Construction Data

Data Centers Lift Construction Outlook, but Economic Worries Grow

Survey shows strong demand for data centers and power projects in 2026, even as contractors grow more concerned about recession risks, labor shortages and policy uncertainty.

Commercial construction firms are banking on data centers, power projects and healthcare facilities to fuel demand in 2026, but a growing list of concerns—including recession fears, persistent labor shortages and policy uncertainty around tariffs and immigration—has dampened overall industry sentiment compared to a year ago, according to a new survey from the Associated General Contractors of America and Sage.

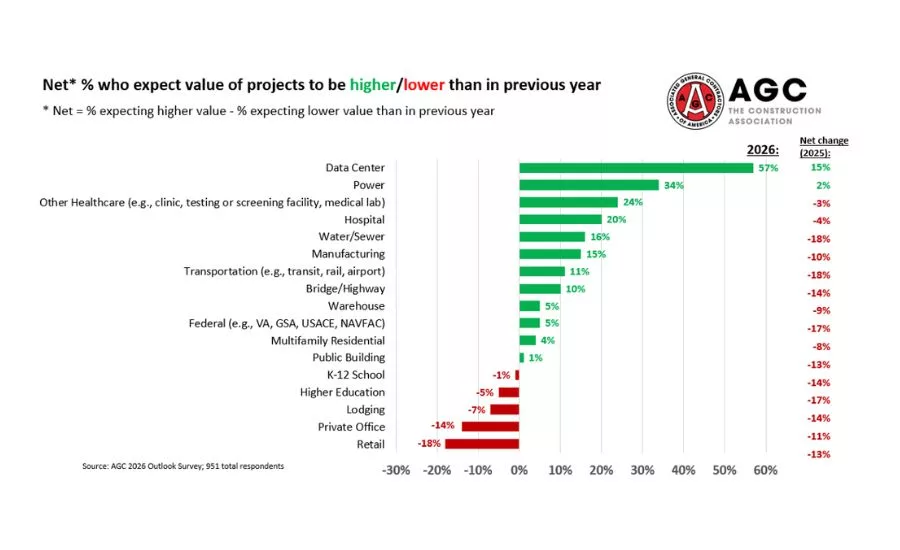

The 2026 Construction Hiring and Business Outlook survey shows contractors expecting growth in just 12 of 17 market categories, down from 15 a year ago. And while data center construction leads all segments with a 57% net positive reading, economic slowdown or recession emerged as the industry's top concern, cited by 62% of respondents—the highest share for any concern measured in the survey.

"2026 offers a handful of clear, bright spots amid a growing number of challenges, reflecting the mixed outlook reported throughout this survey," said Jeffrey Shoaf, CEO of the Associated General Contractors of America.

Data Centers Lead, But Contractors Urge Diversification

The survey found 65% of contractors expect the data center market to expand in 2026, with only 8% anticipating a contraction. Power projects ranked second at 34% net positive, while healthcare facilities—both hospitals and non-hospital facilities like clinics and medical labs—showed moderate optimism.

The AI-fueled data center boom is creating opportunities across the country, not just in traditional hubs like Northern Virginia, a shift panelists described as increasingly national in scope.

"We are seeing a lot of what the data is saying, with growth in data centers, transportation, manufacturing, and some of those key utilities that drive those developments—the power and the water sector," said Kyle Van Slyke, COO of Musselman & Hall Contractors in Overland Park, Kan. "Those are very much in a growth trajectory."

Van Slyke said the benefits extend beyond the massive projects themselves. "What the data centers bring are very large projects that are great to do, but all the ancillary things that support and touch those projects and the overall economic growth is really what makes it a nice economic engine," he said, comparing the ripple effects to those of an airport or stadium development.

But contractors cautioned against over-reliance on a single hot sector.

"We definitely need to have a foot in the institutional work, the water and sewer, the energy—all of the things that are pushing our industry forward," said Jim Rhodes, senior vice president of Wayne Brothers Companies in Davidson, N.C. "We got to make sure that we don't live and die by the data center 'cause the rug can get pulled out pretty quickly if you're not careful."

Rhodes noted that while his firm remains "cautiously optimistic" about 2026, margins have compressed as more contractors chase available work. "For the past 12 to 18 months, we feel like there's been the same amount of contractors chasing a little bit less work," he said.

Backlogs Hold, But Owners Are Cautious

Despite broader economic concerns, contractors report stable project pipelines. Nearly 40% of survey respondents said their current backlog is larger than a year ago, and 63% expect to add headcount in 2026, a signal that most firms are planning for continued, if uneven, demand.

In Chattanooga, Tenn., Arch Willingham IV, president of T.U. Parks Construction said business remains steady. "Our work has continued to increase, and backlogs haven't really shrunk since 2025," he said. "None of it is like it was post-COVID. We're not having any issues getting subs. We're not having many issues getting suppliers. Our subs are healthy."

