Understanding How to Spot Trouble on Your Roofing Company's Profit and Loss Statement

I realize that for many of you, this article may be very elementary. However, contractors are notorious for not being interested in, and really not knowing their numbers. Accounting, particularly profit and loss statements, is much easier to understand than many contractors realize. Accounting is easier than estimating. There’s no multiplication and division. Estimating is predicting what you think costs will be. Accounting is simply the adding and subtracting of facts to see what the cost actually was. Unfortunately, many statements are put together in confusing formats and require some digging to figure things out.

The first rule of financial evaluation is to always use accrual statements for financial evaluation. Your accountant may choose to use cash statements for taxes, but cash statements are of little value for actual financial reviews. Why? Cash statements do not include accounts receivable (what people owe you) and accounts payable (what you owe others). Therefore, cash statements do not reflect an accurate evaluation of your business’s current financial situation. Another confusing component of profit and loss statements is that while a profit and loss statement may look like a checkbook register, it does not measure how much cash you have in the bank. Profit and loss statements show if you are making or losing money, and balance sheets show where that money is located or tied up within the system.

It’s important to conduct a regular financial meeting each and every month with the bookkeeper and partners. Contracting profits change rapidly, plus many roofing businesses are seasonal. By not paying attention to a couple of months of summer financials, suddenly your season is over and you realize you’re not profitable. At financial meetings you should also review a balance sheet, an aging report for accounts payable and accounts receivable.

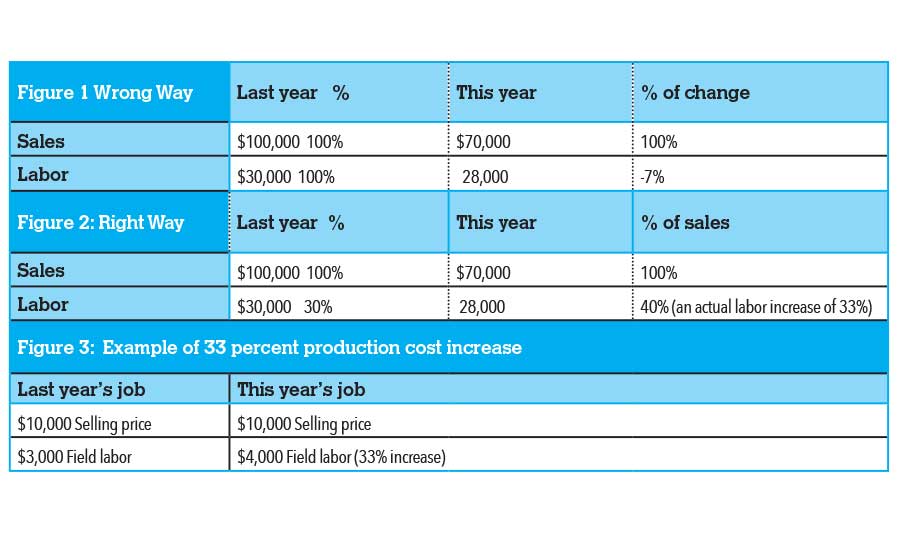

Make sure your profit and loss reports calculate percentage of sales, not percentages of last period to this period of time. A percentage of sales comparison is the only way to realistically compare actual expenses. A statement that compares each line item regarding how much it has gone up or down year-to-year is of little value. The examples above show how misleading this type of comparison can be when comparing costs line item by line item. I’ve used sales and field labor as an example. In Figure 1, labor is compared with the previous year, and is down 7 percent. It seems like a good thing when in reality it’s a disaster.

In Figure 2 and Figure 3, we compare numbers as a percentage of sales. This shows the real problem. Now the cost of actually installing a job has increased by 33 percent. Before a $10,000 job could be installed for $3,000, at this new rate a $10,000 job would cost $4,000 to install.

Labor and sub percentages are the best way to tell if your statements are accurate or if there’s good or bad financial news. What could have caused a 33 percent increase? The culprit is usually one of two things:

Something is unbilled. Possibly a large job was done last month, but not billed until this month or maybe jobs just were not billed on time.

You’re losing money. You’re either the victim of bad job estimates or you’re paying employees who are not producing. It’s also possible employees are being poorly managed or maybe you have been trying to keep people busy during a slow period by dragging out jobs or having field people work in the shop.

If your business uses subs instead of employed field labor, the same logic applies. Common sense tells us that you wouldn’t pay a sub for doing nothing. If you use subs and field labor, look at them both and see if the total percentage falls within your norm. There are lots of ways to look at a profit and loss statement, but labor/subs cost to billings is an excellent way to quickly evaluate the statement’s accuracy. Too many roofing contractors simply look at the top and bottom lines and really don’t question what’s between the two.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!