Supply Chain Survey Demonstrates Desire for Better Service

Consolidation in other industries and the resulting turmoil has often created opportunities for creating greater customer value in the sale, delivery and support of products. Given the consolidation within the entire roofing industry, I wondered how well professional roofing contractors perceived they were being served today, and wanted to gain insight into changes contractors expect in their future purchase habits.

With comprehensive support from Roofing Contractor, a survey was sent to over 1,000 professional roofing contractors. These professionals were asked about the experiences and satisfaction with various types of vendors in our industry and what was important to them in their choices of supply.

Survey Indicates Opportunity for Industry Improvement

Independent Distributors Scored Best

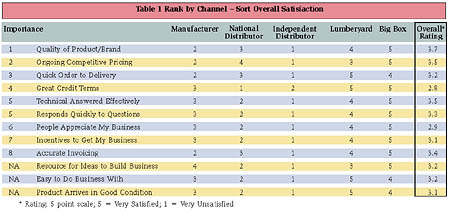

Contractor satisfaction with vendors is relatively weak with the ordering, delivery and support processes in the industry. On a five point scale (5= very satisfied; 1 = very unsatisfied) the highest average score was less than four. For perspective, an overall score of around three suggests that as many people were satisfied as were unsatisfied. This data indicates that there is significant opportunity for the industry to improve (see Table 1 for satisfaction and importance ratings.) Independent distributors received the highest satisfaction scores in 11 of the 12 categories of contractor satisfaction. National distributors surpassed the independents only in receiving attractive credit terms.National distributors received the second highest satisfaction scores. However, they share perceived deficiencies in the speed of ordering through delivery, access to quality brands, ongoing competitive pricing and accurate invoicing. A clear, competitive strength is their credit services.

Manufacturers that provide a direct source of product received scores slightly below national distributors. Specific areas of competency noted were their ability to deliver products quickly, ongoing competitive pricing and invoice accuracy.

Lumberyards and Big Box retailers did not receive strong ratings. Specifically, Big Boxes had the lowest satisfaction rates in nine of the 12 categories of professional contractor satisfaction.

Quality of Product Most Important Decision Factor

The most critical driver of choice for product ordering, delivery and support is access to quality brands. Second in importance is experiencing ongoing competitive pricing and quick order through delivery. Good credit terms was next most important, but received the lowest overall satisfaction rating for industry performance. Also, contractors perceive that the industry does not demonstrate appropriate appreciation for their business.

Expect Ordering Processes to Change

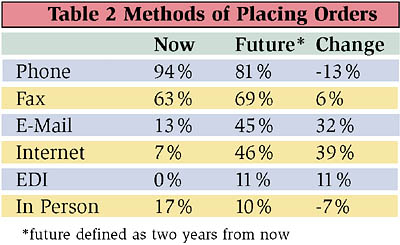

Most contractors shared that the majority of their orders are by phone and fax today (94 percent and 63 percent respectively). Less than 15 percent use any of the electronic methods, including e-mail (13 percent) and the Internet (7 percent), and none are currently using “EDI” (electronic data interchange). However, contractors shared that they expect that in only two years from now, their usage of electronic ordering will increase significantly while the use of phone and in-person ordering will drop (see table 2).

Contractors Are Generally Loyal

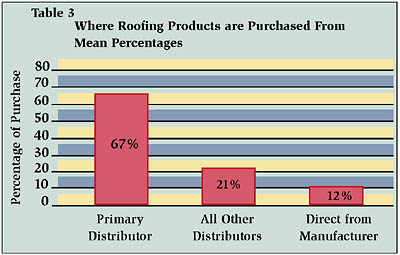

While there often seems to be an enormous amount of industry discussion about contractors buying primarily on price, the reality is that on average, 67 percent of all orders are placed with their “primary” distributor (see table 3).

