Roofing Insurance

Florida OIR Makes Massive 15.1% Cut to Workers’ Comp Rates

Objections from roofing contractors do little to stop one of the largest decreases in years

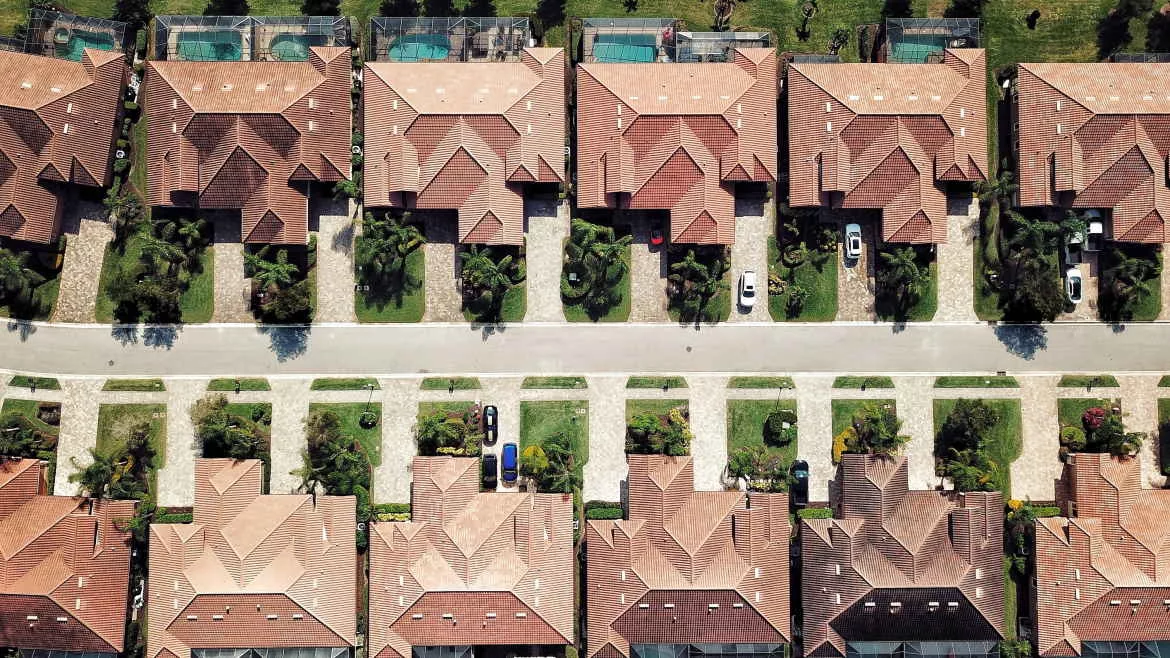

Photo by Ameer Basheer on Unsplash.

The Florida Office of Insurance Regulation [OIR] approved of a 15.1% average decrease in workers’ compensation rates in spite of roofing contractors asking for a rate freeze.

The OIR granted approval to the National Council on Compensation Insurance [NCCI] for a statewide decrease. The rate applies to both new and renewal workers’ compensation insurance policies and takes effect Jan. 1, 2024.

Rates have decreased in Florida since January 2018, including a 8.4% drop his year. From Oct. 2003 to January 2023, rates have gone down by a cumulative 73.8%. With the newly-approved rate, that cumulative decrease will be 77.7%.

“I’m pleased to announce that Florida businesses will see a reduction in workers’ compensation rates for the seventh consecutive year,” said Insurance Commissioner Michael Yaworsky in a written statement. “It’s clear the workers’ compensation market in Florida is stable and competitive; I’m confident lower workers’ compensation rates will assist in ensuring that all of Florida’s businesses have the opportunity to succeed in our state.”

Not everyone agrees with Yaworsky’s conclusions. In October, the NCCI held a public hearing about the newest rate decreases. Members of the Florida Roofing and Sheet Metal Association [FRSA] voiced their concerns that the data used by the NCCI for tracking workplace injuries focused on the pandemic years of 2020 and 2021, a time when not all industries were operating at full capacity.

Skewed Data

Les Sims, president of Armstrong Roofing in San Mateo, Fla., and president of the FRSA, said during the hearing that the association wanted the NCCI to consider freezing the rates for a year.

“I know what your data says, but I also believe there are other factors that are not being taken into consideration,” he said.

Sims, who is head of the association’s Self Insurers Fund, explained that since COVID-19, roofers have had to turn to unskilled and inexperienced laborers to maintain their workforce, thereby taking on significant risks regarding workers’ compensation. With that in mind, he believes roofing contractors will see more claims in the coming years.

“We’ve enjoyed the lower rates over the years, the state has done a great job,” Sims said. “At some point, the pendulum will have to swing and the rates will have to increase, very similar to the property insurance debacle we have now.”

Ralph Davis, owner of Streamline Roofing & Construction in Tallahassee and a trustee with the FRSA’s Self Insurers Fund, said as much as he would enjoy lower rates, he doesn’t want to see the insurance system crash.

“I’m not asking you to freeze the rate, I’m begging you to please freeze the rate,” he said.

Davis, who has been in the industry for over 25 years, agreed with Sims that the council’s data is potentially inaccurate, pointing out the use of subcontractors in roofing has drastically increased over the past decade.

“A lot of the roofing industry has seen these subcontractors come in. The problem with that is the subcontractors work for the [professional employer organizations]. The PEOs don’t necessarily report all of those small injuries, so I believe the data coming out of these PEOs is askew,” he said.

The FRSA’ Self Insurers Fund has about 337 companies that use it for insurance services. The fund was created in 1955 as an alternative to standard Workers’ Compensation Insurance in roofing.

If decreases continue, workers’ comp insurance carriers may end up leaving the state. Laurie Zdanis, president and CEO of Michigan Commercial Insurance Mutual, said during the hearing that, as a carrier with its largest concentration of business in Florida, the company is concerned that rate decreases aren’t taking into consideration higher attorney fees and medical costs.

“There’s a number of factors that need to be addressed, including possibly changing the rate making methodology, to factor for inflation before we can look at a 15% rate decrease,” she said.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!