Eat or Be Eaten

I love nature shows, especially those that

demonstrate ferocity in the animal kingdom. Last night I caught a segment where

an imposing monitor lizard went looking for lunch in a badger’s den, only to

end up becoming lunch for the badger.

I love nature shows, especially those that demonstrate

ferocity in the animal kingdom. Last night I caught a segment where an imposing

monitor lizard went looking for lunch in a badger’s den, only to end up becoming

lunch for the badger.

I love nature shows, especially those that demonstrate

ferocity in the animal kingdom. Last night I caught a segment where an imposing

monitor lizard went looking for lunch in a badger’s den, only to end up becoming

lunch for the badger.

In business, I subscribe to the theory that you provide the best products and services and let the market dictate who wins or loses. But it’s also wise to know your competition in order to articulate your advantages to the market.

Sometimes it even makes sense to buy, merge with or sell to a competitor. Perhaps it’s now time for your company to consider one of these options.

To gain insight into this topic, Clear Seas Research* surveyed hundreds of participants in our Building Materials Panel. The panel, comprised of subscribers to BNP Media’s construction-themed magazines, provided intriguing insight into the competitive mindset of contractors, wholesalers, designers and engineers during this challenging period.

When panel members were asked if any of their competitors had gone out of business in 2008, 40% said no. The other 60% indicated a mean average of three competitors had bit the dust. That’s a lot of roadkill.

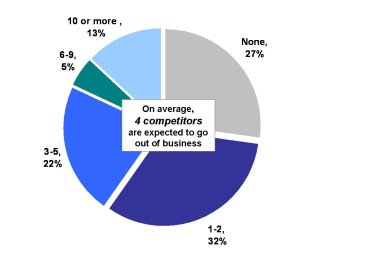

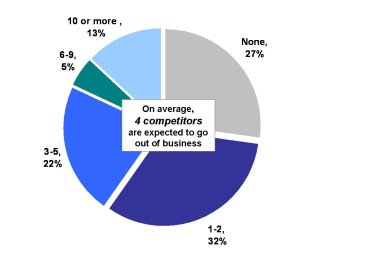

Looking into 2009, only 27% of respondents believe that none of their competitors will fold. Conversely, 73% said they expect a mean average of four competitors to go out of business next year. If accurate, there’s even more carnage facing the construction trades.

When respondents listed reasons why they felt their competitors failed this year or will fail in 2009, five words were repeated frequently:

Some respondents were blunt about their dead competitors:

Did not do customer follow up.

Didn’t brand themselves well.

Exorbitant spending when things were good.

Pricing too low, not sustainable.

Unable to collect from accounts.

Owed the bank too much money.

What, if anything, should your company do in response to these market conditions?

When asked how likely it is that their company would consider selling to or merging with another company, only 3% of respondents said it was “likely” their company would pursue these options. Both survival and expansion were cited by respondents as reasons for selling/merging:

Keep my employees and myself employed.

Merge skills and assets to survive economic crises.

Open up new geographic areas of business.

To consolidate resources.

Opportunity for owner to cash out.

However, when asked how likely it is that their company would consider buying a competitor in 2009, 12% of respondent said it was “likely/very likely” they would do so. Here are a few reasons respondents gave for buying a competitor:

Gain customers at fire-sale prices.

Obtain equipment and real estate at a decent price.

Increase market share.

Better regional representation.

Diversify.

Only an owner (or, in some cases, the owner’s bank!) can determine if now is a good time to sell, merge or buy a competitor. It’s a simple but daunting question. Is it time to eat, or be eaten?

*Clear Seas Research provides custom research, reports, and analysis for the construction field. For more information, contact Kelly Clinton at clintonk@clearseasresearch .

In business, I subscribe to the theory that you provide the best products and services and let the market dictate who wins or loses. But it’s also wise to know your competition in order to articulate your advantages to the market.

Sometimes it even makes sense to buy, merge with or sell to a competitor. Perhaps it’s now time for your company to consider one of these options.

To gain insight into this topic, Clear Seas Research* surveyed hundreds of participants in our Building Materials Panel. The panel, comprised of subscribers to BNP Media’s construction-themed magazines, provided intriguing insight into the competitive mindset of contractors, wholesalers, designers and engineers during this challenging period.

When panel members were asked if any of their competitors had gone out of business in 2008, 40% said no. The other 60% indicated a mean average of three competitors had bit the dust. That’s a lot of roadkill.

Looking into 2009, only 27% of respondents believe that none of their competitors will fold. Conversely, 73% said they expect a mean average of four competitors to go out of business next year. If accurate, there’s even more carnage facing the construction trades.

When respondents listed reasons why they felt their competitors failed this year or will fail in 2009, five words were repeated frequently:

- Bad (bidding, branding, debt, clients, installations, reputation, service)

- Lack of (advertising, business skills, capital, cash flow, customer base)

- Low (demand, prices, sales, margins)

- No (work, credit, management training, new construction market)

- Poor (economy, marketing, planning, workmanship)

Some respondents were blunt about their dead competitors:

Did not do customer follow up.

Didn’t brand themselves well.

Exorbitant spending when things were good.

Pricing too low, not sustainable.

Unable to collect from accounts.

Owed the bank too much money.

What, if anything, should your company do in response to these market conditions?

When asked how likely it is that their company would consider selling to or merging with another company, only 3% of respondents said it was “likely” their company would pursue these options. Both survival and expansion were cited by respondents as reasons for selling/merging:

Keep my employees and myself employed.

Merge skills and assets to survive economic crises.

Open up new geographic areas of business.

To consolidate resources.

Opportunity for owner to cash out.

However, when asked how likely it is that their company would consider buying a competitor in 2009, 12% of respondent said it was “likely/very likely” they would do so. Here are a few reasons respondents gave for buying a competitor:

Gain customers at fire-sale prices.

Obtain equipment and real estate at a decent price.

Increase market share.

Better regional representation.

Diversify.

Only an owner (or, in some cases, the owner’s bank!) can determine if now is a good time to sell, merge or buy a competitor. It’s a simple but daunting question. Is it time to eat, or be eaten?

*Clear Seas Research provides custom research, reports, and analysis for the construction field. For more information, contact Kelly Clinton at clintonk@clearseasresearch .