Earnings Report

Beacon Reports Q3 2024 Profit Amid Strong Roofing Demand

Beacon Roofing Supply (NASDAQ: BECN) reported third-quarter net income of $145.3 million after reporting a loss in the same period a year earlier; on a per-share basis, the Herndon, Va.-based company said it had profit of $2.30 and earnings, adjusted for one-time gains and costs, were $2.80 per share.

The results did not meet all Wall Street analysts’ expectations: the average estimate of six analysts surveyed by Zacks Investment Research was for earnings of $2.88 per share. The roofing and exterior building envelope materials distributor posted revenue of $2.77 billion in the period, which also did not meet Street forecasts. Six analysts surveyed by Zacks expected $2.78 billion.

![]()

“We have, once again, shown that we can grow in any environment,” Julian Francis, Beacon’s president and CEO, said in a statement on Oct. 30. “The majority of our demand is underpinned by non-discretionary repair and reroofing, which remained solid in the third quarter.”

Francis added that despite an overall lower activity level than the company expected, “disciplined margin management resulted in favorable price-cost across all lines of business.”

Beacon shares have increased almost 10% since the beginning of the year. In the final minutes of trading on Wednesday, shares hit $95.47, an increase of 36% in the last 12 months.

Third Quarter

![]()

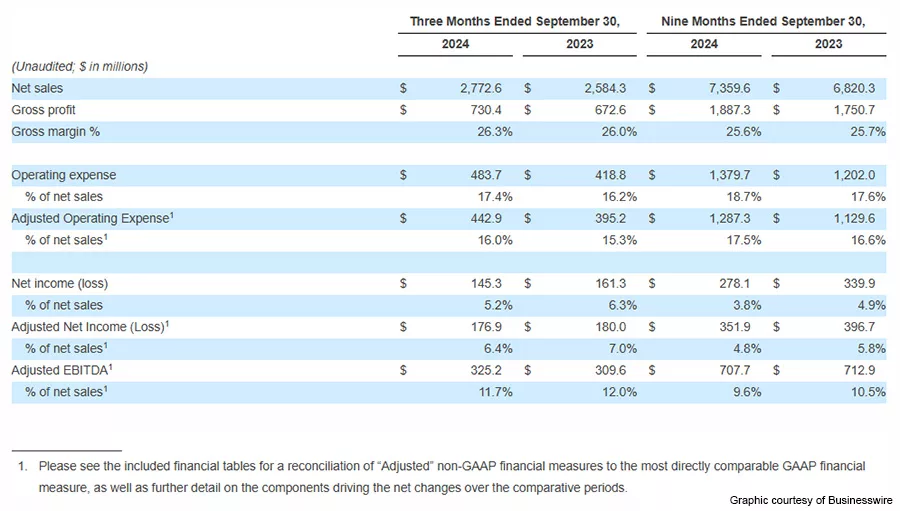

Net sales reached a record $2.77 billion, up 7.3% year-over-year (5.6% on a per-day basis). The weighted-average selling price rose by 1-2%, while estimated organic volumes increased by about 0-1% but decreased 1-2% on a per-day basis. Acquired branches contributed approximately 5.6% to the third quarter's net sales growth.

Sales of residential roofing products grew by 2.3% year-over-year, or 0.7% per day. Non-residential roofing product sales increased by 9.4% (7.7% per day), while complementary product sales surged by 17.2% (15.4% per day).

The rise in residential sales was mainly due to effective pricing, while non-residential sales benefited from strong market demand. The increase in complementary sales resulted from three waterproofing acquisitions that added 20 branches since September 30, 2023.

The three-month periods ending September 30 for 2024 and 2023 had 64 and 63 business days, respectively.

Gross margin increased to 26.3% from 26.0% last year, driven by higher average selling prices that offset rising product costs and a greater non-residential product mix.

Operating expenses and Adjusted Operating Expenses rose due to acquired branches and higher organic selling, general, and administrative (SG&A) expenses. The increase in SG&A was primarily from higher payroll and employee benefits, along with increased warehouse costs.

In response to market conditions, Beacon said it reduced its headcount at the end of the third quarter. The rise in payroll and benefits was linked to a higher average number of employees in 2024, along with severance payments for those impacted by cost-reduction initiatives. Consequently, both operating expenses and Adjusted Operating Expenses as a percentage of sales were higher in 2024.

Net income for the year was $145.3 million, down from $161.3 million the previous year. Adjusted EBITDA rose to $325.2 million from $309.6 million. The diluted earnings per share (EPS) improved to $2.30, compared to $(4.16) last year, with the prior year's negative EPS largely due to a $414.6 million preferred stock repurchase premium.

Year-to-Date

Year-to-Date

Net sales reached $7.36 billion, reflecting a year-over-year increase of 7.9% (7.3% on a per-day basis) and setting a company record for the first nine months. Estimated organic volumes rose by about 2-3% (1-2% per day), while the weighted average selling price increased by approximately 1-2%. Acquired branches contributed roughly 4.4% to this growth.

Sales of residential roofing products increased by 4.0% (or 3.4% per day), while non-residential roofing products saw a significant surge of 12.1% (11.5% per day). Complementary products also experienced growth, rising by 12.2% (11.6% per day) compared to the previous year.

The company said a rise in residential sales can be attributed primarily to effective pricing strategies. In contrast, the growth in non-residential sales was driven by higher volumes resulting from customer destocking in the previous year and strong market execution.

The increase in complementary products was fueled by three waterproofing acquisitions, which included a total of 20 branches since September 30, 2023.

Net income was $278.1 million, down from $339.9 million last year, while Adjusted EBITDA dropped to $707.7 million from $712.9 million. Diluted EPS rose to $4.35 from $(1.93) due to a $414.6 million repurchase premium last year.

On May 9, the company initiated an accelerated share repurchase agreement for $225.0 million. By September 30, it had repurchased $180.0 million worth of stock, reducing shares outstanding to 61.9 million from 63.6 million.

Yahoo Finance said that Beacon’s annualized revenue growth of 8.4% over the last two years is above its five-year trend, suggesting some bright spots.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!