Willingham, whose firm focuses on medical and commercial work, said owners remain engaged despite uncertainty. "Owners are still cautious, but they're still spending," he said. "You see it in their faces, but they still sign the contract."

He also pointed to residential construction—which his firm handles alongside commercial work—as a leading indicator. "The residential side of our business has always led the commercial side by about six months," Willingham said. "Residential side, they're still spending as fast as they can. So in my world, there's at least six months in the hopper of good times."

Recession Fears Top List of Concerns

The survey found economic anxiety has overtaken workforce issues as contractors' primary concern for the first time in several years, though labor challenges remain a close second.

Ken Simonson, AGC's chief economist, said the top five concerns cited by respondents were:

- Economic slowdown or recession: 62%

- Insufficient supply of workers or subcontractors: 57%

- Rising direct labor costs: 56%

- Worker quality: 53%

- Materials costs: 53%

More than 60% of respondents said a project had been postponed, scaled back or canceled in the past six months. When asked why, 37% cited lack of funding or uncertainty about funding sources, while one-third said project financing was unavailable or too expensive.

Tariffs Impact Muted—For Now

While 70% of contractors reported being affected by tariffs in 2025, with 40% raising bid prices in response, several panelists said the feared price spikes haven't fully materialized.

"Tariffs are one of those things that owners ask us about, and we go, 'It really hasn't hit us,'" Willingham said. "The suppliers talk about it, but it's more of a marketing thing—as in, 'You need to go ahead and sign on the dotted line.' We really have not seen any prices changing as a result of tariffs. Knock on wood."

Still, about one-third of firms reported accelerating purchases in anticipation of tariff-related price increases, and 20% added price-sharing adjustments or other protective terms to contracts.

Immigration Enforcement Creates Workforce Uncertainty

One-third of contractors said they've been affected by enhanced immigration enforcement in the past six months. Of those, 6% reported immigration authorities showing up at job sites or offices, 11% said workers had disappeared or failed to show, and 24% said subcontractors were affected.

Simonson noted that construction is far more dependent on foreign-born workers than the broader economy. "Thirty-five percent of construction craft workers were foreign-born," he said, citing Census Bureau data. "That's about double the 18% of the total U.S. workforce that is foreign-born."

The dependence varies significantly by state, Simonson added. "California, Texas, Maryland, New Jersey, D.C.—half or more of the workforce of craft workers is foreign-born. And then when you get to northern tier states and some of the others, like West Virginia, it's single-digit percentages."

Rhodes emphasized that immigration policy must account for the industry's reliance on authorized foreign-born workers. "The backbone of our industry, along with the rest of our blue-collar workers... more than 30%, 40% of our workforce is not native-born in America," he said. "Whatever policy gets put in place, we have to figure out a way to implement and execute that policy so that we're not intimidating the workforce or driving people out of the industry."

AGC is calling on federal officials to expand lawful temporary work visa pathways for construction and to focus immigration enforcement on criminal activity rather than on otherwise law-abiding workers.

The survey found hiring difficulties at their highest point in three years, with 82% of firms reporting trouble filling hourly craft positions and 80% struggling to fill salaried roles.

Van Slyke said the challenge extends beyond the trades to leadership succession. "The skilled trades performing the work is definitely a key point, but also the senior leadership that continues to retire and not be replenished is really hurting our market," he said. "We're losing that key leadership, and we're not having the quality craft and the skilled workforce."

Local initiatives are making a difference. Willingham highlighted Chattanooga's construction career center, developed by the local AGC chapter. "We raised $10 million because we got tired of... looking at a guy that's working for you and going, 'Do you know anybody? Do you know anybody at church? Do you know anybody that has a pulse that can show up from 7:30 to 4?'"

"That's not a great way to staff in our industry. It's a dangerous industry. It requires a lot of technical proficiency. That's a terrible way to vet people," Willingham said. The center now puts 100 to 125 students through training each year, with jobs waiting upon graduation.

AI Reshaping Operations and Driving Demand

The survey found 61% of contractors now use AI or plan to increase AI investments, up from 44% a year ago. Current applications include office and administrative functions (45%), estimating (23%), design and preconstruction (20%), and HR functions (16%).

Julie Adams, vice president of construction at Sage, said AI is creating a dual opportunity for the industry—driving demand for data center construction while helping firms address workforce constraints.

"We're at an inflection point, where AI is both driving demand and reshaping how construction firms operate," Adams said. "The firms that strategically embrace these technologies to address workforce constraints and improve efficiency will be best positioned to capitalize on emerging opportunities."

Van Slyke said the AI-driven demand for data centers shows no signs of slowing. "This definitely seems like something that will continue for the foreseeable future," he said. "This will not be a rapid decline in the next year or two. It's going to continue at least for the next three to five years from what I've talked with people about."

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

.webp?height=200&t=1760632077&width=200)