Industry Surveys

Survey Data Shows How Distributors Can Boost Roofing Contractors’ Growth

Macroeconomic conditions are battering roofing contractors and the construction industry at large, but roofing distributors and suppliers can play a role in supporting their customers' success.

While there isn’t much they can do about ongoing labor shortages and economic uncertainty generated by tariffs, distributors can gain helpful data from surveys conducted by ServiceTitan, a cloud-based software platform for commercial service and specialty contractors.

Whether it’s learning their goals and pain points or how contractors aim to improve operations, below are insights pulled from three of ServiceTitan’s 2025 surveys that distributors can use to work with their customers.

Exterior Expectations

Image courtesy of ServiceTitan

ServiceTitan’s surveys include one focused on exterior trades. Those queried for this survey were primarily in roofing, gutters, siding and windows and earned more than $1 million in annual revenue.

Overall, 76% of the 1,020 roofing and exterior respondents said they’re focused on growing revenue in 2025, while 50% listed increasing margins as a top priority.

Contractors face numerous challenges in accomplishing those goals. The top risk they listed was an increase in material prices at 64%. This is followed by labor shortages at 58%, labor/overhead costs at 53%, and access to working capital at 27%.

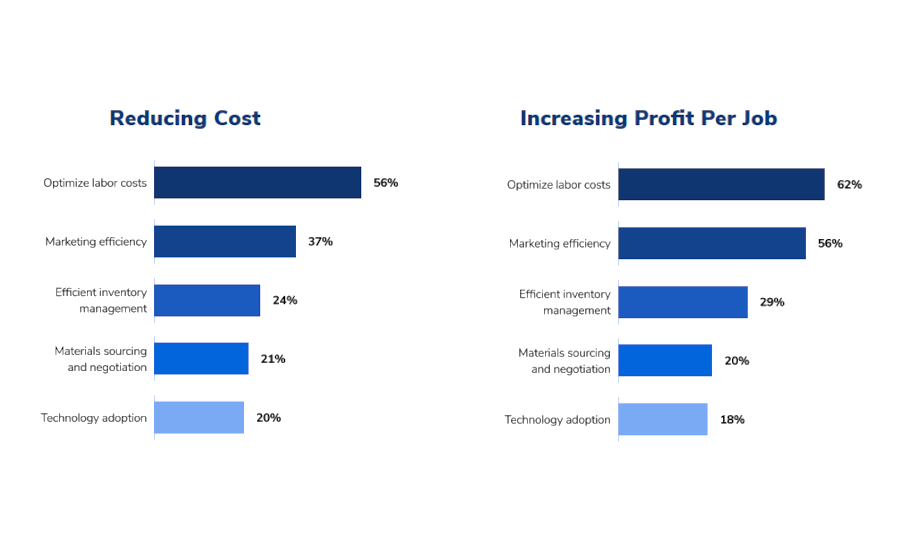

Additionally, 24% seek efficient inventory management to reduce expenditure, and 29% see it as a way to boost profit. Another 21% say material sourcing and negotiating would help shrink their expenses, and one-fifth of them see it as an avenue to improve profits per job.

It should be reassuring that material sourcing is the fourth-highest priority for contractors. Even so, it highlights how distributors and suppliers can play an integral role in helping customers achieve their goals.

A key strategy that distributors can use is helping customers explore different verticals. Two popular tactics are expanding into metal roofing, which 23% are exploring, and 35% are expanding into commercial work.

Around 40% said they’re exploring siding, another 22% are getting into roofing insurance claims, and 11% are exploring solar.

“Increasing revenue, while a popular growth strategy in roofing, isn’t always the best option when it requires increasing headcount,” said Sue Drummond, roofing industry advisor at ServiceTitan. “We are starting to see a shift toward a profit-focused approach over sheer volume.”

Tech Talk

Image courtesy of ServiceTitan

About a third of respondents said they’re looking to modernize or digitize the customer experience. They say their top needs in software include comprehensive features tailored to business needs (37%), automation capabilities (36%) and ease of use (32%).

“Private equity has the ability to create a firestorm of growth within the industry by implementing some basic systems and processes,” said Michael Ippoliti, roofing industry advisor at ServiceTitan.

That being said, only 9% of respondents said they view selling to private equity as an opportunity, meaning distributors are a factor in helping contractors achieve tech goals.

Distributors can work with their customers to provide software solutions, whether it’s streamlining operations with their own platforms or integrating popular software companies that their customers use into existing platforms.

This ties into contractors’ desires to optimize labor costs (56%) to reduce operating expenses, as technology can make their workforce more efficient. Similarly, 62% of contractors want to optimize labor costs to increase their profits per job.

Any marketing support distributors can provide would be beneficial to contractors as well, as 37% seek marketing efficiencies to reduce costs, while 56% said it would help them increase profits.

