ARMA Report Shows Major Shipment Decreases at End of 2022

Advanced Roofing Inc. received an Honorable Mention for reroofing Atlantic Technical College, Arthur Ashe Jr. Campus in Fort Lauderdale, Fla. Photo: Advanced Roofing Inc.

Every category of asphalt roofing products saw massive declines in shipments in the final quarter of 2022, revealing the true impact of the supply shortage on roofing.

In the final 2022 Quarterly Product Shipment Report from the Asphalt Roofing Manufacturers Association (ARMA), quarterly comparisons show each product category it tracks dropped by at least 16% from the third quarter.

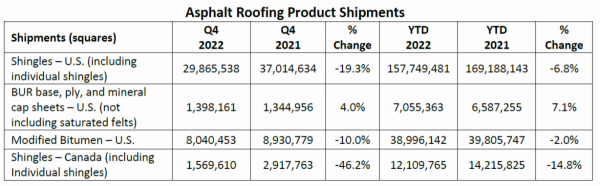

Here is a breakdown of the Q4 2022 shipments compared to Q3 (reported in squares):

- U.S. Shingles: 2.9 million, down by 24%

- BUR: 1.3 million, down by 23%

- Mod Bit: 8 million, down by 16%

- Canada Shingles: 1.5 million, down by 49%

The supply shortage, which first emerged during the COVID-19 pandemic, only worsened in 2022. Roofing contractors have reported as much in RC’s 2023 State of the Industry survey. In last year’s survey, 23% of contractors said supply shortages have had little to no impact on their business. In this year’s survey, that shrank to 5%.

Shipments typically slow down in the fourth quarter, in part due to cold weather hindering roofing work. This year’s declines, however, far outpace what was seen in 2021, where U.S. shingles dropped by 11.9%; Canadian shingle shipments by 12.4%; and U.S. modified bitumen shipments and BUR by 17.8% and 17.7%, respectively.

BUR appeared to be the only product that saw any increases. Of the four product categories, it was the only one that improved when comparing Q4 2022 to the same time last year. Every other product saw decreases ranging from 10% to 46%.

Similarly, comparing overall 2022 shipments to the 2021 shipment totals paints a picture of the impact the supply shortage had in the past year:

- U.S. Shingles: Down by 6.8%

- BUR: Up by 7.1%

- Mod Bit: Down by 2%

- Canada Shingles: Down by 14.8%

Material prices could also be a contributing factor to the declines. Inflation, combined with the current shortages, have caused prices to spike over the past year. Data from the Bureau of Labor Statistics shows construction input prices fell 2.7% in December compared to the previous month, though they are still 7.9% higher than they were a year ago.

These latest price point developments are both good and bad news, says Associated Builders and Contractors Chief Economist Anirban Basu, though it does bode well on the inflation front.

“Recent consumer and producer price releases indicate that inflation is fading, though it remains well above the Federal Reserve’s 2% target,” said Basu in a written statement. “Should inflation continue to abate, the Federal Reserve may be able to stop increasing interest rates sooner than anticipated. Interest rate-sensitive segments like real estate and construction would be among the primary beneficiaries.”

The ARMA report is created with roofing product shipment data collected from participating manufacturers by an independent third party, Association Research Inc.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!