Sponsored

2018 Commercial Roofing Trends: Still Rolling

Roofing Contractors are Feeling Optimistic about the Industry's Future, but Workforce Issues Persist

As 2018 comes to a close, roofing contractors have much to be thankful for and much more to look forward to, according to RC’s latest market research.

As 2018 comes to a close, roofing contractors have much to be thankful for and much more to look forward to, according to RC’s latest market research.

As 2018 comes to a close, roofing contractors have much to be thankful for and much more to look forward to, according to RC’s latest market research.

As 2018 comes to a close, roofing contractors have much to be thankful for and much more to look forward to, according to RC’s latest market research.

A decade ago, the roofing industry was on the precipice of potential disaster. While the economy slowed and the housing bubble began to burst, roofing contractors in all markets were feeling the pinch of the Great Recession and began looking for ways to survive.

As 2018 comes to a close, roofing contractors have much to be thankful for and much more to look forward to, according to RC’s latest market research. With the help of experts from Clear Seas Research — the survey and research arm of RC’s parent company, BNP Media — our editorial study set out to identify the successes and challenges of the past year, with an eye on the year to come for roofing contractors.

The exclusive study took a deep dive into the commercial side of the North American roofing industry with responses from hundreds of roofing contractors about their business experiences in 2018 and the trends they see emerging as the new year approaches. Respondents consisted of roofing contractors that subscribe and receive RC.

The commercial roofing contractors that responded indicated that their companies generate at least 50 percent of their overall annual revenue from commercial projects. The majority were between the ages of 40 and 69, and the bulk said they have between one and 50 employees that generated between $1 million and $19.9 million in revenue last year, the data showed.

Turn Up the Volume

As one might expect with booming economic indicators, sales proved strong in 2018 and overall sales expectations in the commercial roofing industry were also extremely positive for the foreseeable future.

Nearly two-thirds of overall survey respondents said they experienced sales growth in 2018, and more than half expect greater growth next year. At least two-thirds of roofers said they expect sales to continuously improve over the next three years, with the vast majority (78 percent) indicating that commercial roofing sales should continue to increase into 2021.

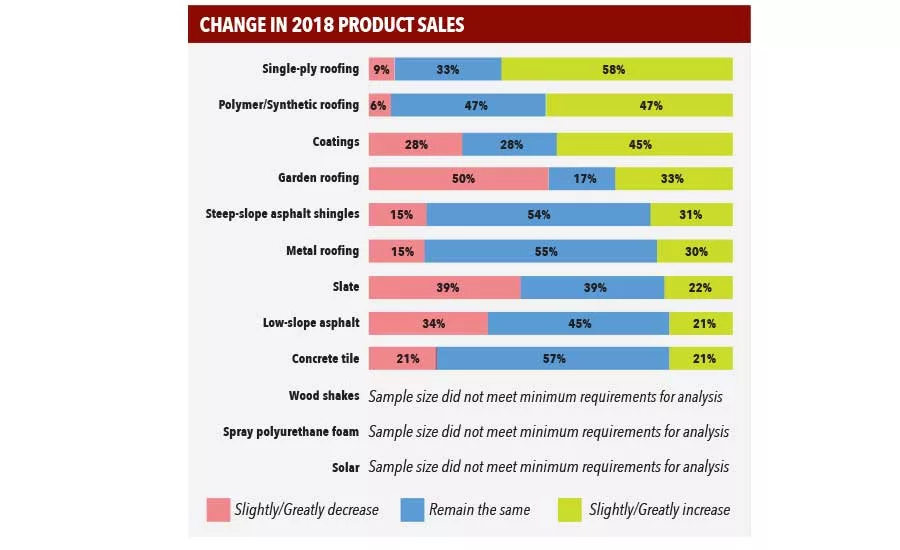

The majority of respondents (88 percent) said their company is involved with single-ply roofing, followed by metal (82 percent) and then coatings (67 percent). On average, 42 percent of overall sales revenue is generated by single-ply roofing, while metal and coatings together account for a quarter of overall sales revenue.

Four Commercial Roofing Trends For 2019

As 2018 draws to a close, it’s a great time to identify what trends have been driving the commercial roofing industry in recent months, then analyze them to find out how contractors, designers and other industry professionals can be best prepared to hit the ground running in 2019. We touched base with two industry veterans — SOPREMA USA’s Jeremiah Price, district sales manager, and Bryan Beth, Midwest regional manager — who work closely with roofing contractors, consultants, architects, engineers and designers across the country to find out what they are seeing and hearing.

