Earnings Report: OC

Owens Corning Drops 10% After 2023 Q3 Earnings Report, Still Beats Street

Surpassing expectations, stock still drops more than 10%, slowly recovering but still down at end of trading on Friday; roofing remains a bright spot in company financials

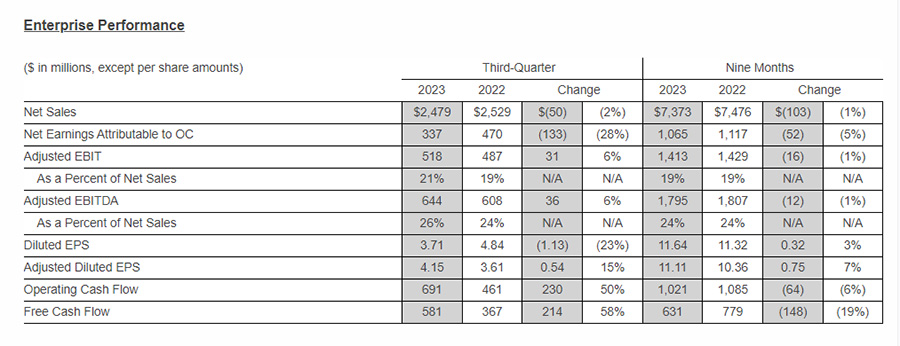

Owens Corning [NYSE: OC] reported mixed results for the third quarter of 2023, reporting net sales of $2.5 billion, similar to the year prior, wherein earnings surpassed the Zacks Consensus Estimate, and increased year-over-year, net sales missed the consensus mark and declined from the prior year.

During the Q3 earnings call on October 25, OC noted sales declined due to lower sales volumes in both the insulation and composites segments, partially offset by higher selling prices.

“Owens Corning delivered another strong quarter, as our global teams executed incredibly well in response to dynamic market conditions, a statement by Brian Chambers, OC’s CEO and Board chair, read after the earnings call.

“The sustained quality and consistency of performance reflects the strength of our team, our market positions and our strategy,” Chambers added. “These results demonstrate our ongoing ability to outperform prior cycles as we position the company for long-term success.”

Owens Corning's shares plunged 10.34% after the earnings release. The company reported adjusted earnings of $4.15 per share, which topped the consensus mark of $3.78 by 9.8% and increased 15% from $3.61 a year ago.

Net sales of $2.48 billion missed the consensus mark of $2.52 billion by 1.7% and declined 2% year over year. However, since Jan. 1, OC shares are up for the year by more than 6.4% despite last week’s nosedive.

Segment Details

Net sales in the Composites segment decreased 11% year over year to $567 million. The company attributed the drop to 9% lower volumes and price declines resulting from lower spot prices in glass reinforcements. Earnings before interest and taxes [EBIT] margin contracted to 14% from 20% in the year-ago period. EBITDA margins of 22% also declined from 26% reported a year ago.

The Insulation segment’s net sales came in at $913 million, down 5% year over year on 10% lower volumes in North American residential insulation and technical and global insulation businesses, partially offset by positive price realization.

EBIT and EBITDA margins of 16% and 22% decreased by 200 and 100 basis points, or bps, respectively, on lower volumes and planned maintenance downtime and production investments, partially offset by positive price realization.

The roofing segment’s net sales rose 8% year over year to $1,084 million, driven by strong demand in several markets backed by higher levels of storm activity and a favorable mix and positive price. EBIT and EBITDA margins expanded to 32% and 33%, respectively, driven by favorable price/cost and higher volumes.

Operating Highlights

Adjusted EBIT and adjusted EBITDA improved 6.4% and 5.9%, respectively, on a year-over-year basis —adjusted EBIT and adjusted EBITDA margin expanded by 200 bps, each from the year-ago figure.

Balance Sheet

As of Sep 30, 2023, the company had cash and cash equivalents of $1,323 million compared with $1,099 million at the 2022-end. Long-term debt — net of the current portion — totaled $3 billion, up from $2.99 billion at 2022-end.

In the first nine months of 2023, net cash used in operating activities was $1,021 million versus net cash provided by operating activities of $1,085 million in the previous year. Free cash flow came in at $581 million for the reported period compared with $367 million a year ago.

The company returned $187 million to shareholders in the third quarter through dividends and share repurchases. At the end of the third quarter, 10.8 million shares were available for repurchase under the current authorization.

Q4 Outlook

Owens Corning's businesses primarily depend on residential repair and remodeling activity, U.S. housing starts, global commercial construction activity and industrial production. The company warned investors that it expects challenges in its end markets due to “inflationary pressures, increased interest rates and continued geopolitical uncertainties.”

For the fourth quarter of 2023, the company expects net sales to remain slightly below year over year and EBIT margins in the mid-teens, compared with 15% reported in the prior-year quarter.

For the quarter, the company expects revenues in the insulation segment to be down by mid-single digits compared with the prior year’s value of $956 million. The EBIT margins are expected to be in the mid-teens compared with 16% in the year-ago quarter.

For the composites segment, revenues are anticipated to be down by high-single digits compared with the $589 million reported in the previous year's quarter. The EBIT margins are expected to be in the mid-to-high single-digit range compared to the 11% reported a year earlier.

For the roofing segment, revenues are expected to be up by mid-to-high-single digits compared to $799 million year over year. The EBIT margins are expected to be mid to high 20% compared with the reported fourth-quarter 2022 margin of 21%.

For more information, visit owenscorning.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!