Economic Indicators

ARMA Releases Mostly Upbeat Fourth Quarter Product Shipment Report

Shipments square with other economic data from U.S. Chamber of Commerce, U.S. Bureau of Labor Statistics, show 2023 enjoyed solid growth

The Asphalt Roofing Manufacturer’s Association’s Quarterly Product Shipment Report for the final quarter of 2023 showed most numbers in the green both from Q3 to Q4 and year-over-year; Canada seems to be in a slump.

— Image by Bryan Gottlieb for RC

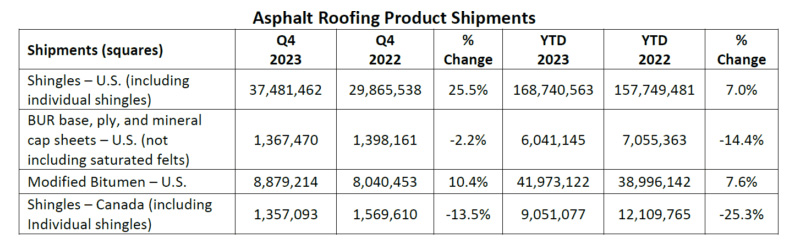

Domestic shipments of asphalt shingles and modified bitumen both saw gains in the fourth quarter from the previous year's last quarter and also realized year-over-year increases, according to the Asphalt Roofing Manufacturer’s Association’s Quarterly Product Shipment Report for the final quarter of 2023.

ARMA’s 2023 Q4 report, released last Thursday, showed that the domestic shingles and modified bitumen market remains robust, with shingles up 25.5% and modified bitumen up 10.4% for the final quarter of 2023 from the same quarter a year earlier. Year-over-year gains for each were 7% and 7.6%, respectively.

However, all figures were lower than the previous quarter.

Shipments |

Q3 - 2023 |

Q4 - 2023 |

% Change |

Shingles - US |

45,717,847 |

37,481,462 |

- 18% |

BUR Base, ply etc. - US |

1,490,014 |

1,367,470 |

- 8.2% |

Modified Bitumen - US |

11,390,159 |

8,879,214 |

- 22.1% |

Shingles - Canada |

1,901,659 |

1,357,093 |

- 28.6% |

Domestic shipments of BUR base, ply, and mineral cap sheets dipped slightly in the final quarter, down 8.2% in the U.S., and saw a decline of 14.4% year-over-year, ending 2023 with 6.04 million squares shipped.

The Canadian market, broken out separately for shingles, did not fare well in the last three months of 2023, with shipments down more than 28% from the prior three months and down more than 25% year-over-year.

ARMA said its roofing product data is collected from participating manufacturers by Association Research Inc., an independent third party, and is aggregated to create the group’s Quarterly Product Shipment Report.

“ARMA members and others interested in the industry value ARMA’s shipment report for the relevant, important insights it provides into the asphalt roofing industry,” said ARMA’s Executive Vice President Reed Hitchcock.

The ARMA report squares with other economic data that saw growth continue to exceed expectations for 2023. The U.S. Chamber of Commerce’s 2024 State of American Business Data Center, which aggregates numerous economic indicators to forecast the year ahead, demonstrated plenty of good news from 2023, portending a good year ahead.

“Last year, we said the U.S. economy was on solid footing at the time, despite challenges such as high-interest rates, declining savings, and dwindling credit causing volatility and leading many to predict a recession,” said Curtis Dubay, chief economist at the U.S. Chamber of Commerce.

“We not only avoided a recession, but also the economy grew in 2023, a testament to the strength and resilience of the business community; businesses continued investing, hiring, and raising wages despite the headwinds,” Dubay continued. “There will be challenges in 2024, but the data points to another solid start to the year.”

Key takeaways from the U.S. Chamber of Commerce’s 2024 forecast include:

- Worker shortage sees no improvement: The Chamber’s Worker Shortage Index reading is near an all-time low at 0.71, meaning for every 100 job openings, there are only 71 available workers.

- IPO market sagging: The number of IPOs declined after a surge in IPOs in 2021 due to Special-Purpose Acquisition Companies (SPACs). Rising interest rates have suppressed mergers and acquisitions.

- Small business loan value stays strong: Despite tightening monetary policy, Commercial and Industrial (C&I) Loan value, a primary source of capital for small businesses, improves.

- Consumer spending is strong: Even though inflation remains high, spending still surpasses it. Retail sales rose by 0.3% in November 2023, outpacing the inflation rate for the month.

- Supply chain strains are easing: The New York Federal Reserve’s Global Supply Chain Pressure Index is at 0.11, down from a pandemic high of more than 4.0 in 2021.

- Energy prices are coming down: Energy prices have been at record highs but are now beginning to stabilize.

- The share of patents issued to U.S. residents is declining: The pandemic slightly decreased the number of patents issued in the U.S. However, less than half goes to U.S. residents.

- Entrepreneurship is booming: A projected total of 5.5 million new business applications were filed in 2023, continuing at an elevated level compared to pre-pandemic.

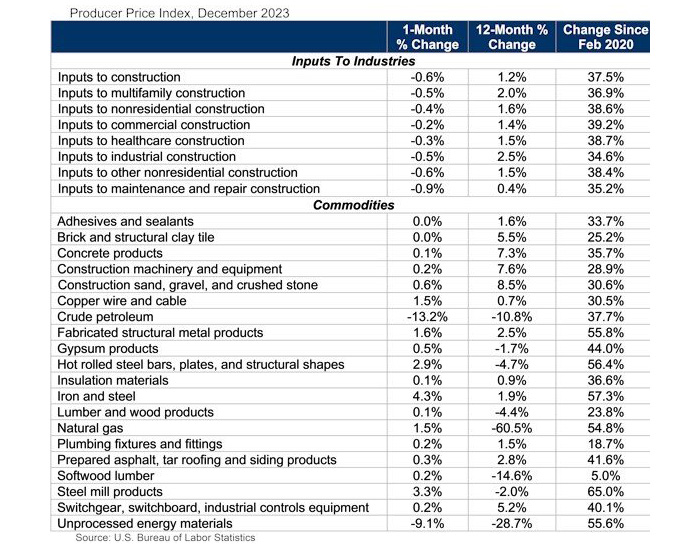

Domestic Construction Materials Prices Fell in December

According to the Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics Producer Price Index data, U.S. construction input prices decreased by 0.6% in December 2023 compared to the previous month. Nonresidential construction input prices decreased 0.4% for the month.

Overall construction input prices are 1.2% higher than a year ago, while nonresidential construction input prices are 1.6% higher. Prices decreased in two of the three energy subcategories last month. Crude petroleum input prices were down 13.2%, while unprocessed energy materials were down 9.1%. Natural gas prices rose 1.5% in December.

“Construction input prices fell sharply in December,” said ABC Chief Economist Anirban Basu. “While plunging oil prices are the primary factor behind the sharp decline, most input prices were tame in 2023’s final month. That serves as a fitting end to a year during which aggregate input prices increased just 1.2% and many individual commodity prices actually fell.

“Despite continued materials price moderation and other positive developments regarding inflation, the outlook is not without risks,” Basu added. “Piracy in the Red Sea and the resulting diversion of ships from the Suez Canal around the Cape of Good Hope has caused global freight rates to nearly double in the first two weeks of 2024, according to the Freightos Baltic Index. All else equal, rising shipping costs will put upward pressure on certain input

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!