Manufacturer News

OC Celebrates Impressive Q2 Earnings; Returns $160M in Dividends and Buybacks

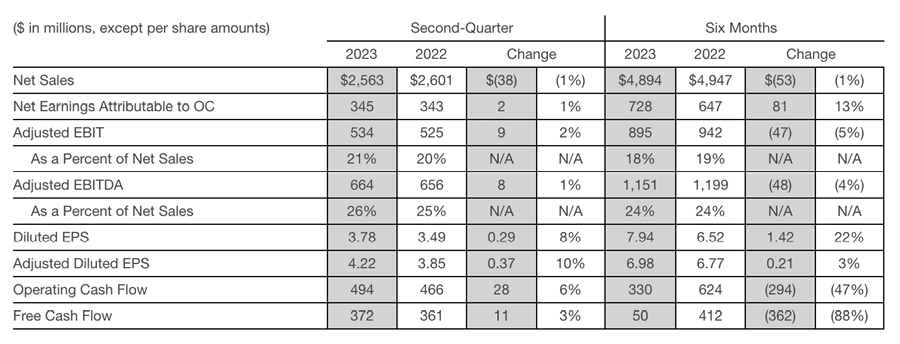

Construction materials bellwether reports $2.6 in net sales and $3.78 earnings-per-share

OC’s net sales for roofing materials increased 10% to $1.1 billion in the second quarter of 2023 compared with Q2 2022. Reasons cited included higher volumes related to storm activity in the quarter and positive price realization. EBIT increased $80 million to $338 million, expanding EBIT margins to 30% and EBITDA margins to 32%.

— Top image by Bryan Gottlieb

Owens Corning’s second-quarter 2023 earnings report had to make executives smile as both earnings and net sales surpassed Wall Street analysts’ expectations, and earnings increased year-over-year despite a dip in net sales.

The company reported adjusted earnings of $4.22 per share, which topped the Zacks Consensus Estimate of adjusted earnings of $3.30 per share by 27.9%. The metric also grew 9.6% from the prior-year quarter’s reported value of $3.85 per share.

Net sales of $2.56 billion beat the consensus mark of $2.52 billion by 1.8% but declined 1.5% year over year.

“Owens Corning delivered another outstanding quarter highlighting the capability of our teams, the value of our product lines, and the earnings power of our company,” said Board Chair and Chief Executive Officer Brian Chambers. “Our second quarter results continued to demonstrate the progress we have made in elevating the performance of the enterprise to generate higher, more resilient earnings.”

Segment Details

Composites net sales decreased 14% to $620 million in the second quarter compared with the second quarter of 2022. The company attributed the drop to lower volumes and the expected net headwind from the impact of divestitures and acquisitions.

Earnings before interest and taxes [EBIT] decreased $67 million to $87 million while maintaining 14% EBIT margins and 21% EBITDA margins on the impact of lower sales volumes and the resulting production downtime.

Additionally, the net impact from the divestitures and acquisitions contributed to the year-over-year EBIT decline. The company noted positive price realization and favorable delivery more than offset input cost inflation.

Insulation net sales decreased 3% to $905 million in the second quarter of 2023 compared with second-quarter 2022 numbers due to what the company described as lower volumes partially offset by positive price realization and favorable product and customer mix.

EBIT increased $6 million to $163 million, expanding EBIT margins to 18% and EBITDA margins to 24%, on positive price realization and favorable customer and product mix, which offset lower volumes, input cost inflation, and higher manufacturing costs.

Roofing net sales increased 10% to $1.1 billion in the second quarter of 2023 compared with Q2 2022, primarily due to higher volumes related to storm activity and positive price realization. EBIT increased $80 million to $338 million, expanding EBIT margins to 30% and EBITDA margins to 32%, primarily due to positive price realization and higher volumes. Lower input costs, including delivery, more than offset higher manufacturing costs.

Enterprise Performance

Enterprise Strategy Highlights

In the second quarter, the safety performance resulted in a recordable incident rate [RIR] of 0.59.

Owens Corning continues to invest in accelerating new product and process innovation to support customers and generate additional growth. In the second quarter, 6 new or refreshed products were launched, bringing the first-half total to 17 launches.

The company also continues its effort to be an industry leader in environmental, social, and governance matters. In May, OC published its 17th annual Sustainability Report. Earlier this year, the company completed a major renewable electricity supply agreement, which is expected to come online in stages through 2024, contributing significantly to reducing carbon emissions.

Combined with existing wind-driven virtual power purchase agreements operating in Finland and Sweden, the new deal means that 100 percent of the company’s European production sites and science and technology centers will be covered by contracts and VPPAs supplying renewable electricity.

During the second quarter, the company returned $160 million to shareholders through dividends and share repurchases. The company paid a quarterly cash dividend of $47 million and repurchased 1.1 million shares of common stock for $113 million. As of the end of the quarter, 11.8 million shares were available for repurchase under the current authorization.

“Our strong and consistent cash generation combined with our solid financial position provides us the flexibility to execute on our enterprise strategy while remaining committed to maintaining our investment-grade balance sheet and returning approximately 50% of free cash flow to shareholders over time," said Executive Vice President and Chief Financial Officer Ken Parks.

Other Notable Highlights

In May, Owens Corning was recognized for its workplace fairness and inclusion practices and policy by DiversityInc as one of its Top 50 companies. Participation in the Top 50 survey measures overall performance in six key areas of diversity and inclusion management: leadership accountability, talent programs, workforce practices, supplier diversity, philanthropy, and human capital diversity metrics.

Q3 2023 Outlook

The key economic factors impacting the company’s businesses are residential repair and remodeling, U.S. housing starts, global commercial construction activity, and global industrial production.

Inflation continues to moderate while increasing interest rates and ongoing geopolitical tensions continue to result in slower global economic growth. While global economic growth is expected to be lower year-over-year, the company expects many end markets to be relatively stable soon.

For third-quarter 2023, the company expects overall performance to result in net sales similar to the previous year's comparable quarter while generating high-teen EBIT margins.

For more information, visit owenscorning.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!