Economic Indicators

November Jobs Report Shows Economy Still Humming; Unemployment at 3.7%

Country added 199,000 jobs in November; inflation continues to abate

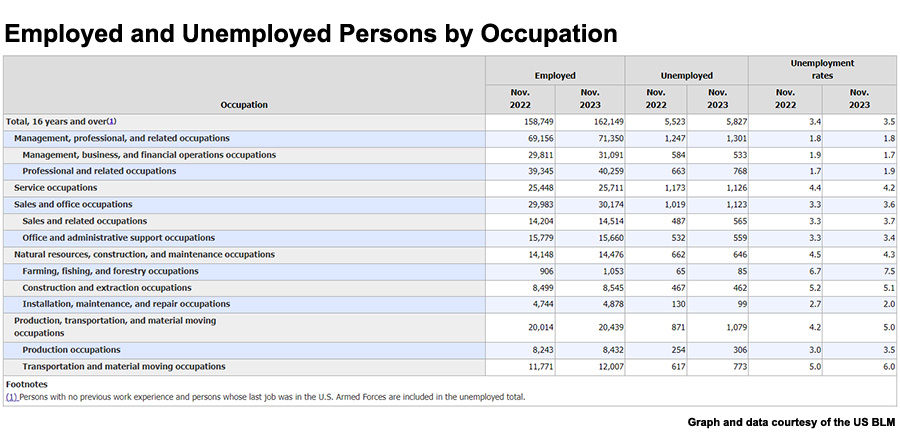

Total nonfarm payroll employment increased by 199,000 in November, according to the U.S. Bureau of Labor Statistics, and the unemployment rate edged down to 3.7 percent. Job gains occurred in health care and government. Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined.

— Image by Bryan Gottlieb/RC

Defying the naysayers who keep predicting a downturn, the U.S. economy continues to keep humming and notched another solid month of job growth, with added lift from the resolution of strikes in both the acting and auto sectors, which contributed to 199,900 jobs added in November.

The November jobs report, released last Friday by the Bureau of Labor Statistics, showed that in addition to the nearly 200,000 jobs added to the economy, the unemployment rate edged down to 3.7%.

Economists were expecting net job gains of 180,000 for the month and for the unemployment rate to hold steady, according to Yahoo Finance, and the labor participation rate ticked up 0.1% to 62.8%, returning to its highest level since the onset of the pandemic in March 2020.

Job gains were most significant in health care and government, which added an estimated 93,200 and 49,000 jobs, respectively. Employment also increased in manufacturing, reflecting what the report said was “…the return of workers from a strike,” referring to both the UAW negotiations with the domestic Big 3 and the Screen Actors Guild.

The return of striking autoworkers lifted motor vehicles and parts employment by 30,000 jobs. Additionally, the resolution of the Screen Actors Guild strike against Hollywood studios resulted in 17,200 jobs added in the motion picture and sound recording industries.

In total, the BLS was anticipating a net gain of 35,000 workers returning after strikes: The agency estimated that 61,000 workers were absent from the labor market due to labor disputes versus 96,000 the month before.

In total, the BLS was anticipating a net gain of 35,000 workers returning after strikes: The agency estimated that 61,000 workers were absent from the labor market due to labor disputes versus 96,000 the month before.

Isolating the return of striking workers, the underlying rate of job growth is likely around 160,000 jobs per month, which aligns with the 2019 average, ZipRecruiter Senior Economist Julia Pollak wrote in an analysis of the latest numbers.

While retail and temporary help services saw declines of 38,400 and 13,600, respectively, analysts said many of those transient jobs were due to attrition from technology efficiencies and were unreflective of more substantive underlying concerns.

The continued strength in the labor market has helped fuel consumer spending and economic growth. Still, Federal Reserve officials believe slower demand and slower wage growth will help bring down inflation.

Through November, the economy has added an average of 232,000 jobs per month — far more moderate growth than in 2022 and 2021, when an estimated 399,000 and 606,000 jobs were added every month, respectively.

Last Friday’s jobs report also showed average hourly earnings rose 0.4% in November from the month before, demonstrating a more accelerated pace of growth than the 0.2% uptick seen in October and the 0.3% expected by economists.

On an annual basis, however, wage gains eased to 4% from the 4.1% rate seen a month before.

The Federal Reserve left interest rates unchanged at a range of 5.25 percent to 5.50 percent, keeping rates the highest they have been in 23 years. In a news conference, Fed Chair Powell said it was still too early to tell when to expect rate cuts.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!