Measuring Up: Material Increases and Margins: Are You Charging Too Much?

After years of consulting with contractors, I am confident many do not fully understand their costs and use arbitrary markups to recover overhead and profit. Some of these markups are based on previous employer practices, others on competition, and some are based on outdated budgets. Costs for roofing contractors have fluctuated a great deal in the last year.

After years of consulting with contractors, I am confident many do not fully understand their costs and use arbitrary markups to recover overhead and profit. Some of these markups are based on previous employer practices, others on competition, and some are based on outdated budgets. Costs for roofing contractors have fluctuated a great deal in the last year. Gas prices soared and then dropped; roofing materials prices have increased as much as 60 percent to 100 percent. In the meantime, the market is flooded with per square roofing subs that roofed new homes and have no idea of their actual re-roofing costs. Such fluctuations mean many contractors must take a hard look at their budget and carefully calculate break-even costs. Now is not the time to guess at pricing and break-even points.

Traditionally, material price increases have in an odd way helped the pricing practices of some contractors. In the good old days when materials increased 5 percent, many contractors simply bumped their prices 5 percent. Such a system was the way many contractors gave themselves a raise. Such dramatic material increases and a tightening economy have made it impractical to use such arbitrary practices. Short term, many contractors did their best to manage the situation. Some contractors raised prices too slowly and material price increases ate into their 2007 margins. Others priced material on each and every job and did their best to manage the situation. However, yearly numbers and margins have changed as such historic price increases play havoc with traditional financial percentages.

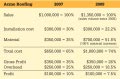

Material price increases have inadvertently reduced contractor gross profit percentages. It really is a math issue and seeing materials double in one year is a once in a lifetime phenomenon. Some contractors have not recalculated gross profit break-even points based on such material increases and may be, without knowing it, overpricing jobs. I have used a sample company to illustrate how such percentage changes can occur. To keep the math simple, let’s start with a company that did $1 million in sales in 2007 and the company experienced a 100 percent material cost increase. Costs comparisons are shown in Figure 1.

Material price increases have inadvertently reduced contractor gross profit percentages. It really is a math issue and seeing materials double in one year is a once in a lifetime phenomenon. Some contractors have not recalculated gross profit break-even points based on such material increases and may be, without knowing it, overpricing jobs. I have used a sample company to illustrate how such percentage changes can occur. To keep the math simple, let’s start with a company that did $1 million in sales in 2007 and the company experienced a 100 percent material cost increase. Costs comparisons are shown in Figure 1.

As you can see in the example outlined in Figure 1, as material prices increased, the actual gross profit percentages changed a great deal. A contractor that once calculated a gross profit need of 35 percent to arrive at $350,000 in gross profit now finds that 26 percent - or 9 percent less gross profit - brings the same $350,000.

The above is a fictitious example and I am the first to admit it is a dramatic one with extreme price increases. However, now is not the time to guess or use arbitrary margins. Now is the time to carefully budget your overhead and price jobs accordingly. If your overhead budget is too high, look to how you might lower your overhead.

As far as calculating overhead is concerned, there are lots of ways to calculate overhead recovery. I have always preferred relating the majority of your overhead costs to labor. Labor is a much better measurement of time and capacity. The simple truth is overhead is so much a day, per week or per month.

In the above example, overhead is $250,000 a year. We assume this includes a fair owner’s salary. With this in mind, this equals $20,833 a month ($250,000 divided by 12 months). This means that each and every month the company is going to spend an extra $20,883 above direct costs to break even. Rent, salaries, truck payments are all made so much per week or month. This company must recover this $20,833 each month before a dime of profit is recovered. We can also look at this cost as it relates to labor. Labor costs was $300,000 and overhead was $250,000, so for every $1 dollar spent in labor this company spent 83 cents to employ that labor.

In the above example, overhead is $250,000 a year. We assume this includes a fair owner’s salary. With this in mind, this equals $20,833 a month ($250,000 divided by 12 months). This means that each and every month the company is going to spend an extra $20,883 above direct costs to break even. Rent, salaries, truck payments are all made so much per week or month. This company must recover this $20,833 each month before a dime of profit is recovered. We can also look at this cost as it relates to labor. Labor costs was $300,000 and overhead was $250,000, so for every $1 dollar spent in labor this company spent 83 cents to employ that labor.

