Sponsored by SOPREMA USA

2020 Commercial Roofing Report: Roofing Remains Resilient

The launch of a new decade in commercial roofing started out bright. Companies of all sizes were reporting backlogs of work following another busy storm season and booming construction markets across the country. The outlook for roofing contractors across the landscape, with few exceptions, was very strong for the first 10 weeks of the year. But a harsh reality set in mid-March as the COVID-19 pandemic took a foothold on both coasts and washed across the United States in horrific fashion.

Roofers won the battle for “essential worker” status in most places and workflow continued. Yet company leaders were challenged with increased health and safety protocols, tightening supply lines, and managing so much uncertainty while trying to keep a handle on cash flow and an already fragile workforce situation.

Roofers have seen tough times before, and responded with a collective resilience. They also showed an ability to adapt to keep an optimistic eye on the future. That shined through in RC’s continued coverage of the pandemic, as well as in the latest annual survey of commercial roofing contractors.

With the help of experts from BNP Market Research — the survey and research arm of RC’s parent company, BNP Media — we again circulated our annual editorial study in the fall to help identify the successes and failures of the past year in an effort to measure and prepare for the challenges ahead. And certainly, there will be some.

The exclusive study took a deep dive into the commercial side of the North American roofing industry with responses from hundreds of roofing contractors about their business experiences in 2020 and trends forming as the new year arrives. Respondents consisted of roofing contractors that subscribe and receive RC.

The commercial roofing contractors who responded represent companies that generate more than 50% of overall annual revenue from commercial projects — whether that be in roof replacement, repair or new construction. The majority were men (82%) and more than half (54%) were between ages 40-59. Roughly 43% identified themselves as corporate or executive management, and another 23% were general managers.

Sales Remain Strong

Of those that responded, 43% said commercial roof replacements accounted for the majority of sales, and 26% indicated they relied on new commercial construction. Single ply roofing was the dominant product preference with 91% of respondents. Among those contractors, 44% reported using TPO, followed by EPDM (30%) and PVC (14%). Metal was the next most popular roofing system category at 77%, followed by coatings (68%), low slope asphalt (59%) and steep slope asphalt (50%).

Despite health and safety concerns and implementing new ways to find and engage with customers, roofing contractors still sold well in 2020. Nearly half (45%) indicated sales would increase this year over 2019, and the majority anticipated slight gains. About 34% indicated sales would dip slightly, while 9% of others said sales would greatly decrease.

As a prominent roofing contractor in New York and New Jersey — which absorbed the pandemic’s first deadly wave and mandatory shutdowns — the leaders at Peck Brothers Construction in Elmwood, N.J., said they felt the harsh impact right away.

“We planned and positioned ourselves to achieve $24 million in revenue this year, however we’ve felt the effects of the virus within our revenue stream,” said President John Peck. “We’re currently experiencing a 50% downturn in revenue but have successfully managed to hold our footing and persevere through it.”

Early on, the impact was widespread, regardless of region or market size.

“Revenue is down from the previous year, yet we’re seeing consistent profit margins,” said Weldon Good, vice president and CEO of DKG & Associates Inc., in Albuquerque, N.M. “We’re expecting a minimum 10% increase in sales through increased opportunities in building envelope services and specialty metals such as insulated wall panels. We hired additional sales support, and it’s demonstrated our ability to compete with companies nationally while conducting business in the confines of a smaller market.”

More than half of the roofers using metal said sales remained the same in 2020 and only 18% said sales increased greatly. Coatings appeared to grow the most, as 45% of contractors said sales increased in 2020.

The number of contractors with concerns about future sales dropped further when asked about projected volume for next year. Just 14% of contractors felt sales would slightly decrease in 2021, and 7% expected great losses. Well over half (68%) said they expected sales to increase again in 2021, with 11% of respondents anticipating sales to increase greatly.

