Latinos En Techado

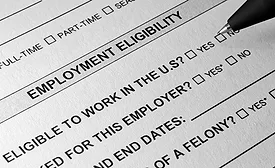

Cómo contratar y pagar a los trabajadores sin números de seguro social

Navegar cómo incorporar legalmente a los trabajadores sin números de seguro social es un tema creciente mientras los contratistas de techado tratan de abordar la escasez de mano de obra en la industria.

Read More