Nexa Equity Announces Majority Growth Investment in Leap

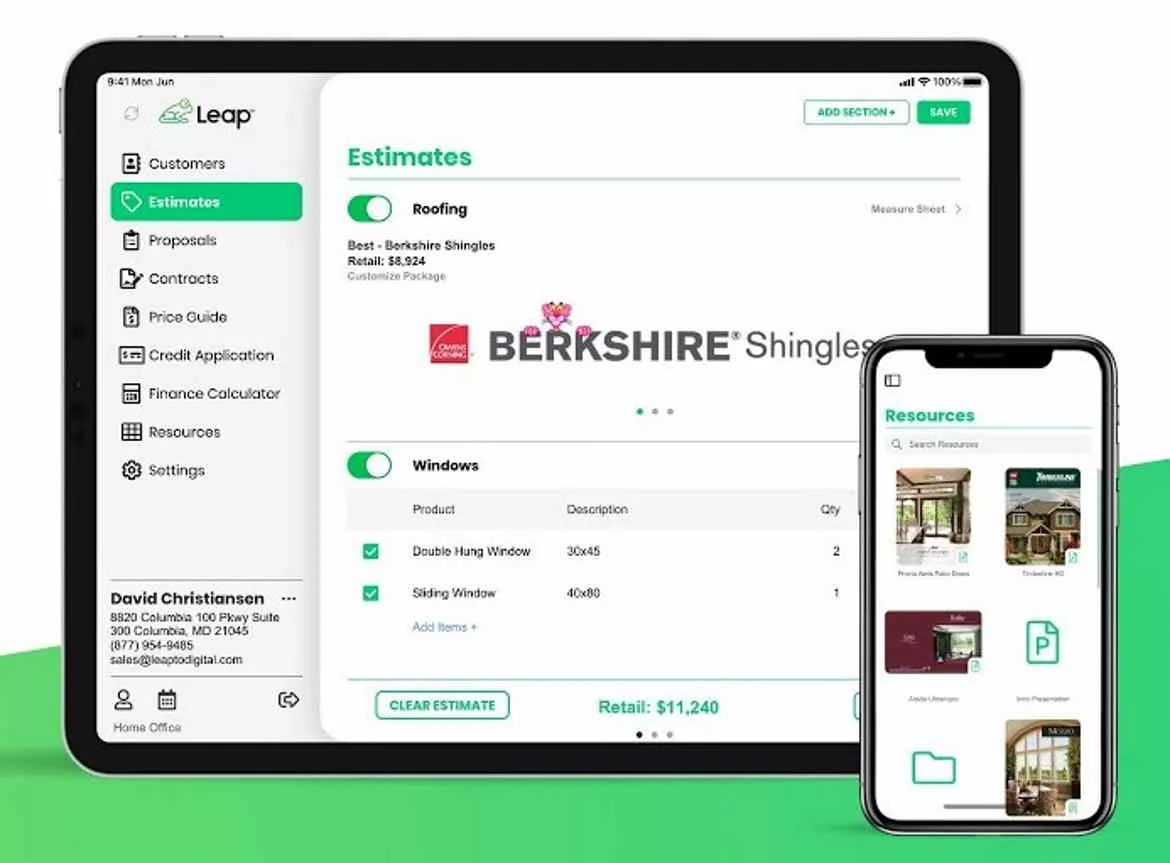

Image courtesy of Leap.

SAN FRANCISCO — Nexa Equity LLC announced that it has made a majority growth investment in Leap, a leading provider of home contractor sales enablement software. Leap’s management team and founders will continue to be meaningful shareholders. Financial terms of the transaction were not disclosed.

Leap is a purpose-built, on-demand software product developed by seasoned home improvement professionals that enables contractors to provide sales bids to potential clients on the spot. The home remodeling and renovations industry has seen significant growth in the past few years, and Leap is uniquely positioned to provide further efficiency and transparency to contractors and their customers.

“Leap is automating an industry that has traditionally relied on manual processes, estimates from memory, and spreadsheets,” said Vlad Besprozvany, founder and managing partner at Nexa Equity. “Home contractors can utilize Leap’s software to simplify their jobs and close bids quicker. The founding team’s deep expertise in the home contractor space has enabled them to build out best-in-class features with strong product-market fit, while driving significant customer growth and revenue.”

Leap digitizes every stage of the in-home sales process, including estimating, financing, contracting, and real-time communication. Leap’s proprietary application helps home contractors eliminate errors, increase profit margins and present professionally throughout the sales process. The company serves more than 700 home contracting businesses, processing more than $4 billion of estimates and funding over $1 billion of loan volume annually.

“Leap’s application improves existing home contractor sales processes and drives tangible ROI for its customers,” added Joey Maloney, a principal at Nexa Equity. “We’re thrilled to partner with the Leap team to further expand what they’ve built.”

Leap plans to utilize the investment from Nexa Equity to develop new products, accelerate go-to-market efforts, and further support their loyal customer base. Leap and Nexa Equity will partner closely to implement operational best practices, enter new markets, and execute strategic acquisitions.

“We pride ourselves on great people and culture, and we wanted to find a partner with the same values. It was a high priority of ours to work with a partner that is highly experienced in scaling software businesses and that shares a common vision for continuing to grow Leap into the leading end-to-end sales enablement platform for home contractors,” said Patrick Fingles, CEO and founder of Leap. “Our partnership with the Nexa Equity team will accelerate the realization of this vision while continuing to innovate for our customers.”

Willkie Farr & Gallagher LLP and Kirkland & Ellis LLP served as legal counsel to Nexa Equity.

Vista Point Advisors, a San Francisco-based boutique investment bank, acted as the exclusive financial advisor to Leap.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!