Employee Healthcare

3 Tips to Get the Most Out of Your Health Insurance Renewal

Companies are reviewing their benefits options for 2024, and these tips are worth considering to ensure employees get the best plan for the lowest premium

Eliminating overspending starts with having the proper funding arrangement. Many small and mid-size businesses are in a fully-insured health plan that may not cover their overspending at the end of the plan year.

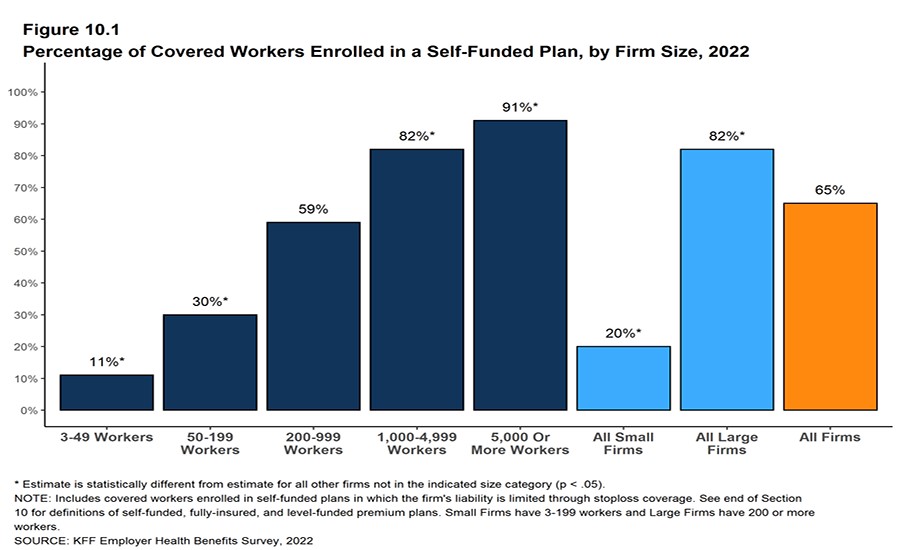

— Top image courtesy of Blue Diamond Gallery; chart courtesy of KKF

What does everyone want? Lower costs! When do they want it? Now!

With the fourth quarter quickly approaching, many businesses will review benefit options for the 2024 plan year. If you find yourself in this situation, here are some tips to ensure that you get the best health plan for the lowest cost:

Tip 1: Competition creates opportunity.

While most businesses work with the same broker year after year, evaluating new broker relationships will likely uncover new solutions for your company. Most businesses rely solely on their broker to shop the market for them regarding their benefit renewal.

The fact is, not all brokers shop in the same market. If your broker brings you the same three or four carriers each year, and you bounce around from one provider to the next, you are likely stuck in the vicious cycle of renewal purgatory.

When your broker must compete to keep your business, your company will win. You will be surprised by what your current broker is suddenly able to do for you, or you will be surprised by the number of alternative options available for your group that your broker is not evaluating.

Tip 2: Choose the Proper Funding Arrangement for Your Health Plan.

Eliminating overspending starts with having the proper funding arrangement. Many small and mid-size businesses are in a fully-insured health plan that may not cover their overspending at the end of the plan year.

Moving to a level-funded, captive, or self-funded health plan allows employers to implement cost controls and create designs that incentivize employees to seek lower-cost care. In the past, many small and mid-size businesses have overlooked or have not been presented with these options by their broker.

That failure to present is due mainly to two misconceptions: too much volatility or the business is not big enough. Both have been dispelled by the many successful small and mid-size companies taking advantage of these funding arrangements' lower costs.

According to the latest Kaiser Family Foundation survey numbers, 65% of all workers were enrolled in a self-funded health plan in 2022. However, only 11% of workers in firms with 3-49 employees and 30% of workers in firms with 50-199 employees were enrolled in a self-funded plan. These funding arrangements can be implemented at the small-group level with at least two enrolled employees.

Tip 3: Shift Your Focus from the Lowest Premium to the Lowest Cost of Care.

Having the lowest premium does not guarantee the lowest cost of care. What drives the price up in a health plan is the cost of care your employees receive. If you have a fully insured health plan, you effectively give your employees a company credit card with no spending limit.

The highest-performing health plans in today’s market have found a way to drive down the cost of care, and can be accomplished in myriad ways. Some of the most effective are network design, medical management and direct contracting.

Regarding network design, you have many options. You can access large name-brand PPO networks from the big carriers without being in one of their insurance plans. You can explore regional networks. You can implement a non-name brand national PPO. Or you can eliminate the “network” altogether and give your employees access to all providers. Ask your broker to evaluate network options and to provide you with a disruption report to view the difference in providers.

Medical management is a great way to ensure that you have safeguards to lower the cost of care for your employees. These providers will ensure your employees get the proper care, at the right place, for the best price. It will also help your employees by keeping their out-of-pocket expenses to a minimum — a win-win for your plan and staff.

Direct contracting for services such as imaging, labs and surgical procedures may be one of the most effective ways to ensure that your plan pays the lowest cost for care. When you arrange a direct contract in your health plan, you can also afford to eliminate employee out-of-pocket expenses for these procedures.

These are just a few strategies employers use to get the most out of their benefits renewal. If you have questions, feel free to reach out for advice.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!