Earnings Report

Owens Corning Celebrates Stellar Fourth-Quarter 2023; Solid Performance for the Year

Company outperforms expectations with a $131 million Q4 profit and $9.68 billion in revenue for the full year

OC’s fourth-quarter results were a pleasant surprise for analysts: Roofing sales surged 16% to $928M in Q4 2023 vs Q4 2022, driven by strong demand and favorable pricing. Insulation sales dipped 3%, while Composites sales fell 13%. EBIT margins expanded across segments.

— By Bryan Gottlieb for RC

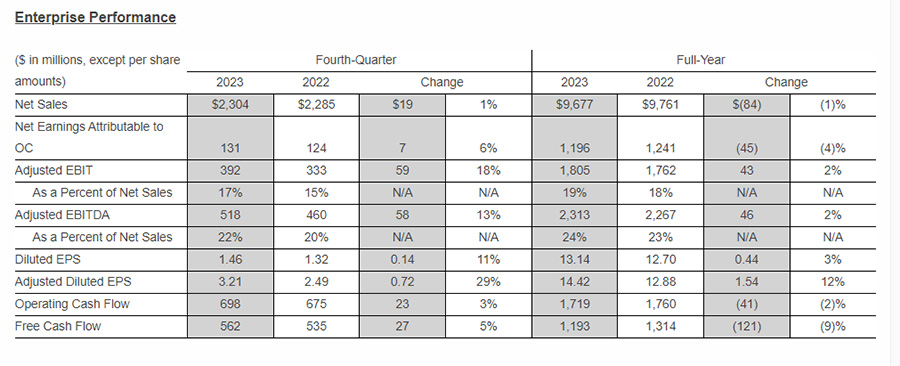

For the quarter ended December 2023, Owens Corning (NYSE: OC) reported revenue of $2.3 billion, up 0.8% over the same period last year; earnings-per-share came in at $3.21, compared to $2.49 in the year-ago quarter.

The reported revenue represents a surprise of +2.97% over analyst firm Zacks consensus estimate of $2.24 billion. With the consensus EPS estimate being $2.82, the EPS surprise was +13.83%.

Investors focus on revenue and earnings; key metrics provide better company performance insight. Since these metrics are crucial in driving the top- and bottom-line numbers, comparing them with the year-ago numbers and what analysts estimated about them helps investors better project a stock's price performance.

Here is how Owens Corning performed in the just reported quarter in terms of the metrics most widely monitored and projected by Wall Street analysts:

- Net Sales- Insulation: $931 million versus the three-analyst average estimate of $903.80 million. The reported number represents a year-over-year change of -2.6%.

- Net Sales- Composites: $514 million compared to the $536.86 million average estimate based on three analysts. The reported number represents a change of -12.7% year over year.

- Net Sales- Roofing: $928 million versus the three-analyst average estimate of $857.61 million. The reported number represents a year-over-year change of +16.2%.

- EBIT- Composites: $26 million versus the three-analyst average estimate of $34.08 million.

- EBIT- Roofing: $284 million compared to the $231.53 million average estimate based on three analysts.

- EBIT- Insulation: $150 million versus $140.92 million estimated by three analysts on average.

In a Feb. 14 news release announcing the company’s Q4 and full-year numbers, OC delineated highlights of its enterprise strategy, including recently made moves:

- On Feb. 9, Owens Corning announced it entered into a definitive agreement to acquire Masonite International Corporation, a leading global provider of interior and exterior doors and door systems.

- Owens Corning is updating the long-term EBIT margin guide for the Roofing segment from approximately 20% to mid-20% on average.

- Owens Corning continues to invest in new products and process innovations to support customers and generate additional growth. In 2023, it launched 39 new or refreshed products.

- Owens Corning sustained a high level of safety performance in 2023 with a recordable incident rate (RIR) of 0.60.

Owens Corning continues to be recognized as an environmental, social, and governance leader. In the fourth quarter, the company earned a place on the Dow Jones Sustainability World Index for the 14th consecutive year.

Shareholder Value

- The company returned $812 million to shareholders in 2023 through dividends and share repurchases. The company paid dividends of $188 million and repurchased 5.4 million shares of common stock for $624 million.

- In December 2023, Owens Corning announced its Board of Directors declared quarterly cash dividends of $0.60 per common share, a 15% increase compared with the associated prior quarterly dividends.

Segment Performance | Q4

- Roofing net sales increased 16% to $928 million in fourth-quarter 2023 compared with fourth-quarter 2022, with continued strong demand tied to the mild weather extending the roofing season in many regions and strong components attachment rate, as well as favorable mix and positive price. EBIT increased $116 million to $284 million, expanding EBIT margins to 31% and EBITDA margins to 32%. The EBIT improvement was due to higher volumes, favorable input and delivery costs, positive price, favorable mix, and manufacturing costs.

- Insulation net sales decreased by 3% to $931 million in the fourth quarter 2023 compared with the fourth quarter 2022. The change was primarily due to lower volumes in North American residential insulation and technical and global insulation businesses, partially offset by favorable price and mix. EBIT decreased $3 million to $150 million, with 16% EBIT margins and 22% EBITDA margins, as the year-over-year impact of lower volumes was primarily offset by favorable price realization.

- Composites net sales decreased 13% to $514 million in the fourth quarter of 2023 compared with the fourth quarter of 2022, primarily due to lower volumes and price declines resulting from lower spot prices in glass reinforcements. EBIT decreased $38 million to $26 million, with EBIT margins of 5% and EBITDA margins of 13%. In addition to price, the impact of lower demand in glass reinforcements and the actions the company took to balance inventories with corresponding production downtime contributed to the year-over-year EBIT declines, which were partially offset by favorable manufacturing performance.

FY 2023

- Roofing net sales increased 10% to $4.0 billion in 2023 compared to 2022, with strong year-over-year demand driven primarily by higher levels of storm activity, positive price and favorable mix. EBIT increased $343 million to $1.2 billion, with 29% EBIT margins and 31% EBITDA margins. The EBIT improvement was primarily due to positive price, favorable input costs and delivery, higher volumes, and a favorable mix for the full year.

- Insulation net sales decreased slightly to $3.7 billion in 2023 compared to 2022, primarily due to lower sales volumes in North American residential insulation and technical and global insulation businesses, largely offset by positive prices, favorable delivery costs, and mix. EBIT increased $7 million to $619 million, with 17% EBIT margins and 23% EBITDA margins, with positive price and favorable mix more than offsetting the impact of lower volumes, input cost inflation, higher manufacturing costs, and planned maintenance downtime and production investments.

- Composites net sales decreased 14% to $2.3 billion in 2023, primarily due to lower volumes and the net impact of divestitures and acquisitions. EBIT decreased from $256 million to $242 million while delivering 11% EBIT margins and 18% EBITDA margins. The EBIT decline was driven by lower demand, primarily in glass reinforcements, the company's associated production downtime actions throughout the year to balance inventories, and the net impact of divestitures and acquisitions. Input costs were inflationary for the year, largely offset by favorable delivery costs.

First-Quarter and Full-Year Outlook 2024

- The key economic factors that impact the company’s business are residential repair and remodeling activity, U.S. housing starts, global commercial construction activity, and global industrial production.

- Macroeconomic trends outside of the U.S. and elevated interest rates continue to result in slow global economic growth, but the company expects most of its building and construction end markets to be relatively stable in the near term.

- For the first quarter of 2024, the company expects overall performance to result in net sales slightly below the first quarter of 2023 while generating mid-teens margins.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

.webp?height=200&t=1743707846&width=200)