( Read more... )

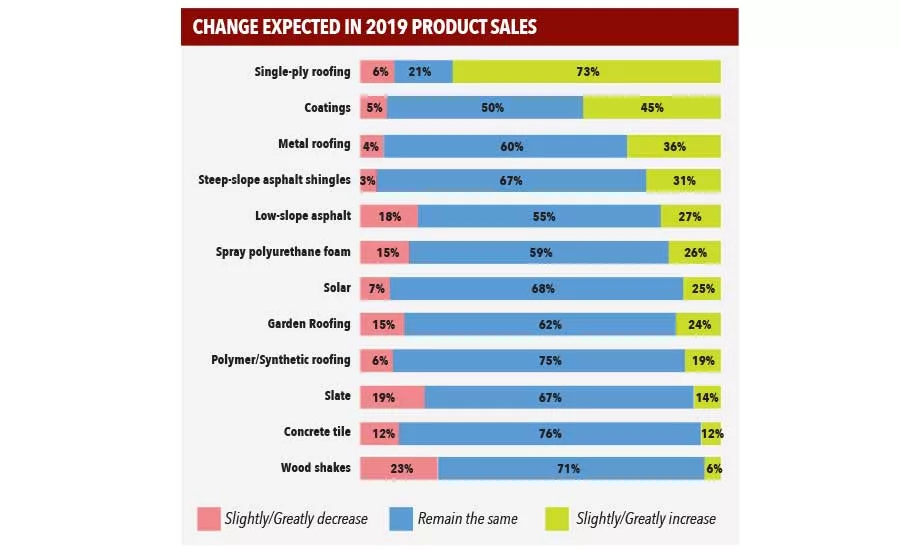

More than half of respondents (67 percent) said they expected steep slope asphalt shingle sales to remain the same as 2018, and 60 percent indicated the same for metal roofing.

Commercial sales of single-ply roofing and metal roofing have primarily increased over the past year, and that trend is expected to continue. Nearly three-quarters (73 percent) of respondents said they expected to see single-ply grow in 2019, followed by coatings (45 percent) and metal (36 percent) — both again climbed toward the top of commercial roofing products in demand for the second-straight year of RC’s commercial roofing report.

On the “green” roofing front, a vast majority of respondents (68) percent said solar-related sales should stay the same, and only about 25 percent said they expect sales to grow in 2019. Garden roofing followed suit, with 62 percent of respondents saying demand should remain the same, and 24 percent expecting increases. Polymer/synthetics (19 percent) and slate (14 percent) joined concrete tile and wood shakes in the product areas with the least anticipated amount of growth. That said, exactly three-quarters of commercial roofing contractors surveyed said polymer/synthetic sales should stay the same next year.

Workforce Woes

Even without a question pertaining directly to impactful issues facing the roofing industry as a whole, commercial roofing contractors that completed RC’s survey indicated clearly that workforce, labor and training matters are the key issues keeping them up at night.

More than three-quarters (79 percent) said they experienced an increase in overall labor costs since the start of 2018, and that uptick, on average, was by about 10 percent. Another 19 percent said labor costs remained the same and just two percent reported a cost decrease this year. While most (70 percent) indicated field work was completed by full-time employees, another 20 percent consistently used subcontractors. The data shows that the use of subs is believed to be mostly consistent since the start of 2018, but about a third of commercial roofing contractors report an increase over the past 12 months.

The prevailing reasons for the increases included large jobs with tight production timelines, increasing project backlogs and cost control. Only 9 percent of respondents said their use of subs decreased this year.

