Economic Indicators

U.S. Housing Market, June ´23; Softwood Lumber Prices, July ´23

Lumber Prices are a key indicator of economic trends in the North American construction sector; every home needs a roof

The U.S. Census Bureau and the US Department of Housing and Urban Development released July 26 new home sales and house price data. New home sales comprise 10% of real estate activity and are considered a leading housing market indicator as they are recorded when contracts are signed.

— Graphics courtesy of Madison Lumber Report; top image by Bryan Gottlieb

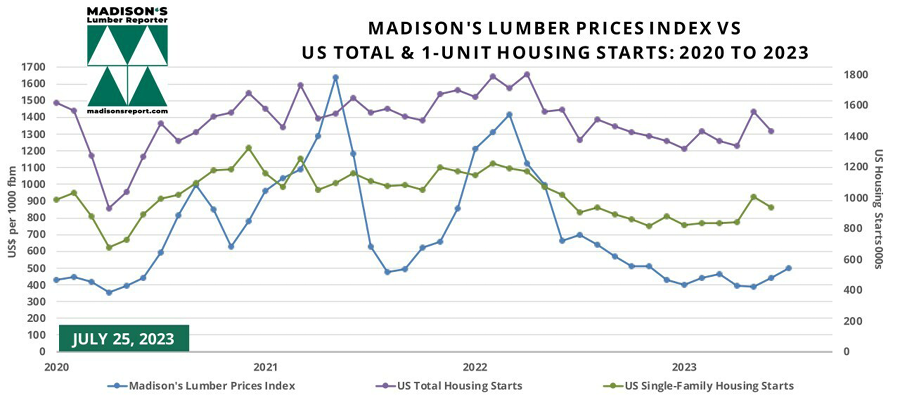

U.S. housing starts corrected sharply downward in June 2023, demonstrating a lingering weakness in an important economic indicator, according to the latest Madison’s Lumber Report. A silver lining woven in the June 2023 domestic housing market analysis is the indication that stability in real estate seems to be returning.

Released on July 27, the report shows that both housing starts and new home sales are at a better equilibrium than the volatility of the previous few years. The momentum of demand for housing appears strong, especially for existing homes, even as interest rates on 30-year fixed-rate mortgages climb.

After a big jump in May, total housing starts in the U.S. fell by -8% in June, to 1.434 million units, compared to the downwardly revised 1.559 million units reported for May 2023, and were down -8% from the June 2022 rate of 1.561 million units, Madison analysts said.

Madison's Lumber Prices Index July & US Housing Starts June: 2023

An indicator of construction activity to come, building permits also tumbled, down by almost -4%, at 1.440 million units from the May rate of 1.496 million. This is -15% below the June 2022 rate of 1.701 million. These permits will eventually become starts and will help to underpin residential construction.

Meanwhile, Madison's Lumber Prices Index for the week ending July 21, 2023, was $498 mfbm [thousand feet board measure], up 0.8%, or $4, from the previous week at $494 mfbm.

Still very high compared to historical averages, housing completions fell by more than -3% from May to an estimated annual rate of 1.468 million housing units. Units under construction also remained high compared to historical averages, at 1.682 million units. Of those, 688,000 were single-family homes, compared to 694,000 in May.

June starts of single-family housing, the largest share of the market and construction method which uses the most wood, dropped as well, down -7% to a rate of 935,000 units from May's upwardly revised 1,005,000 units.

Single-family authorizations were at 922,000 units, which is more than -2% below the upwardly revised May figure of 907,000 units. Building permits are generally submitted two months before the home building begins, so this data indicates July construction activity.

Economists are in general agreement that framing softwood lumber prices is a good leading indicator for domestic housing activity, including construction and home sales.