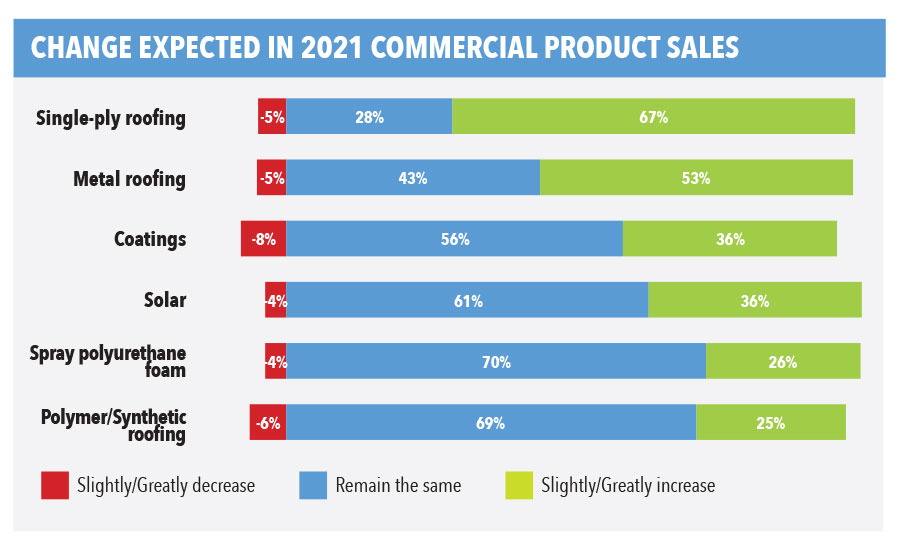

Products they expect to use more of during those increases are single ply (67%), metal (53%), coatings and solar (both 36%). Just about the same amount of contractors (70%) said they anticipate spray polyurethane foam and synthetic roofing sales to stay the same, while similar amounts (roughly 25%) expected those product sales to increase next year.

That optimism also spread to future projections. A vast majority (84%) of contractors said they believe sales volume will increase through 2023, though 57% said those increases would be slight. Those numbers similarly reflected in the overall sales outlook, in which about 80% of all contractors (commercial and residential) anticipated sales volumes to grow over the next three years.

Peck said the company did not have to lay off any workers during the pandemic’s onset, and he fully expects to come out the other side stronger than before.

“Our recent and past investments into culture, technology, remote working, and structure really allowed us to quickly pivot into this new world we have all been faced with without missing a beat,” he said. “Minus the downturn in available work we’re feeling good about our year, although we are going to be adjusting our annual goals down considering the effects of COVID-19.”

Workers Still Wanted

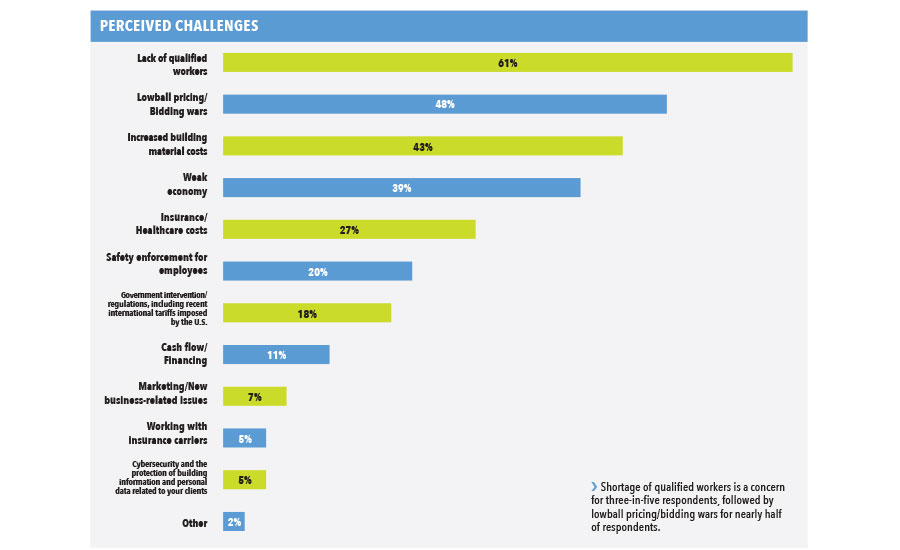

While the pandemic and ensuing economic crisis caused a painful wave of layoffs, furloughs and financial strain for workers across the country, it did little to help the roofing industry’s quest for workers. The lack of qualified, skilled workers in roofing topped the list of industry challenges at 61%, according to the survey data. Lowball pricing was next at 48%, with increased costs of building materials next at 43%. The nation’s weak overall economy (39%) and insurance/healthcare costs (27%) rounded out the top five.

For the first time in several years of the survey, safety enforcement for employees and government regulations were out of the top five at 20% or less.

It’s also costing roofing contractors more to keep that skilled labor. Roughly 60% of respondents said labor costs increased over last year, and another 30% said costs stayed the same. Of those who said costs increased, the vast majority (83%) measured the spike between 1-10%

On average, companies were comprised of full-time employees (76%) as opposed to subcontractors. However, use of subs has increased for nearly two-in-five respondents over the last 12 months, while it remained the same for about half. Just 13% indicated they were using subs less than previous years. The reasons for using subs ranged from a heavy workload, specialized skillset and far distance to complete the job, data showed.

The majority of companies seeking new roofing talent are largely dependent on employee referrals (86%), as well as family and friends (61%). About 68% said they use online postings on job boards and websites, and another 57% used social media to recruit. Using favorable pay and cash bonuses are the most popular method of retaining workers (57%) while others are using benefits like health insurance and retirement plans to differentiate in the field (36%).