Many roofing contractors bid so much per square. Such per-square prices tend to reflect what the contractor thinks others are charging. In reality, each square should be a mini-bid that includes so much for labor, so much for material, so much for overhead and so much for profit. The problem with such square pricing is that it tends to be an arbitrary measure. I suspect many roofing contractors have built material price increases into per square prices. I wonder how they arrived at their new per square number. Was it arbitrary or a budgeted calculation that was carefully thought out? Possibly it is an average. Well, if I had one foot on a hot stove and one foot in a bucket of ice water, on the average, I would feel OK. Now is not the time to guess at break-even points and pricing. Now is the time to make sure you know your bottom line and where you have to be to stay in business.

There is much talk about the recession and its impact on the economy. Everywhere contractors meet there is a grumbling that includes political rhetoric and price increase complaints. That is all fine and good, but what are you doing to help your business? Yes, there are numerous outside pressures impacting your business, but your success will be driven by your inward actions, not external pressures. Now is the time to look at your company and make any necessary changes.

After years of consulting with contractors, I am confident many do not fully understand their costs and use arbitrary markups to recover overhead and profit. Some of these markups are based on previous employer practices, others on competition, and some are based on outdated budgets. Costs for roofing contractors have fluctuated a great deal in the last year. Gas prices soared and then dropped; roofing materials prices have increased as much as 60 percent to 100 percent. In the meantime, the market is flooded with per square roofing subs that roofed new homes and have no idea of their actual re-roofing costs. Such fluctuations mean many contractors must take a hard look at their budget and carefully calculate break-even costs. Now is not the time to guess at pricing and break-even points.

Traditionally, material price increases have in an odd way helped the pricing practices of some contractors. In the good old days when materials increased 5 percent, many contractors simply bumped their prices 5 percent. Such a system was the way many contractors gave themselves a raise. Such dramatic material increases and a tightening economy have made it impractical to use such arbitrary practices. Short term, many contractors did their best to manage the situation. Some contractors raised prices too slowly and material price increases ate into their 2007 margins. Others priced material on each and every job and did their best to manage the situation. However, yearly numbers and margins have changed as such historic price increases play havoc with traditional financial percentages.

Figure 1. The effect of material price increases on profit margin is illustrated here. In this example, a company with $1 million in sales in 2007 experienced a 100 percent material cost increase. Note: Installation cost includes subs, labor, and workers’ compensation insurance.

As you can see in the example outlined in Figure 1, as material prices increased, the actual gross profit percentages changed a great deal. A contractor that once calculated a gross profit need of 35 percent to arrive at $350,000 in gross profit now finds that 26 percent - or 9 percent less gross profit - brings the same $350,000.

The above is a fictitious example and I am the first to admit it is a dramatic one with extreme price increases. However, now is not the time to guess or use arbitrary margins. Now is the time to carefully budget your overhead and price jobs accordingly. If your overhead budget is too high, look to how you might lower your overhead.

As far as calculating overhead is concerned, there are lots of ways to calculate overhead recovery. I have always preferred relating the majority of your overhead costs to labor. Labor is a much better measurement of time and capacity. The simple truth is overhead is so much a day, per week or per month.

Many roofing contractors bid so much per square. Such per-square prices tend to reflect what the contractor thinks others are charging. In reality, each square should be a mini-bid that includes so much for labor, so much for material, so much for overhead and so much for profit. The problem with such square pricing is that it tends to be an arbitrary measure. I suspect many roofing contractors have built material price increases into per square prices. I wonder how they arrived at their new per square number. Was it arbitrary or a budgeted calculation that was carefully thought out? Possibly it is an average. Well, if I had one foot on a hot stove and one foot in a bucket of ice water, on the average, I would feel OK. Now is not the time to guess at break-even points and pricing. Now is the time to make sure you know your bottom line and where you have to be to stay in business.

There is much talk about the recession and its impact on the economy. Everywhere contractors meet there is a grumbling that includes political rhetoric and price increase complaints. That is all fine and good, but what are you doing to help your business? Yes, there are numerous outside pressures impacting your business, but your success will be driven by your inward actions, not external pressures. Now is the time to look at your company and make any necessary changes.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!