First Quarter Asphalt Product Shipments Hint at Improved Supply Issues

The 2021 ARMA Gold Award was presented to West Michigan Roofing & Construction for Henderson Castle in Kalamazoo, Mich. Photo: Bob Ackerman.

Shipments of asphalt-based products saw major increases from the previous quarter, a possible indication that supply shortage impacts are decreasing.

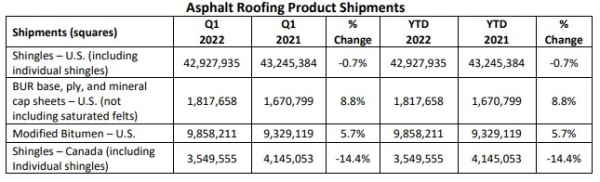

The latest Quarterly Product Shipment Report from the Asphalt Roofing Manufacturers Association (ARMA) shows shipments in all categories it tracks — U.S. and Canada shingles, BUR and modified bitumen — are on the rise compared to the fourth quarter of 2021.

Comparing year-to-year data, however, shows the roofing industry is not out of the woods yet regarding supply shortages.

Quarterly Improvements

Data for ARMA’s report is collected from participating manufacturers by an independent third party. According to those manufacturers, shipments (reported in squares) were the following in Q1 of 2022:

- U.S. Shingles: 42.9 million, up 15.97% from Q4 2021

- BUR Base, Ply and Mineral Sheet Caps: 1.8 million, up 35.14% from Q4 2021

- Modified Bitumen: 9.8 million, up 13.92% from Q4 2021

- Canada Shingles: 3.5 million, up 61.5% from Q4 2021

“We are optimistic about 2022, given the continued strength of the residential housing market and continuation of alternative work arrangements,” Reed Hitchcock, ARMA executive vice president, told RC. “That said, there does remain some question around commercial real estate, and while we have seen some growth over the past couple of years, the hope is that building owners will invest in their properties and also address some deferred maintenance from the pandemic.”

Research from Freedonia Group indicates the large amount of storm-related reroofing that took place in 2020 is expected to stunt residential roofing growth, as these roofs will not likely require additional work in the short term. However, Freedonia does predict new roofing, particularly among construction of single-family homes, will account for twice as many gains as reroofing.

“We are seeing homeowners investing in new homes and renovating existing properties as they have spent more time than ever in the home over the past two years,” Hitchcock said.

The commercial gains shouldn’t be discounted, either. With businesses returning to “normal” as COVID-19 restrictions ease up, more building owners are looking to improve their facilities.

“We continue to see strong performance in institutional low-slope projects, where asphalt is very often the material of choice, and as many businesses have returned to some degree of ‘in person’ work,” said Hitchcock.

A Sluggish Recovery

Although the quarter-to-quarter comparisons give hope that supply shortages are on the way out, ARMA’s report shows shipments for most products aren’t much better than the same time last year:

- U.S. Shingles: 42.9 million, down 0.7% from Q1 2021

- BUR Base, Ply and Mineral Sheet Caps: 1.8 million, up 8.8% from Q1 2021

- Modified Bitumen: 9.8 million, up 5.7% from Q1 2021

- Canada Shingles: 3.5 million, down 14.4% from Q1 2021

Hitchcock said even if the material shortage crisis is sorted out, another shortage that has plagued the industry before the pandemic hampers any optimism the data inspires.

“We hear a lot about material shortages, but labor shortage is as big an issue if not bigger, and as supply chains normalize we will go back to labor being the biggest challenge facing the roofing industry,” said Hitchcock.

To that end, more than 250 roofing professionals were in Washington, D.C. during the 2022 Roofing Day April 5-6 advocating for immigration reform and career and technical education funding to help solve the labor shortage.

“We hear from our (National Roofing Contractors Association) members all the time that if employers could get more employees, they could be doing anywhere from 10, 20, 30% more work," said Duane Musser, vice president of government relations for the NRCA.

For more insights into the roofing industry, view our 2022 State of the Industry Report.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!