Mid-Year Outlook

Tariffs, Talent and Tech: The New Rules of Roofing Consolidation

As 50% steel and copper duties squeeze margins, PE-led roofers lean on digital tools and workforce programs to protect high-multiple valuations

With non‑discretionary repair demand and federal rebuild programs, PE platforms are writing ever‑bigger checks in a market that won’t let a stormy forecast slow them down.

QUICK READ

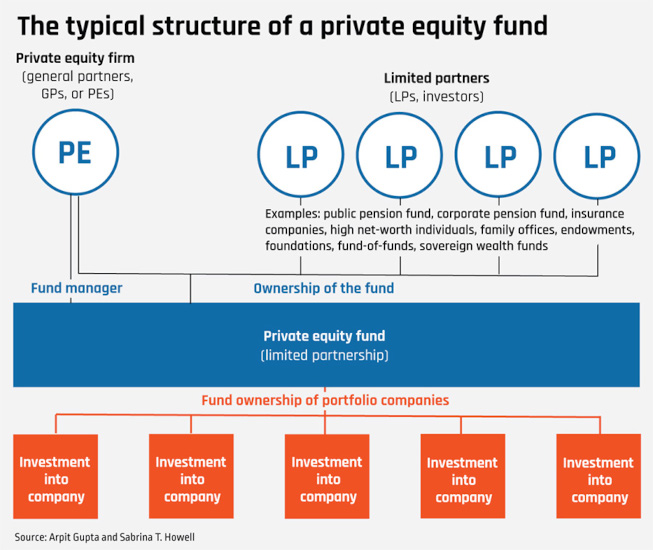

- Private Equity Deal Volume Is Surging: By mid-2025, private equity firms were acquiring a U.S. roofing platform every 48 hours, with 134 deals expected this year — more than double the volume in 2021.

- The Market Is Growing Fast: Valued at $23.35 billion in 2024, the U.S. roofing market is projected to hit $44.24 billion by 2034, driven by storm damage, aging homes, and non-discretionary repair needs.

- Technology Adoption is Accelerating: Once tech-averse, the industry is now investing heavily in CRM platforms, estimating software, aerial measurement tools, and early-stage AI, often via PE-backed rollups.

- Tariffs and Labor Shortages are Pressuring Margins: New Section 232 tariffs on steel and copper have spiked material costs and delayed deliveries. In contrast, a shortage of skilled labor continues to pose a challenge to contractors nationwide.

- Distribution Wars Reflect Broader Consolidation: Major acquisitions — including Home Depot’s $18.25B buy of SRS and QXO’s $11B deal for Beacon — highlight intensifying competition across the roofing supply chain.

By mid‑year, private equity firms had acquired at least one U.S. roofing platform every 48 hours, underscoring a frenzied deal pace that shows no signs of slowing, according to research by marketing analytics firm ERM.

The U.S. roofing services market, valued by ERM at $23.35 billion in 2024, is forecast to reach $44.24 billion by 2034, and is attracting acquisitive capital despite mounting economic and trade uncertainties.

Investors find roofing irresistible. Demand for storm repairs, leak fixes, and full-roof replacements is effectively non-discretionary; homeowners simply can’t defer a collapsed roof.

“It’s necessary, and there’s no such thing as offshore roofing,” says Randy Korach, chief executive of Roofing Corp. of America, one of the original consolidators to go institutional in the sector.