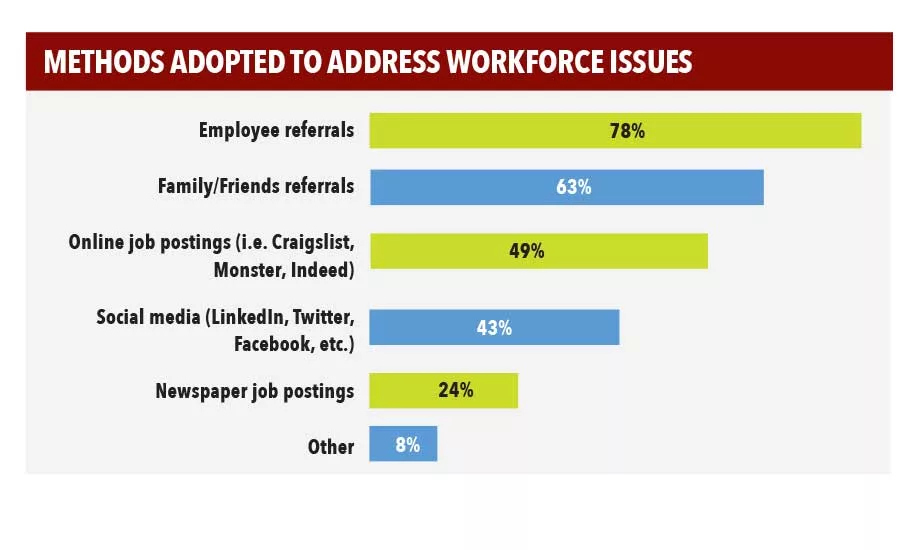

When it came to tackling arguably the biggest problem facing the roofing industry, the majority of respondents said they rely on their own employee referrals for recruitment. More than 78 percent of respondents said employee referrals were the best method to address workforce issues, while nearly two-thirds (63 percent) said they rely on family and friends to refer new potential workers. Just under half (49 percent) use online job postings and slightly less (43 percent) said they use social media platforms like LinkedIn, Facebook and Twitter to recruit.

As they struggle to find skilled hands to meet project demands, commercial roofing contractors are overwhelmingly looking to become more efficient and technically sound both on and off the rooftop by getting serious about training.

Nearly all surveyed (92 percent) indicated they offer in-house, on-the-job training, and more than half (51 percent) have a designated training program for all employees. An additional 53 percent said they participate in manufacturer training, while over one-third (35 percent) are involved with training programs offered by roofing contractor associations. Only 12 percent indicated using vocational or training schools for their workers.

Commercial roofing contractors, as a whole, also appear supportive of national training and certification efforts underway by the National Roofing Contractors Association (NRCA). Well over half of respondents (57 percent) said they believe certification will improve the industry, and more than two-thirds (69 percent) said they’ll likely participate in the NRCA’s ProCertification program, expected to launch next year.

It’s also clear that the educational efforts are just getting underway. At least a third of contractors said they don’t see any impact — positive or negative — from national or regional certification programs. And roughly one-quarter of all respondents do not plan to participate in any roofing certification programs in 2019.

Technology Trends

Another path commercial roofing contractors are depending on to become more efficient is through the adoption of new technology. Survey data showed that on-the-job mobile devices and wearable communication devices are the most used technological tool among roofers, adopted by 29 percent of respondents. Cloud service/computing followed at 22 percent, and drones (18 percent) rounded out the top three. Drone usage is also expected to increase over the next two years as 22 percent said they’re currently exploring their options with an intent to use drones by 2020. One quarter of respondents said they plan on purchasing or upgrading drones and estimating software next year.

The data conclusively shows that estimating software emerged as the primary type of digital programs in use by the majority of contractors, at 57 percent. Aerial measurement was another popular recent technological enhancement at 43 percent. About 39 percent use enterprise or accounting software.

Roofing contractors also appear to be on the cutting edge of other developing technologies. Sixty-five percent of respondents said they’re exploring augmented and virtual reality programs to add to their business model, and slightly more (67 percent) said they’re looking into robots. More than half (57 percent) said they’re exploring 3-D printing and additive manufacturing, and 55 percent said they’re discussing the use of artificial intelligence and predictive analytics.

Conclusion

Respondents to this year’s study showed that the optimism felt and experienced in the North American roofing industry over the past few years continues. Many shared the same positive outlook on both the short-term and long-term future like they did a year ago. The data suggests that most respondents feel that continuing the course and riding the overall positive economic wave for as long as possible is the best path toward prosperity. At the same time, however, many are looking to technology and innovation to help solve the worsening workforce shortage, and to better prepare themselves for leaner times ahead.

Many expect the industry to provide solutions from both the product development side and enhanced training in order to become more efficient and profitable. Key answers that could be provided in 2019 may include whether those innovations are coming fast enough to make a difference in commercial roof sales, and if large-scale efforts to ‘coach-up’ roofing contractors everywhere can turn the workforce dilemma around.

The information contained within this article is comes from: Clear Seas Research. 2018 Roofing Contractor Commercial Roofing Trends Report, Nov. 2018. Full disclosure: RC provided a $5 gift card for every qualified completed response, and entered that survey participant into a random drawing for one $100 gift card.

Clear Seas Research is a full service, B-to-B market research company focused on making the complex clear. Custom research solutions include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!