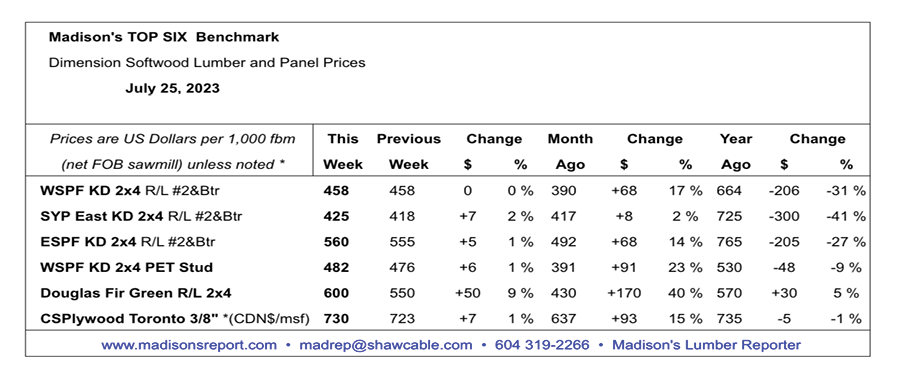

Benchmark Softwood Lumber and Panel Prices

Looking at lumber prices, in the week ending July 21, 2023, the price of benchmark softwood lumber commodity Western Spruce-Pine-Fir 2x4 #2&Btr [kiln-dried], was $458 mfbm, remaining flat compared to the previous week, according to Madison's Lumber Report; that figure is up $68, or 17%, from one a month earlier when it was $390.

Even as delivery times have since stretched into mid-August and beyond, contractors have little choice but to remain engaged as end-users are hungry for material to feed busy job sites. With prices rising on standard-grade bread-and-butter widths and stud trims, the adage from an experienced player that 'the best deals were those already made' has never rung more true.

Future supply remains a constant topic of conversation, with wildfire activity in the Pacific Northwest still raging out of control in many regions. The Flat Fire in southern Oregon has burned through upwards of 5,500 acres in steep and remote terrain.

Demand for Western S-P-F continued to chug along at a solid pace in Canada, considering the time of year. Larger, national producers maintained three- to four-week order files on most items, while many regional suppliers showed prompt availability on the odd width – which the report noted was quickly snapped up in most cases.

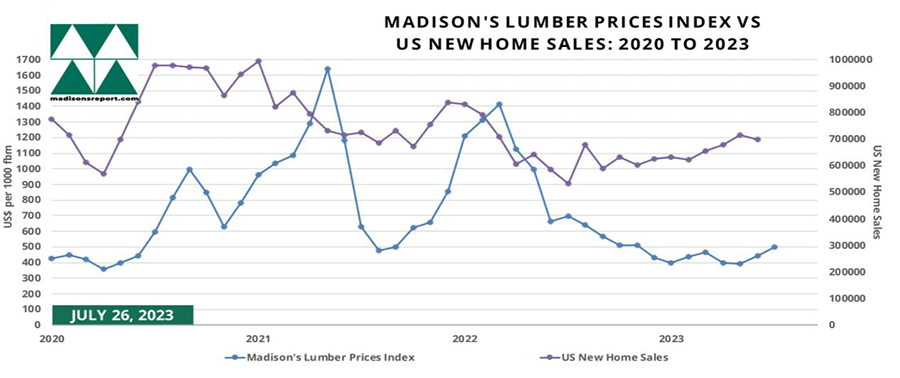

Approaching more stability after the volatility of the past couple of years, sales of new single-family homes in the US significantly corrected down in June, at 697,000 units, which is -2.5% lower than May's very downwardly revised 715,000 but is up almost +24% compared to June 2022 when it was 563,000 units.

U.S. NEW Home Sales June ‘23, Madison's Lumber Prices Index July ‘23

At the sales pace in June, it would take 7.4 months to clear the supply of new houses on the market, up from 6.7 in May. According to the Madison report, there were 432,000 new homes on the market at the end of June, up from 429,000 in May. Houses under construction made up 60% of inventory, with those yet to be started accounting for 23%. The median sales price of a new home in June was almost flat, at $415,400, compared to $416,300 in May, and is down 4% from a year earlier.

Upshot

What all this means for roofing contractors specializing in new construction is that there remains plenty of future work in the pipeline.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!