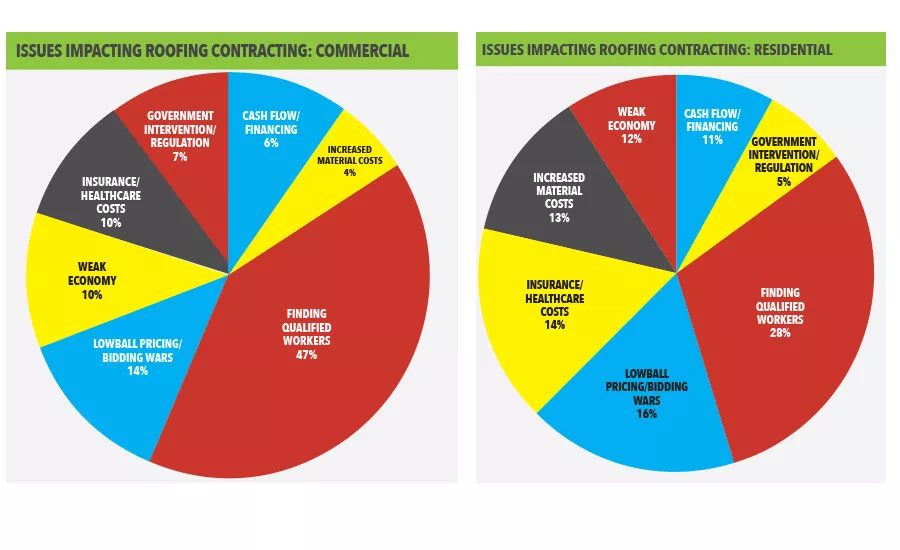

Whether focused on future growth opportunities or just overall business viability in the roofing industry, respondents repeatedly said success in 2016 and beyond is dependent on the growing workforce problem. The vast majority of contractors in both residential (28 percent) and commercial categories (47 percent) indicated that finding quality workers was the most-impactful issue facing roofers today.

The scarcity of quality workers continues to take a toll in markets across the country, and a stalled comprehensive approach to national immigration reform isn’t helping. That may change in 2016 under a new presidential administration, but it’s only one aspect of the workforce problem. As the core of the current workforce just got a year older, multiple experts agree that the roofing industry as a whole needs to do a better job recruiting young professionals.

“We have an aging workforce in the office and field,” said Gregg Wallick, president and CEO of BEST Roofing in Ft. Lauderdale, Fla. “We must make our companies an exciting and attractive place to work if we hope to attract younger talent.”

While individual companies like BEST, and organizations like the National Roofing Contractors Association (NRCA) have publicly committed to improving recruiting efforts, others are turning to incentive programs to help attract new employees while retaining their own.

At CentiMark, Dunlap said management invested millions of dollars in equipment, expanded its human resources staff, and implemented an employee stock ownership program to reward employees as true stakeholders in the company’s future.

“The distribution of company stock at the labor level will help attract and maintain the best labor in the industry for many years,” he said. “Both finding and developing a strong labor force is what truly differentiates one contractor from another.”

Manufacturers are also trying to be part of the solution, offering advancements in prefabrication that make installation easier and creating products that let crews get more accomplished with fewer shingles per bundle in less work hours.

The cost of labor also appears to be a growing concern.

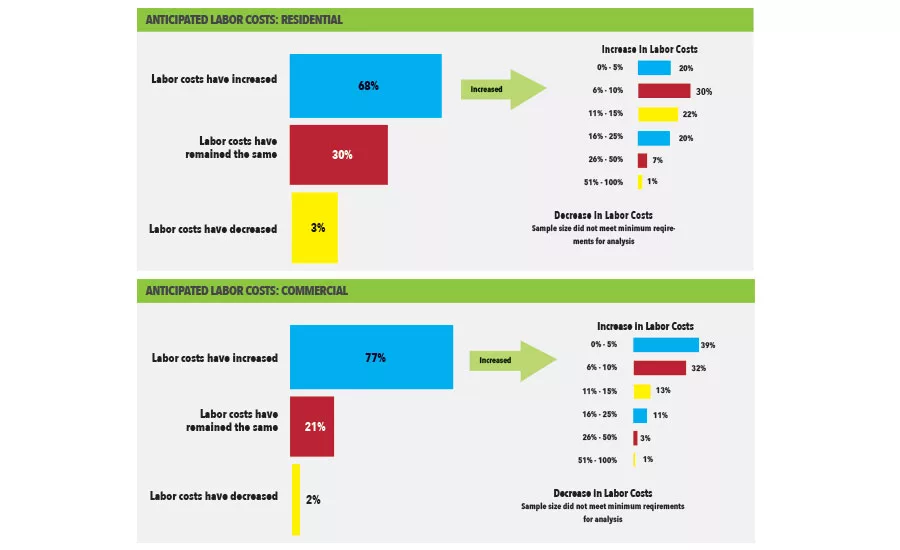

The majority of residential contractors (68 percent) felt an increase in labor costs on average of 15 percent. Most said the increase was between 6-10 percent, and a small amount (7 percent) indicated the increase was a staggering 26-50 percent. Just 3 percent reported that labor costs decreased in 2015.

The data indicates that the hike in labor costs was felt even more among commercial contractors. Seventy-seven percent of commercial contractors reported increases in 2015 and average cost was about 11 percent. Most respondents (39 percent) felt an increase of between 0-5 percent, while 14 percent said the increase was at least 16 percent or higher.