Overall, Industry Consolidation Viewed as Positive

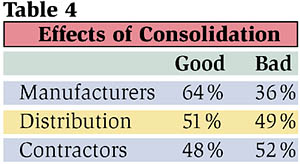

Contractors shared that consolidation has been good for the industry. Specifically, 64 percent of those surveyed believe that manufacturer consolidation is positive for the industry. Most common reasons for this belief were related to improved quality, better service and less confusion related to choices for the property owners (see table 4).

Contractors were split on their perception of whether consolidation of distributors and contractors was positive. Related to distributors, the more common reasons for either positive or negative perceptions were related to access to competitive pricing, service and product availability. As it relates to contractor consolidation, the positives were the upgrading of the industry with more skilled, insured and licensed firms. The negatives stated were often related to the decreased ability of smaller contractors to compete.

Personal View of Survey Results

Frankly, these survey results might serve as a wake up call for our roofing industry. I’ve personally reviewed similar surveys by customers in other industries and typically have witnessed much higher overall satisfaction results.With perspective from other industries, I’ve created some hypotheses on why our industry is experiencing this mediocre level of customer satisfaction by the professional contractors that we have the privilege of serving.

I believe that that the root cause of our industry problems is that we fundamentally operate as if we market a commodity. This means that the industry view revolves around price, with the perception that there is little difference in industry products and services. This perspective starts with the property owners, and evolves through contractors, distributors and manufacturers. I personally know of no commodity-oriented industry where the returns on personal and financial investment are attractive.

The question that you may ask yourself is: “Are we really a commodity?” I believe the answer is no. Why do I believe this? Because, travelling the country, I’ve witnessed huge amounts of pain and frustration by property owners who suffered with poor roof evaluations, design, installation, inspections and choice of guarantee protection. I’ve seen big differences in the capability of contractors. Some I’d want to use if I had issues with personal property; but I’ve also seen workmanship that would be appropriate for only a really rotten property owner. I’ve seen manufacturer product performance promises, actual performance and guarantees that don’t pass the test of integrity. My guess is that you’ve made similar observations.

This means that the reality is we are not a commodity industry. If we were, there would not be these actual differences in quality. So, if we’re actually not a commodity, what’s the problem?

I think it’s fundamental: As an industry, we don’t communicate well. Consider how we speak to property owners. We often use jargon they don’t understand, and then wonder why they have trouble differentiating us from the others in our industry that are providing lower quality products and services. We then rationalize: “We’re not salespeople – we’re professionals.”

Simply, in every profession I know of, the person and organization that earns trust and educates best outperforms the competition. Aren’t there lawyers making fortunes, while others are just scraping together a living? Have you seen some doctors that make an extraordinary income, while others make significantly less? Think about the most successful professional you’ve met. In general, don’t they typically communicate their value very well?

What do professionals communicate? First, that they care. They ask lots of questions. They listen. They probe. They seek understanding and insight into “your” issues, pains and concerns. Most importantly, they help educate you about the pains of a bad decision. By definition, this means they are explaining why their products and services are not a commodity!

Second, they demonstrate that “you” are important. They explain and assure things in your language, and not in their jargon. When they explain, they not only share “what” they think, but more importantly, “why” they think it. They focus on what’s in it for “you” first, and not what’s in it for them.

Third, they share appreciation. They thank you for trusting them, and allowing them to serve you.

It’s amazing, but professionals who demonstrate these “triple As” (ask, assure, appreciate) seem to almost always do best!

In Summary

I’ve grown to love coming to work everyday in this industry. Why? We’re not a commodity, and our individual leadership can help us all evolve out of our industry issues. As we focus on better communication and educate ourselves about what our customers need, we’ll all experience more enjoyment and greater rewards.If you are a vendor to professional contractors, what can you specifically consider doing tomorrow that you may not have been doing as much of yesterday? Demonstrate appreciation for the privilege and trust given to us by professional roofing contractors. Focus on helping professional roofing contractors differentiate their services from the “trunk slammers” marketing support to property owners. Share the vision of helping shift this industry from one that operates with the negatives of a commodity, and to the result of an industry that delivers meaningful products and services that property owners can depend on.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!