Consolidation Accelerates

Image by Bryan Gottlieb

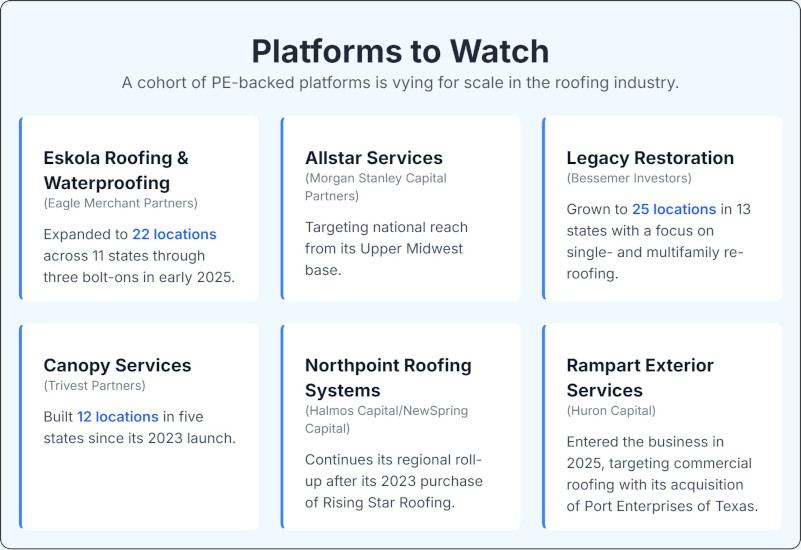

Deal counts have surged from 62 platform transactions in 2021 to 134 in 2024, a 25% increase, according to both PitchBook and ERM. By March 31 this year, there were 56 active private‑equity‑backed roofing platforms, up sharply from 17 two years earlier.

Tyler Veit, a managing director at Stax, a Boston‑based global strategy consulting firm, cautioned that not all platforms are equal, pointing out that heavy insurance‑driven revenues can create “waves” in EBITDA that are hard to underwrite.

“You hit a wave of claims tied to environmental factors that came through, and it’s hard to underwrite what is a more steady state versus what the seller is trying to sell off, like a more inflated EBITDA or revenue number,” he said.

Yet not all appetites run at full throttle. Jim Ziminski, president of Omnia Exterior Solutions — a CCMP Capital‑backed roll‑up — says volume deliberately eased in Q1 2025.

“Some of the big acquirers have said, ‘Let’s take a pause and integrate,’” he explained. “A lot of people were just buying businesses and then couldn’t make the synergies stick.”

His own platform, which closed eight deals in 2024, expects only four this year as it focuses on leadership continuity and unified systems.

Technology Joins the Fray

PE’s rise in roofing has spurred investment in software for an industry not known as an “early adopter” of tech innovation. Last year, Sumeru Equity Partners took a $330 million majority stake in JobNimbus, a CRM and operations hub for roofers.

ServiceTitan, already a major player in the HVAC industry, has expanded aggressively into exterior services, illustrating how investors are building end‑to‑end platforms that blend contractors, suppliers and SaaS tools.

According to Roofing Contractor’s “State of the Industry” report, adoption of digital tools has soared in 2025: 74% of commercial roofing firms now use estimating software, 69% use enterprise/accounting systems and 64% rely on business‑process tools; residential contractors show similar uptake at 71%, 62% and 56%, respectively.

Other indicators of a shift include that 54% of contractors are deploying aerial measurement tools via drones, with another 27% planning to adopt them within two years. Additionally, 61% already use satellite or aerial measurement tools, and 19% are evaluating them for future use. Meanwhile, roughly 25% of firms are piloting AI, predictive analytics, 3D modeling or augmented reality/virtual reality solutions — an early sign of the next innovation wave.

Veit stressed that technology alone won’t win deals—platforms need clean, traceable data.

“You just need to have clean and traceable data. People need to be able to do financial due diligence and trust that they can make bets on what data is in place,” he said.

Section 232 and Tariff Shocks

Section 232 of the Trade Expansion Act of 1962 allows the president to impose tariffs when imports threaten national security — a power first used in 2018 to levy duties on steel and aluminum. On March 12, those duties were reinstated at 25% and increased to 50% on June 4. Copper joined the list with a 50% levy, effective Aug. 1, covering raw, refined and scrap forms.

The tariff barrage has roiled material markets. Domestic metal premiums jumped 54% in six weeks, squeezing panel, flashing and fastener costs, and the National Roofing Contractors Association reports a 46% rise in overall material costs since 2020.

Border inspections and mill backlogs have stretched lead times by six to eight weeks, according to NRCA’s June 2025 Quarterly Market Survey, prompting contractors to bundle price‑escalation clauses into client contracts.

