Insulation Industry Explores Consolidation Alternatives

To remain competitive, individual contractors must decide carefully if banding together with other insulation contractors or remaining on their own is in their best interest. Of course, many contractors choose to remain completely independent, but others are choosing to join consolidation alternatives like roll-ups and co-ops rather than sell out completely. But what do these alternatives entail, and why do some insulation contractors prefer one situation to another? To get to the bottom of these questions, we asked contractors involved in roll-ups and co-ops, as well as independent contractors, to explain their situations in regard to consolidation and why they chose the paths they did.

Consolidation Alternatives

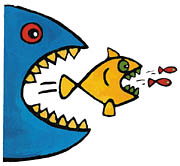

Almost everyone in the insulation industry has witnessed an example of a buy-’em-out consolidation situation in which a bigger company purchases one or several other companies, creating one large enterprise in the process. However, not all contractors have been exposed to roll-ups and co-ops, groups that are a bit more difficult to explain than out-and-out consolidations.Both co-ops and roll-ups adhere to the belief that strength lies in numbers, but they choose to unite and organize themselves differently. For example, co-op participants join together under a common name, but each company in the co-op still retains its independence. Ginny Cameron’s company, A.C. & R. Insulation, Beltsville, Md., belongs to the Insulate America co-op. Cameron explains the alliance by saying, “A co-op is nothing more than a group of people coming together to take ownership in a bigger organization, but it’s an equal ownership. You’re just rubbing shoulders with a lot of other people who are other independents.” On the other hand, the two or more companies involved in a roll-up come together to form an entirely new company. Each roll-up participant retains some ownership in the newly created entity, but is no longer independent.

To understand the fundamental difference between co-ops and roll-ups, Larry Helminiak of Carroll Insulation, a roll-up participant in Eldersburg, Md., suggests that we think about a plate of ham and eggs. He explains that the chicken was involved with the making of this dish, but the pig was committed permanently. Helminiak goes on to clarify, “An insulation company involved in a co-op is like the chicken: It has the ability to pull out of the arrangement if it doesn’t like where the deal is headed. However, a company in a roll-up is like the pig: It can never go back to being a pig once it’s been turned into a piece of ham.”

According to Helminiak, the perceived economic advantages of roll-ups and co-ops often convince people to join these consolidation alternatives. He explains that he entered a roll-up in an attempt to achieve volume parity. “Six insulators from across the country, of which I was one, got tired of the perception that we weren’t buying right because of our volume,” Helminiak says. “We formed one new company so that together, we would be as big as the other companies.”

Cameron explains that while economics often fuel people to join co-ops, she believes that the organizations have advantages beyond the financial realm. One reason she says she chose to join was “to preserve the existence of being independent and to strengthen alliances with other contractors who have similar interests and also with suppliers.” According to Cameron, co-ops also give contractors a forum in which they may meet with one another and “gather ideas through training, education and partnership with fellow contractors.”

Remaining Independent

However, not all contractors like the idea of joining together with other contractors. Many who remain independent say they do so because they place a high value on their freedom. Karl Reinke, Jr. of Dundee, Ill., is one such contractor who says he has no intention of consolidating or joining a roll-up or co-op. He explains, “I started the business some 35 years ago, and I like my independence.”Ken Davis of Insulation by Davis, Bend, Ore., is another independent who says the fear of losing his independence has kept him from joining consolidation alternatives. “You lose local control, and you lose control of your business basically,” he says. However, Davis claims he can imagine considering full-scale consolidation if he just got tired of the business. “You can never close all of your options,” he says. “It’s a stressful industry.”

To compete against consolidated companies, roll-ups and co-ops, many independents are trying to capitalize on their smaller stature. For example, Cameron says, “I think that the larger consolidated contractors thrive on the larger contracts, and it makes the independent groups a little bit more specialized. I think there’s always that market for the more one-on-one relationship.” Davis agrees with Cameron and says that he plans to use his independent standing as a marketing strategy. “We plan to sell ourselves as an independent, locally owned business,” he says. “In some ways, it’s almost an advantage — builders are pretty independent people, and there are some of them who would just probably rather deal with a local rather than a multi-corporate situation.”

Forecasting for the Future

While most people agree that there always will be independents in the marketplace, no one seems to be able to agree where the insulation industry is at in the consolidation cycle and where it is headed in the future. Some contractors like Reinke believe the cycle is coming to an end. He says, “I think consolidation has pretty well run its course. I see nothing but troubles for them later on.” Others forecast that there will be a moderate amount of consolidation in upcoming years. “I think we’re probably in the middle stages of the cycle,” Davis says, “and I see more of it happening in our area.” Cameron and some of her fellow contractors, though, predict unlimited future consolidation. “I think we’re kind of like where we are with the Internet: the consolidation cycle is really still almost in its infancy,” she explains. “I think what we’re headed for are these huge mega-companies in all fazes of business, not just insulation.”Helminiak admits that he has no idea where the cycle will turn next. “If anyone knew the answer to where we are headed,” he says, “they would sell it to any of five manufacturers trying to figure out the answer.” However, Helminiak says he does know that the insulation industry needs all types of contractors to stay afloat. “No two places are the same,” he explains, “and thinking that what works in one market has to work in another is doomed to failure.” So wherever the consolidation cycle proceeds in the future, don’t expect diversity to die any time soon.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!