Regional Economic News: Texas

Manufacturing Weakened Further in November Says Dallas Fed

Latest Manufacturing Outlook Survey shows continued contraction in the Lone Star State

The general business activity index dropped to minus 19.9 from October's minus 19.2, signaling a challenging manufacturing environment marked by slowed production and softer business indicators, according to the Federal Reserve Bank of Dallas' monthly Manufacturing Outlook Survey.

— Image courtesy of the Federal Reserve; charts courtesy of the Federal Reserve Bank of Dallas

Texas factory activity contracted in November after two months of expansion, according to business executives responding to the Texas Manufacturing Outlook Survey, with the contraction stronger than some analysts expected as production slowed amid signals of a challenging environment for manufacturing.

The index for general business activity in November worsened compared with the month before, ticking down to minus 19.9 from minus 19.2 in October, according to the latest TMOS results released yesterday by the Federal Reserve Bank of Dallas.

Economists polled by The Wall Street Journal expected the reading to go upward to minus 17.

The Dallas Fed conducts the monthly survey which asks Texas business executives about conditions in the industrial sector. A reading below zero describes a contraction in industry.

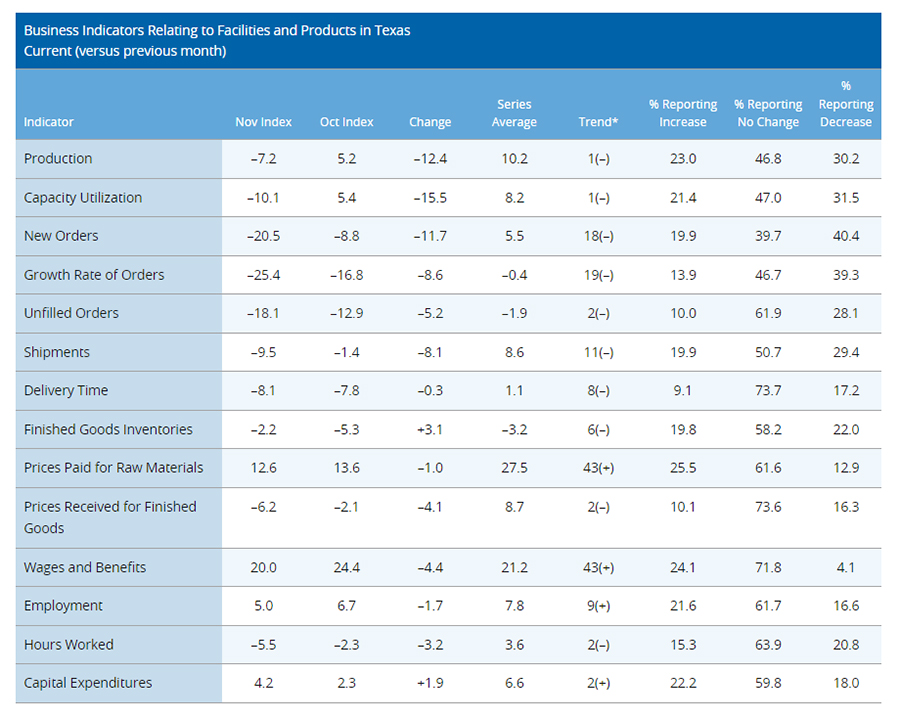

The production index, measuring state manufacturing conditions, fell into contractionary territory, falling 12 points to minus 7.2, the Dallas Fed said.

Other components echoed softening business activity in November. The measure for new orders, capacity utilization and shipments all declined sharply during the month, according to the data.

Labor market measures suggest slightly slower employment growth and shorter workweeks in November, the Dallas Fed added.

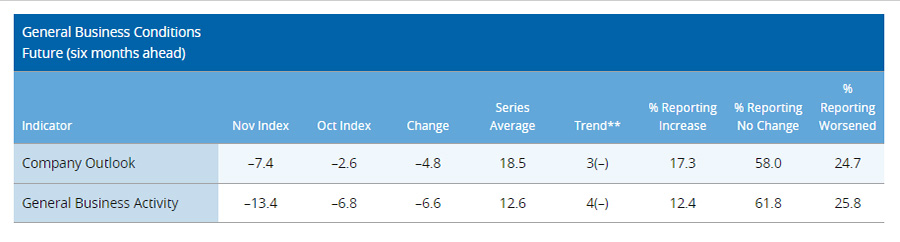

Meanwhile, expectations for future activity were mixed, with the production index positive but falling on month, while for general business activity, it posted a fourth-straight negative reading, ticking down.

[Editor’s Note: Relevant industries related to roofing and broader construction are included; others have been omitted for relevancy.] The following comments, collated from survey respondents, have been edited for publication:

Chemical Manufacturing:

- The chemical industry seems to be in a recession now.

Fabricated Metal Product Manufacturing:

- I think we are on the downside of the through cycle for building products. While the professional-level activity has been somewhat consistent throughout the year, the end users are just now returning to the market.

- New orders are slow coming in.

- Our customer base is very slow to release orders. It is not a price-point issue but rather customers’ concerns surrounding their uncertainty.

Miscellaneous Manufacturing:

- October, November and (estimated) December sales volumes have decreased by 30–35 percent from normal. This is attributed predominantly to the ripple effect of the UAW [United Auto Workers] strike. About 40 percent of our customers are tier 1 suppliers to automotive. In general, the volume of sales across all other segments is down, which is expected this time of year.

Plastics and Rubber Products Manufacturing:

- Our retail sector is reeling somewhat. We’ll wait and see how bad Christmas goes, but the consumer is heavily burdened.

Primary Metal Manufacturing:

- Customers’ inventories are lower, yet they are not buying. This means their customers are slow.

- Our U.S. industry has lost approximately 30 percent of our sales to foreign competition, [which] is either dumping or receiving government subsidies, or both. Last month, a coalition of companies within our industry filed charges against 15 countries with the Commerce Department for unfair trade. A preliminary ruling last week by the International Trade Commission found enough evidence to substantiate our claims and move forward with the investigation. We are hopeful that the rulings will advance our U.S. efforts for fair trade.

- Incoming orders continued to decline over the last six to eight months. Now that we have worked through our backlog, it is affecting our ability to reach breakeven and has affected our employment number. We do not see that this situation will improve into [the] first quarter [of] 2024.

Transportation Equipment Manufacturing:

- There is nothing encouraging on the horizon.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!