Commercial Commentary

Image courtesy of ServiceTitan

In ServiceTitan’s Commercial Service Market Report, commercial contractors are cognizant of headwinds. Regarding material price increases, 73% anticipated a rise, while 16% expected a 15% or higher increase. Overall, 59% are concerned about pricing affecting profitability.

Material lead times are on the minds of commercial contractors, with just under a third worried that it is affecting operations. Around 54% expect a two-week or longer delay, while 10% expect three months or longer increases.

Commercial contractors are also struggling with labor, with 52% saying the shortage is hindering their revenue goals, and 45% said rising labor and overhead costs are prohibitive.

“Even with the expectation of increased labor and material costs, contractors still need to keep a pulse on parts availability and material lead times,” said Raffi Elchemmas, executive director of the Mechanical Contractors Association of America.

When broken down, preventative maintenance agreements are the top profit generator at 25.6%. Next are non-emergency repairs at 22.3%, then demand service at 20.5%.

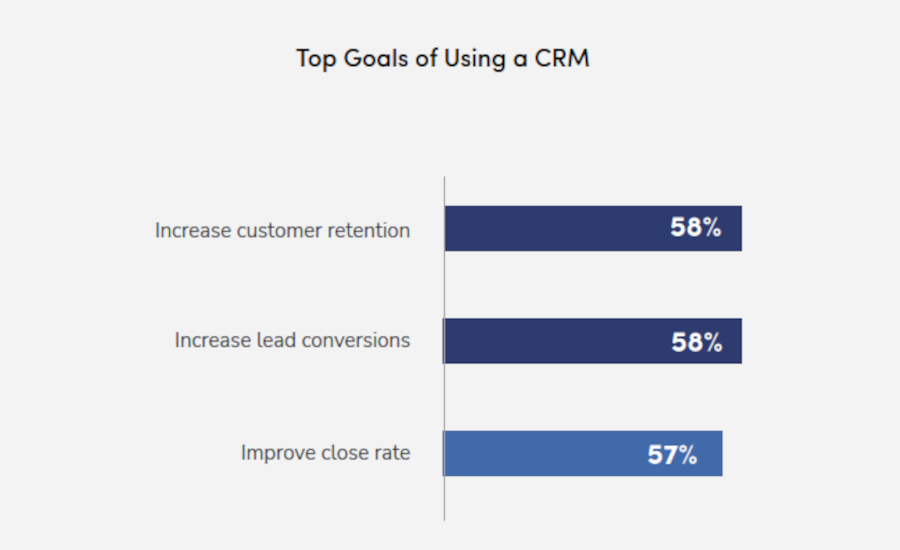

Around 70% of commercial contractors use a CRM, and of the remaining 30% who don’t, about half of them are considering implementing one. Conversely, only 7% of contractors currently report a significant impact from artificial intelligence, though 39% recognize its potential.

The areas where contractors expect AI to have the biggest impact are scheduling and dispatch (28%), followed by predictive maintenance (27%) and proposal/estimate creation (25%).

“Investments in AI are not only driving growth today, but also setting the stage for use of AI in the next set of tools, like scheduling and predictive maintenance,” said Elchemmas.

Residential Responses

Image courtesy of ServiceTitan

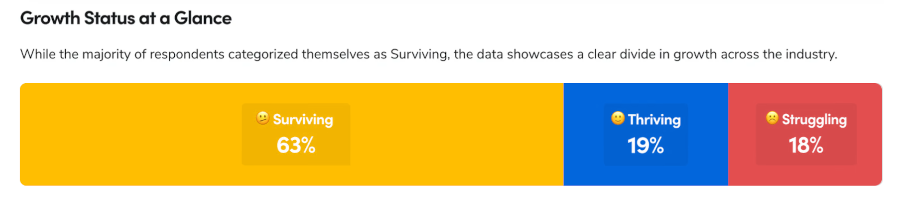

Residential contractors appear to be doing well despite macroeconomic conditions, according to ServiceTitan’s Residential Industry Report. Of the trades represented, roofing had the largest percentage of respondents saying they’re experiencing consistent growth.

Just over half of residential businesses reported annual revenue between $4 million to $9.9 million. Those who reported they were thriving had reported revenue between $10 to $19 million.

However, even thriving businesses face challenges. In 2025, the top three concerns are labor/overhead costs, labor shortage, and increases in material prices. Compare this to 2023, where economic recession, labor shortages and access to working capital were the top worries.

“While those challenges remain, rising costs are also expected to affect the year ahead,” the survey says. “By addressing these challenges strategically and leveraging software tools like ServiceTitan, the industry can overcome obstacles and improve its performance in 2025.”

So what’s making residential businesses successful? According to ServiceTitan, 54% of contractors offer “good, better, best” options on at least half of their jobs. Meanwhile, 28% of struggling businesses present three estimates on less than 10% of jobs.

When communicating with customers, 39% of thriving businesses generate 1% to 15% additional revenue if they follow up on unsold estimates, compared to23% of struggling businesses.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!