“Other than fasteners and underlayment, most roofing materials are U.S.‑based. It won’t affect us too greatly,” says Ziminski, adding that buyers across the sector are bracing for further volatility.

Distribution‑Level Shake‑Up

Consolidation at the contractor level is mirrored within the industry’s distribution network. In June 2024, The Home Depot closed its $18.25 billion acquisition of SRS Distribution at roughly a 16.1× EV/EBITDA multiple, marking the retailer’s largest acquisition ever.

On April 29, QXO Inc., the vehicle of veteran dealmaker Brad Jacobs, completed its $11 billion takeover of Beacon Roofing Supply, making QXO the largest publicly traded distributor of roofing and related building products in the U.S.

As recently as mid‑Q2, Home Depot and QXO tussled over gypsum‑and‑materials supplier GMS. On June 23, Home Depot launched a cash tender at $110 per share, outbidding QXO’s $95.20 proposal and spurring a 27% rally in GMS stock.

Home Depot ultimately prevailed, agreeing to acquire GMS for $4.3 billion in equity (approximately $5.5 billion, including debt) in a deal expected to close by the end of the fiscal year.

Not to be outdone, Lowe's is acquiring Foundation Building Materials for $8.8 billion. The transaction is expected to close in the fourth quarter of 2025.

"With this acquisition, we are advancing our multi-year transformation of the Pro offering," said Marvin R. Ellison, Lowe's chairman, president, and CEO in a written statement. "It allows us to serve the large Pro planned spend within a $250 billion total addressable market and aligns perfectly with our Total Home strategy.

Challenges on the Horizon

Image created by Bryan Gottlieb

Inflation and tariff pressures test margins. Contractors report that a box of roofing nails — once priced at roughly $65 — has tripled to over $200 in regions affected by steel and copper duties, according to NRCA’s June 2025 Quarterly Market Survey.

Labor scarcity remains acute: roofing crews are stretched thin amid a broader construction‑industry shortfall, with Associated Builders and Contractors estimating a need for 439,000 net new workers in 2025 to meet demand. For ballast, platforms are investing in training, signing bonuses and safety programs to retain talent.

Regulatory complexity adds another layer. State-by-state building-code changes — from hail-resistant shingles in the Midwest to wildfire debris rules in California — demand local expertise, complicating the rollout of playbooks.

Looking ahead, Veit warned that rising input costs will drive consumer‑like behavior among homeowners.

“Prices are going to go up, sentiment is going down, and people will operate similar to recessionary behaviors,” he said, underscoring the importance of stress‑testing platforms against downside scenarios.

The cost volatility has reshaped deal structures. Several investment bankers have noted that sponsors now demand price-escalation clauses, earn-out provisions and cost-pass-through mechanisms to protect their returns.

A CBIZ analysis warns that platforms unable to absorb input-cost shocks risk valuation compression, prompting some firms to pause bolt-on activity while they fortify their supply chain and back-office systems.

Strategic Opportunities and Outlook

Despite these headwinds, secular tailwinds remain strong. Roofs wear out on schedule; storms boost replacement cycles; and technology adoption promises efficiency gains. Platforms that pair disciplined operations with targeted tech investments — such as CRM, drone‑based estimates and unified HR — stand to outperform.

Post‑disaster reconstruction offers a revenue spike during severe weather seasons, while public‑sector and insurer partnerships are emerging as new avenues for deal flow and stable contracts. Analysts expect consolidation to persist through 2026. Ziminski likens the trend to a baseball game still in the second inning.

“We haven’t even seen the reliever yet,” he says.

Multiples are at the high end of historical ranges, so buyers are vetting targets more rigorously. Yet with a median U.S. home age over 40 and federal rebuild programs ramping up, the underlying market remains robust.

For contractors considering a sale, private equity offers liquidity and rollover equity, but also a gauntlet of due diligence.

“Most roofing companies are a cult of personality,” RCA’s CEO Korach warns. “Buyers want to know: ‘If you leave, does the business fall apart?’”

As roofers swap hammers for hedge‑fund term sheets, the industry’s defining paradox persists: it is both recession‑proof and fiercely competitive, with every deal driving up valuations.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!