Touting Technology

One area where the pandemic may have inadvertently helped roofing contractors for the long term is the need to embrace new technology. Video conferencing and adopting multiple forms of communications internally and externally was vital for companies that had to manage operations and much of the sales process remotely. Already absorbing an influx of new technology before the crisis, COVID-19 forced a lot of contractors dragging their feet to digital conversion to get up to speed. The ones already there said they found a competitive edge, and continued to deepen their relationships with suppliers.

“We continue to invest in our employees by putting safety first and providing them the most state-of-the-art technology and equipment,” said Jeff Murray, of the Murray Roofing Co. Inc., in Cheektowaga, N.Y. “We have also made it our culture to create partnerships with our suppliers to get the best pricing, which we can pass onto our customers.”

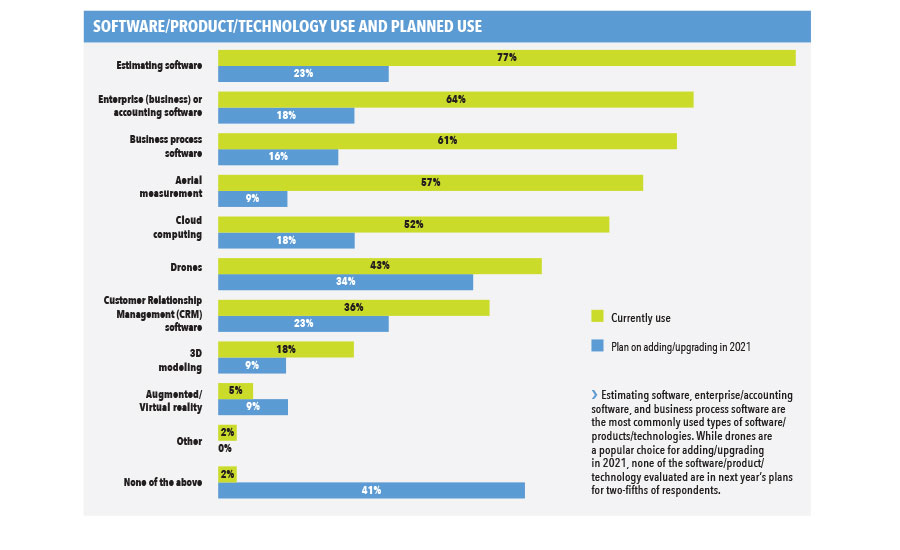

Survey data showed estimating software (77%), enterprise/accounting software (64%) and business process software (61%) were the most commonly used by roofing contractors this year. Drones were the most popular technology upgrade among respondents (34%), followed by customer relationship management programs, and estimating software (both 23%). Barely a fifth of contractors (16%) indicated they currently use on-the-job mobile devices and wearables; however, that category may double in the next two years.

The Unknowns

As they did heading into 2020, commercial roofing contractors continued to show confidence in the roofing industry and were largely optimistic about the path forward while still enduring the effects of the pandemic. The year created a bevy of changes and unknowns — many that won’t be resolved well into 2021:

Curve Caution

Though roofers are deemed essential workers in most states, how much business they’ll be able to conduct and when in 2021 will be dictated by the spread of COVID-19. In areas where mitigation efforts and shutdowns flatten the curve, business should largely continue as-is since the pandemic began. But as the pandemic persists, the danger of outbreaks among crews, companies and communities continues to threaten bottom lines.

Who’s in Charge?

As expressed earlier, contractors that adapted through the crisis understand that continuing to work safely in this new environment will be essential to winning future jobs. But what that environment looks like will depend largely on what regulations are in place and the level of enforcement.

Roofing contractors that benefited from a slowdown in government regulation over the past four years should not expect that to continue with a new administration and political party in the White House. Key cabinet appointees that oversee labor, health, tax and trade policy could all change focus dramatically under new leadership. Of immediate concern for contractors are tariffs, and their impact on building materials, as well as immigration.

Businesses could also get another shot of COVID-19 stimulus relief from a new Congress, after numerous efforts stalled prior to the election.

Healthcare Debate

That same Congress, and new composition of the U.S. Supreme Court, will likely have a major impact on healthcare. With major changes to the Affordable Care Act at stake, and potentially decided by a new Supreme Court, business owners can’t bank on things staying the same.

In order to compete for workers, more contractors are offering healthcare benefits and trying to stay proactive as a tool for employee retention. The roofing industry is responding, led by the National Roofing Contractors Association’s own healthcare program, as roofers face increasing pressure to keep overall employee health — not just jobsite safety — top of mind.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!