Construction Data

Construction Costs Rise Fastest Since Early 2023

New analyses from AGC and ABC show construction input prices surged in November, driven by tariff-impacted materials and energy costs.

Construction input prices surged in November at the fastest pace since early 2023, outpacing contractors’ bid prices and intensifying concerns about materials costs, tariffs, and market uncertainty heading into 2026, according to new analyses from the Associated General Contractors of America and Associated Builders and Contractors.

The producer price index (PPI) for materials and services used in nonresidential construction rose 0.4% in November and 3.6% year over year, marking the largest annual increase since January 2023, AGC reported based on newly released federal data. Contractors’ bid prices for new nonresidential buildings, however, increased only 2.7% over the same 12-month period.

“Input costs for construction are rising faster than for producers or consumers in general, partly because the industry is faced with steep tariffs on many materials,” said Ken Simonson, AGC’s chief economist. “Although many contractors are accelerating purchases and attempting to pass along cost increases, their bid prices have not kept up.”

ABC’s analysis of U.S. Bureau of Labor Statistics data showed even sharper monthly growth. Construction input prices rose 0.6% in November compared to October, with nonresidential construction input prices also increasing 0.6%. Overall construction input prices are now 3.4% higher than a year ago, while nonresidential construction input prices are up 3.8%.

Energy prices contributed to the November increase. Natural gas prices jumped 10.8% for the month, while unprocessed energy materials rose 1.4%. Crude petroleum prices declined 1.1%, according to ABC.

Tariff-affected materials continue to experience some of the steepest price increases. AGC noted that aluminum mill shapes—subject to a 50% tariff—soared 28% from November 2024 to November 2025. Steel mill products, also facing a 50% tariff, rose 4.6%, while fabricated structural metal bar joints and rebar climbed 16.6%.

ABC Chief Economist Anirban Basu said price escalation has been especially pronounced in derivative metal products and electrical equipment.

“Many tariff-affected materials, like derivative metal products and switchgear equipment, have experienced considerable price escalation in 2025,” Basu said. “Prices for aluminum mill shapes and primary and secondary nonferrous metals are both up more than 25% over the past year.”

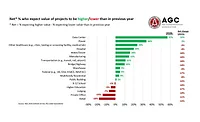

Contractors are feeling the impact. AGC’s 2026 Construction Hiring and Business Outlook Survey, conducted with Sage, found that 53% of contractors listed materials costs as a top concern for 2026. Economic slowdown or recession was cited by 62% of respondents, while labor availability, quality, and cost also ranked high.

Related: Data Centers Lift Construction Outlook but Economic Worries Grow

Tariffs are influencing business decisions across the industry. Only 24% of contractors reported being unaffected by tariffs, according to AGC. Forty percent said they raised bid prices in response to actual or proposed tariffs, 35% passed most or all tariff costs on to owners, and 32% accelerated purchases to avoid future tariff increases.

Despite the volatility, ABC data suggests cautious optimism. According to ABC’s Construction Confidence Index, contractors are on net optimistic that profit margins will expand during the first half of the year, though slightly less so than at the same time last year.

“Unfortunately, it is impossible to know exactly how the cost of tariffs will be distributed throughout the supply chain,” Basu said. “That makes it exceptionally difficult to know how construction input prices will behave in 2026.”

AGC officials urged policymakers to reduce uncertainty by resolving trade disputes and stabilizing materials pricing.

“The frequent increases and announcements about prospective tariffs have pushed up the cost of construction and made owners hesitant to commit to projects,” said AGC CEO Jeffrey D. Shoaf. “Contractors and owners alike need more certainty and fewer price shocks from tariffs to assure a healthy construction market in 2026.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!