How to Tell If Your Roofing Financials Are Accurate

Keeping accounting records can be a hassle, but putting in the time to ensure they’re accurate can lead to a better idea of your company’s health.

Keeping accounting records can be a hassle, but putting in the time to ensure they’re accurate can lead to a better idea of your company’s health.

A profit and loss statement and balance sheet are both snapshots taken at a specific point of time.

Roofing contractors are notorious for poor paperwork and taking little interest in accounting. Having good numbers and using that data to make decisions regarding your business can be exciting and much less stressful.

As consultants, we see thousands of contractor statements that don’t make a lot of sense. We must conclude these contractors are not reviewing the data or don’t know what to look for.

A profit and loss statement and balance sheet are both snapshots taken at a specific point of time. However, your business is ongoing and does not stop at a specific moment. For many bookkeepers, balancing the books means making sure the checkbook balances with the bank statement, but there is more to closing out the month. It is also important to make sure all bills and revenue are posted within that time period regardless of when they are paid, or the money received. While your accountant may calculate your taxes on a cash basis, all financial analysis should be done accrual. For most modern software packages, this is as easy as clicking a button.

Cash statements record what goes in and out of the bank but do not include bills that have not been paid or any accounts receivable. Cash statements are almost useless when looking at monthly profit or loss statements. Worse yet, cash statements can create a false profit or loss reading as all costs may not have been included.

A few years ago, a contractor who joined our networking groups was in bad financial shape. We determined where he was making and losing money, raised prices and improved production; yet at year end he still was not profitable. Come to find out he had over $200,000 in bills sitting on the corner of his desk he had never paid or entered into the books. Now he was paying those old bills and even though his day-to-day business was profitable, the books did not show it. Customer deposits, jobs in progress and other factors can all make a cash statement misleading.

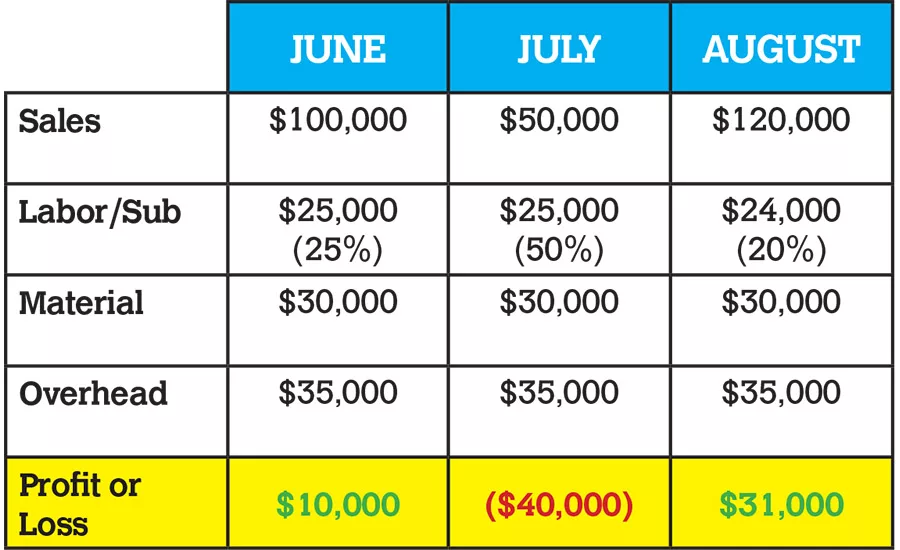

The easiest way to see if your monthly statements are accurate is to compare your field installation costs (labor and/or subs) to actual sales that month. If your direct installation cost is 25% of sales, that means you should bill $100 for every $25 spent in labor. If not, your statement is either incorrect or your jobs were better or worse than they should have been. Common sense tells us that you are not going to pay people for doing nothing. Therefore, installation costs, when recorded properly, are an excellent barometer for measuring profit and loss accuracy. The following situation is a simplified example with an annual average installation cost of 25%.

So did this business really lose $40,000 in July? Maybe not, but this is very worrisome. There are probably some jobs where the expense was incurred in July but not recorded until August. Did July have a major losing job or billings and/or costs that were not recorded in the same month? Who knows? All we really know is either July has a posting error or a huge loss. Too many contractors think, “Well, it will all work out by year end.” Maybe, maybe not. Do you really want to run your business blindfolded for three months?

Accounting is estimating backwards. When estimating, you are predicting costs. When accounting, you are simply recording costs. If you use a common language for monitoring costs, analysis is fairly easy. If not, you have confusing data or cross matched data where it can be challenging to figure out. For example, if you have a general superintendent, how did you include that cost when calculating the estimate? Were hours estimated as part of job cost to cover the superintendent? Then this cost should be recorded as part of direct field labor. If it was included in overhead as part of estimate mark up, it should be recorded in overhead. When most owners are asked this question, the most common answer is, “I don’t know.”

Accounting records are like anything else, if you use them, they get better. If not, they tend to be a jumble of useless information. Asking questions simply makes the information more accurate. Simplicity is also important. For most small contractors, having a 10-page statement is too much detail. Most accounting software has a collapsible feature where you can run a simplified statement. If you have a question, you can click on a line item for more detailed information.

The running joke in our office is the more pages the statement has, the less likely the contractor is going to use or understand it. It is not uncommon for a contractor to email us a 10-page statement and tell us he or she does not understand it. We usually respond: “Neither do we.”

The bottom line is that it costs you no more to keep useful accounting records than to produce garbage. You do not have to know how to use accounting software, you just have to know if the answers are right or wrong.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!