Economic Indicators

Seattle Start-Up Challenges Case-Shiller Index ‘Supremacy’

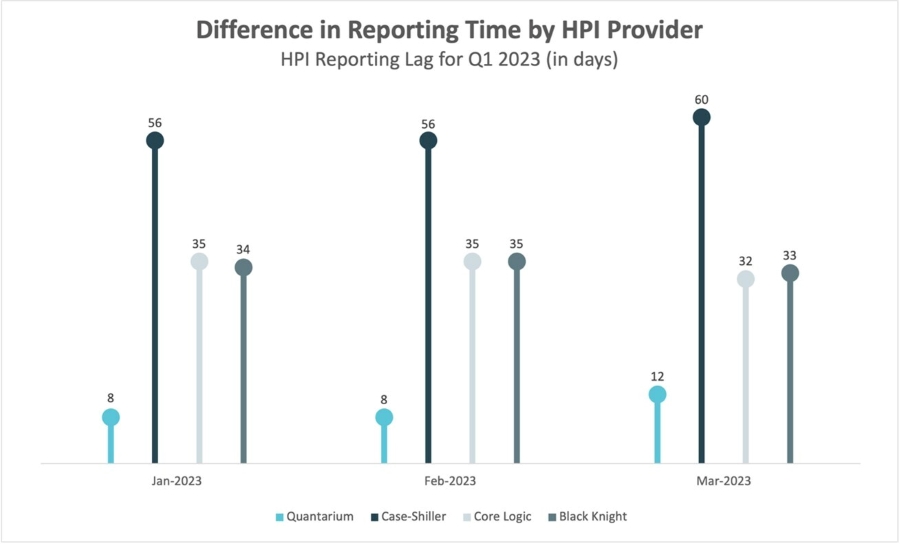

Newly available data science ostensibly reduces the reporting time to days instead of months, questioning the reasoning for a two-month lag in reporting

Quantarium’s TerraIndex HPI has a processing time of about a week, the company says, providing earlier insights into the market's direction based on proprietary valuation data science and making its home price index report for a given month available on the second Wednesday of the following month.

Quantarium, a Seattle-based national real estate AI technology firm, is challenging the assumption that the U.S. housing market must wait two months to reliably determine how home prices are changing, which has been the standard used by the Case-Shiller Index since the 1980s.

In a news release on July 27, Quantarium pulled no punches:

“When a seven-month-long home price depreciation trend suddenly reversed at the end of February of this year, Case Shiller Home Price Index users had to wait until April 25, almost seven weeks later, to get the news, as the Wall Street Journal reported. By comparison, Quantarium's TerraIndex HPI followers would have discovered the reversal on March 8 — only eight days after it happened.”

The previous paragraph is not a direct quote from a company representative: that is the statement leading the news release.

The company says its Quantarium's TerraIndex HPI has been around for years, supporting its proprietary Automated Valuation Model used by lenders and institutions nationwide and providing estimates for more than 100 million U.S. residential properties.

After observing the ups and downs of the national, state and local real estate markets since 2020, the company said it decided to release its HPI to the public this year.

What makes the difference in reporting time, according to Smintina, are the methodologies used. The Case Shiller index, for example, measures repeat sales data and reflects a three-month moving average. The company reports the home price index, or HPI results for a given month with about a two-month lag.

Conversely, Quantarium says it recomputes at least weekly the estimated values for the entire national footprint and HPIs at various geography levels – from state, county, CBSA, down to zip code and census tract.

The concern added that the HPIs produced on any given date are based on proprietary valuation data science, which includes more than 90% of all sales transactions that will have been reported through a four-week rolling period ending on that date. In short, its data science reduces the processing time lag to an absolute minimum.

The TerraIndex HPI report for a given month is typically available on the second Wednesday of the following month. For example, HPIs for May and June were published on June 14 and July 12, respectively.

For more information, visit quantarium.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!