Exit Planning

Stop Overpaying ‘Exit’ Taxes

Most business owners unnecessarily pay ‘exit taxes’ exceeding 55%; here’s how to reduce that rate to 15%-35%, saving a bundle

The "exit" for most business owners is the largest financial event of their lives, and most principals use specialists for exit and tax advice. I get it. During my exit, we went to our trusted accountant and attorney.

Later, I realized that decision was costly to my team and me; we paid millions of dollars in unnecessary taxes, money we could have saved if I knew then what I know now. Let’s use the internal Management Buyout, or MBO, as an example since it is the most prevalent exit strategy in the roofing contracting industry.

Note: Do not use these examples for other exits, as taxation differs in an "external" exit strategy, such as a competitor or private equity sale.

An MBO typically has three parties: the seller, the buyer, and Uncle Sam. During an MBO exit, the company also pays for everything, so strong cash flow is needed to finance the buyout.

This next story offers an overview of a “Payroll Bonus” exit strategy. Ironically, this method is how my team bought the company from the second-generation son of the founder. I was sitting next to a specialty contractor at an event who knew I was an exit planner. He proudly shared how he retired and sold the company to his son.

He also mentioned he sold his S-Corp by grossing up his son’s salary, and then his son bought the stock with after-tax dollars. The father then pushed me to show how we could have saved him money.

Against my better judgment, I gave in to his persistence. I took a piece of paper and sketched a hypothetical $1 million exit to demonstrate his method.

- The son must earn $1.666 million to net $1 million (40% tax on capital gains of $1.6 million = $1 million), not including payroll and other burdens.

The son pays his dad $1 million for him to net $800,000 (20% tax on capital gains) and does not include the Net Investment Income Tax or a State Tax, assuming Dad has a very low stock basis.

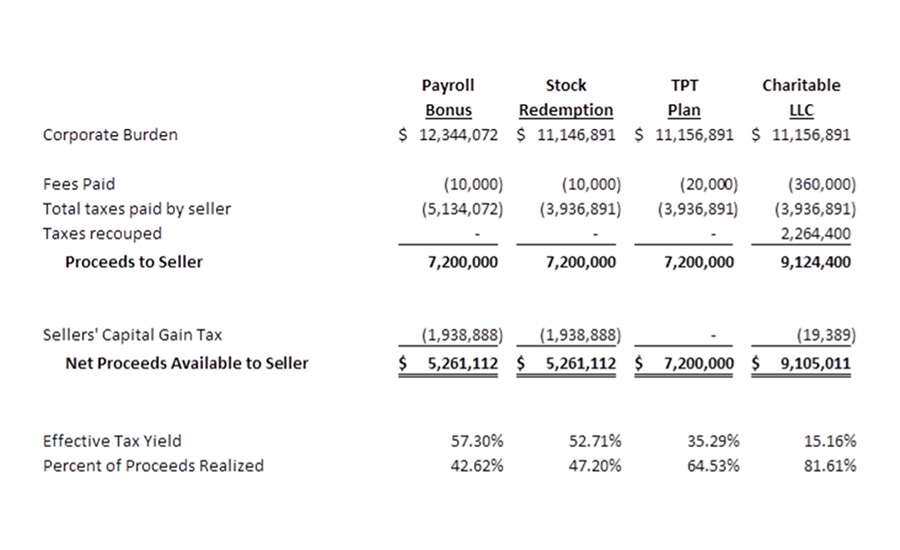

See how this can approach taxes exceeding 55%, free of an Estate Tax burden for wealthier owners? (We call this the “Payroll Bonus” strategy outlined in the chart below.) He seemed unsurprised by my 55% calculation and then asked what a Beacon strategy would look like. I explained several of our strategies could have reduced his tax liability to between 15% and 35%. I then saw the blood drain out of his face.

For your understanding, please use the chart below to illustrate the bottom-line results.

- Remember, it is not how much you make but how much you keep.

- The chart uses the same company/valuation illustrated with four strategies.

- The bottom line is the “Net Proceeds Available to the Seller.”

- Note the bottom two lines that reflect the “Tax Yield” and “Percentage of the Proceeds Realized.”

- Which method would you choose for your exit and retirement?

- Morgan Stanley once said, “You must pay taxes, but no law says you gotta leave a tip.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!