Just two percent reported labor costs decreased in 2015. As far as field labor is concerned, the majority of residential respondents (51 percent) said their workforce consisted of subcontractors. Conversely, the vast majority of work is completed by employees in the commercial sector (80 percent) and just 20 percent by subcontractors.

That distinction takes on greater significance in 2016 as the definition of what a subcontractor is under federal standards has changed. In August, the National Labor Relations Board (NLRB) issued a controversial landmark decision that reversed nearly three decades of legal precedent by redefining who is an employee. (See more about this topic on page 60).

“I was (saying) ‘You’ve got to be kidding me?” said Laurie Spencer, president of Spencer Roofing in Walled Lake, Mich., after hearing NRCA CEO Bill Good describe the change during his presentation at Best of Success 2015. “We have been in business for 34 years and our crews are the backbone of the company. We exceeded our (2015) goals due to the flexibility and reliability of our subs.”

Other Challenges

Outside of labor-related problems, other challenges emerged in 2015 that are likely to carry over into the near future.

Residential contractors said the next most impactful issue was lowball pricing/bidding wars (16 percent) and identified insurance and healthcare costs next at 14 percent. Increased material costs (13 percent) outweighed concerns about a weaker U.S. economy among residential respondents.

Commercial contractors also reflected concerns about lowball pricing (14 percent), followed by healthcare costs and a weak U.S. economy (10 percent each).

Further implementation of the Affordable Care Act this year will impact both (see more about this topic on page 72).

“The greatest challenge facing distribution in 2016 is the increased cost of doing business,” Piché said. “The increase in medical, driver pay, compliance and other ‘people’ costs will result in margin pressure. These same costs will also impact the contractor trade, which has the potential to negatively impact our industry.”

In addition to healthcare, DCI Products President Jack Henderson said the entire industry should be wary of increased insurance costs due to workers compensation for jobsite injuries.

“Heavy fines are being given to small and large roofing companies. Fines for employment or subcontractor status. Fines for non-use of harnesses. Fines for lack of worker compensation benefits,” Henderson explained. “I think the roofing/siding industry needs to get all the safety-related costs under control. What’s happening right now is not working.”

Concerns about government regulation remained relatively low at 5 percent among residential respondents. They were just a bit higher among commercial contractors (7 percent), and perhaps with good reason; commercial companies, on average, had twice as many OSHA inspections in 2015 than residential contractors. Roughly 66 percent of residential contractors indicated they had no inspections at all throughout the year.

Despite the survey results, industry leaders are still talking about regulation as a major obstacle. “The ever-changing regulatory environment poses a perennial challenge for contractors,” said Jonathan Shepard, president of Mule-Hide Products Co. Inc. “They must work hard to stay current on, and adapt their practices to comply with, new local, state, and federal requirements in so many areas, from building codes to energy and the environment, transportation, employment and worker safety.”

Government involvement also took its toll on emerging categories, including spray foam, officials said.

“Regulatory pressures, notably stemming from agencies taking action while lacking familiarity with SPF materials or installation practices, created a disruption for the industry and customers alike,” said Kurt Riesenberg, executive director of the Spray Polyurethane Foam Alliance (SPFA).

To be fair, congress did give the industry a boost at the end of the year by passing a retroactive extension of the Commercial Building Tax Deduction, which significantly increases the competitiveness of SPF on cost, Riesenberg added.

Along with his message about subcontractor reclassification, Good warned that expected government regulations on silica have the potential to radically transform the industry. Still, only a small percentage of respondents found it concerning.

Just fi ve percent of commercial contractors said they believe their employees are exposed to silica dust. Fewer (4 percent) responded similarly on the residential side, and the sample size for both was too small to further explore mitigation strategies. Some, however seemed to recognize the potential for changes, as all indicated they expect the use of respirators and targeted vacuuming to mitigate silica exposure will increase in the future.

In the commercial sector, more than half of the respondents (60 percent) indicated they’ll likely use air-quality testing devices in the near future.

Up Next

So what’s in store for 2016?

The certain switch of presidential administrations – and all the baggage that comes with it – position this year to be one of change. From our view, the industry remains optimistic and is committed to improving regardless of what plans or edicts come from Washington, D.C. That is, as long as the economy keeps moving forward.

“I think the economic recovery has momentum that will overpower any possible headwinds or tailwinds,” Hansen said.

Few industry leaders we spoke with felt the change in presidential administrations, the Federal Reserve’s plans to gradually increase interest rates, or further implementation of Obamacare would cripple the roofing business or stifle its impact.

“If recent history is an indicator, consumer confidence often wanes in the face of significant change,” Lowe explained. “In that respect, all of the changes listed here may create a temporary drag on the housing economy. However, we do not see this reversing long-term gradual growth in new housing or remodeling activity, and remain optimistic about the future.”

In the end, it’s up to those within the industry to keep it vibrant.

“All of the tough challenges though come down to product performance and proper installation completed by experienced, trained professionals,” Riesenberg said. “Getting customers to recognize this and getting contractors to invest in their installers’ capabilities may be one of the most significant challenges facing the entire roofing industry.”

Page 2: No Longer Yesterday’s Roofing Industry By Robert Tafaro

Page 3: Employee or Independent Roofing Subcontractor? By Trent Cotney

Take a look at our previous State of the Industry articles by clicking here!

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!