Supply Chain Improves Service

In 2001, I wondered how well professional roofing contractors perceived that they were being served in the roofing industry. Having witnessed the effects of supply chain consolidation in other industries, I saw that the resulting turmoil and opportunities could potentially lead to value for customers in the sale, delivery and support of products and services.

With comprehensive support from Roofing Contractor, a survey was sent to more than 1,000 professional roofing contractors. They were asked about their experiences and the degree to which they were satisfied with the various channels for obtaining products. Roofing Contractor published the results in February 2002 (see www.roofingcontractor.com).

The results of the survey served as a wake-up call to many in the roofing industry's supply chain. The results demonstrated that professional roofing contractors' satisfaction with the entire supply chain could be described as mediocre at best.

I speculated at the time that the root cause of the industry's problems was that we fundamentally operate as if we market a commodity. This means that there is scarcely meaningful differentiation in products and services. A review of other industries with similar attitudes and structures demonstrates the familiar economic returns - those that provide relatively low yields given the personal and financial investments. However, a clear view of our industry proves that the commodity approach is not justified and deserves to be challenged by manufacturers, distributors, contractors and specifiers.

Roofing Contractor and I wondered: "Have things changed since 2001?"

So, we repeated the study!

In the early fall of 2003, Roofing Contractor mailed over 1,000 surveys to professional roofing contractors across the United States. We tabulated and analyzed the 2003 results, and also compared them to the 2001 results.

The good news is that contractors recognize and appreciate industry improvements. However, there is more opportunity for the industry to move away from the commodity perception. We should strive to be an industry that is respected and rewarded for its value and professionalism, and for the importance that it places on quality, safe and cost-effective roof systems.

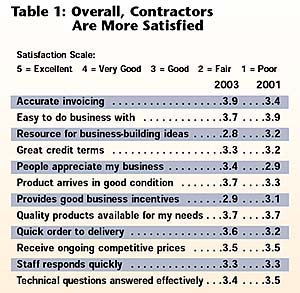

Overall, Contractors Are More Satisfied

Contractor satisfaction with the overall supply chain improved in key areas including invoice accuracy, demonstration of appreciation, product arriving in good condition and quick order to delivery times. The only decrease was in providing good business-building ideas. (See Table 1.)These scores suggest that the supply chain has been getting "back to basics" in doing the things that it is primarily accountable for: delivering products reliably and with good service. In other words, the channel got better at getting the order out, quicker, in good order, getting it invoiced right and all with a smile. That's a great improvement!

Are these great scores? Well, actually they're OK, not great. Keep in perspective that a "3" is only average. People are not necessarily exceptionally loyal to services that they consider average. The overall scores only average 3.4.

Satisfaction with Independent Distributors is Highest

Contractor satisfaction continues to be strongest for independent distributors. They scored best in 2001 and continued to perform, and therefore rank best, in 2003. (See Table 2.)Specifically, independent distributors received the highest satisfaction scores relative to all other supplier options in each area studied except for "accurate invoicing" and "great credit terms," where they slipped to a very respectable second-place ranking.

National distributors ranked second overall. However, their performance relative to other channel options slipped vs. 2001. Specifically, "accurate invoicing" went from the middle-of-the-road rank of third to a below average ranking of fourth. Other highlights were slips from second place down to third-place ranking in a) answering technical questions effectively, b) providing good incentives, c) assuring that the product arrives in good condition and d) being a good resource for business-building ideas.

Manufacturers seemed to have improved in some service areas, specifically, responding to technical issues (moving from a fourth-place ranking up to the top spot), as well as from a third-place ranking to second place for providing business-building ideas. However, manufacturers declined to the fourth-place ranking on both appreciation and quick order to delivery.

Lumberyards, although lagging, showed improvements since 2001. In fact, out of 12 questions, lumberyards improved their rankings in seven, declined in two, and stayed even in three. Big Box experienced the opposite trend, ranking last in all categories except one in 2003.

Contractor Loyalty Declines

Contractor loyalties to their primary distributor decreased since 2001. Primary distributors now enjoy 63 percent of the business (down 4 points). Contractor purchases direct from manufacturers increased to 15 percent (up 3 points). (See Table 3.)

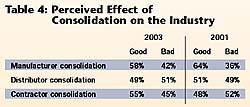

Overall, Contractors Believe Consolidation is Good

The survey again suggests that contractors believe that consolidation actually is healthy for the industry. However, the percent that believe this has declined for manufacturer and distributor consolidation. Since 2001, more perceive that contractor consolidation is actually good for the industry. (See Table 4.) Frankly, this data surprises me and differs from the anecdotal information I hear as I travel extensively across the country. I had expected that contractors would perceive that consolidation, in general, was not good for the industry, but was a reality that was something that they must accept. In the future, I hope to explore this issue to better understand the underlying thoughts, feelings and beliefs.Some Thoughts and Personal Perspectives

I believe that we're fortunate in the roofing industry. We sometimes forget that we're fortunate. We also sometimes take our good fortune for granted.Talk to friends, family and relatives and ask about other industries and what they may be experiencing and compare their answers to your experiences and observations. The most important question I think is: "Overall, are things improving and are you prouder than you were a few years ago - or are things getting worse?"

My belief is simple: An individual is fortunate if he is in a company that is in a business segment involved in an industry that is rallying around a commitment to overall continuous improvement.

The roofing industry is improving. And, this survey is one more "data point" that demonstrates to me that I'm not imagining it. I've become extraordinarily proud to be associated with this industry. This is one of the few businesses where you can go to work everyday, work hard, make a decent living, and actually make a positive difference in other people's lives, too!

Do a very good job, and property owners may make better choices. These choices can help them avoid the pain, frustration and financial loss that result from roof system failures and the subsequent damage to possessions and assets. Further, property owners may gain extra income, appreciation of their property, lower energy expenses, and other financial benefits.

Do a very good job demonstrating the true value of roof systems and as a result property owners may make better choices, purchasing on value as opposed to price. In addition, laborers might earn an income that more fairly reflects their difficult work and conditions of this profession.

The key to moving from a commodity based on price to a value proposition and earning a fair return on investment, is professionalism. The key to professionalism is shifting from convincing customers, which is a focus on getting what you want, to helping them, which is a focus on what the customer needs. When professionals help their clients, they develop trust. When they develop trust, they educate. When they educate, they demonstrate solutions. When they demonstrate solutions, they earn business. And when they earn business and deliver on their promises, they've successfully helped.

You can see the improvements everywhere in our industry without looking very hard, in just the past few years. There are more training options, not guessing; more products that upgrade vs. products that downgrade; more additions of service vs. self-service; more systems vs. components. People are working harder instead of not having passion about their work. There is more property owner education as opposed to hard-core selling.

So, focus on the future, roll up your sleeves, and do you part to help make this industry a little bit better every day. The results of this survey demonstrate that the supply chain is getting better. We can still be even better. Take a second to recognize the progress. Pat yourself and others around you on the back. And then, get back to the discipline and focus it takes to keep going.

Somebody famous (I don't remember who) said: "The future has several names.... for the weak...it is the impossible... for the fainthearted, it is the unknown... for the thoughtful, it is the ideal."

Make tomorrow ideal!

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!