Economic Indicators

Can distributors and shippers regain their pricing power in 2024?

FreightWaves’ Q1 2024 ‘Freight Sentiment Indexes’ show improvement across carriers, brokers, shippers

Image courtesy of Pixaby

Is it possible that 2024 will finally bring an end to the current freight recession? That is undoubtedly what the freight market is hoping for.

Last year, many carriers and brokers struggled, and those still in operation are eagerly awaiting any signs of a turnaround in pricing power. While there are some indications of improvement, it has not yet been widespread or significant.

It’s not surprising since most analysts agree that a year’s first quarter is typically challenging for the freight industry. Additionally, the final months of 2023 were filled with turmoil for trucking and brokerage companies, including numerous bankruptcies; see Yellow.

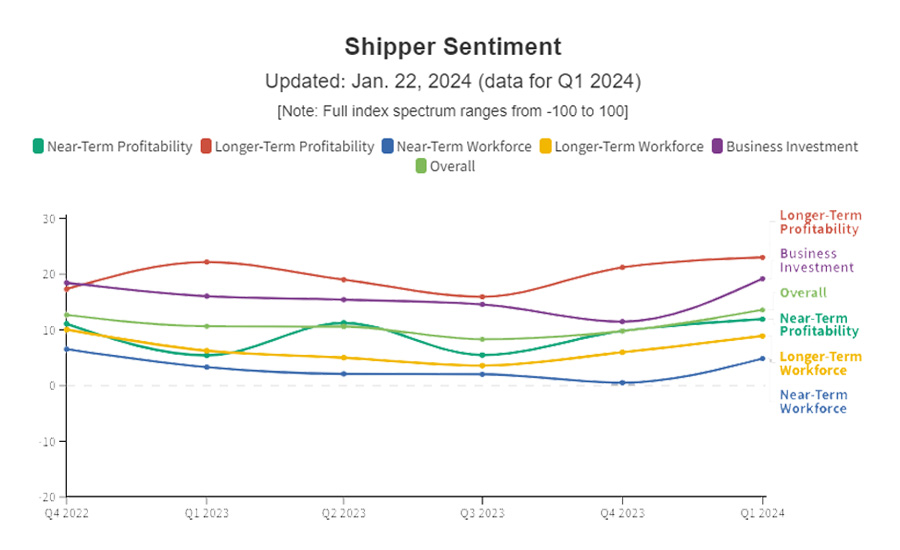

As a result, shippers stand out as the most optimistic group in this environment. FreightWaves' Q1 2024 Freight Sentiment Indexes show a sharp increase in shipper confidence, reaching a record high of 13.58 from 9.79 in the previous quarter.

(Note that data only go back to Q4 2022.)

As shippers become more confident, another question arises: will this optimism continue into the market's recovery, or will they be taken by surprise?

Carriers are also experiencing a cautiously positive recovery, with their sentiment rising from 4.41 to 5.66 in Q4 of 2023. However, there is still excess capacity looming over them like a dark cloud.

In Q1, brokers' moods improved as well, with a score of 9.96 compared to 8.78 previously, despite ongoing issues with fraud that FreighWaves says the Transportation Intermediaries Association is addressing on a national level.

These indexes measure freight sentiment on a scale from negative 100 to positive 100, where higher numbers indicate growth and lower numbers indicate contraction.

FreighWaves: Freight Sentiment Indexes

FreightWaves, a price reporting agency focused on the global freight market and provider of high-frequency data for the global supply chain, sends the same survey questions to shippers, brokers and carriers. The results offer aggregated insights from hundreds of respondents into the industry’s health and expectations for the future.

Ultimately, the freight market experienced a lot of recalibrating in 2023. But the early numbers for 2024 seem to indicate a rebound as the year progresses. Demand remained strong last year, even as consumers turned gloomy. Now, with inflation receding and moods lifting, there’s little reason to think that will change for domestic freight, even with tensions rising internationally.

Of course, it’s not all positive. Optimism is tempered by those persistently low tender rejections in the U.S. truckload space. This year, it’s expected that there will be some progress towards balancing supply and demand, but the exact timing is uncertain. Furthermore, regulatory shifts impacting owner-operators inject additional unpredictability into the industry’s trajectory.

This quarter's Freight Sentiment Indexes paint a picture of an industry on the cusp of change. Shippers are optimistic but need to be cautious as logistics service providers may soon start asking for more.

(Note: Survey data was fielded during the first two weeks of January.)

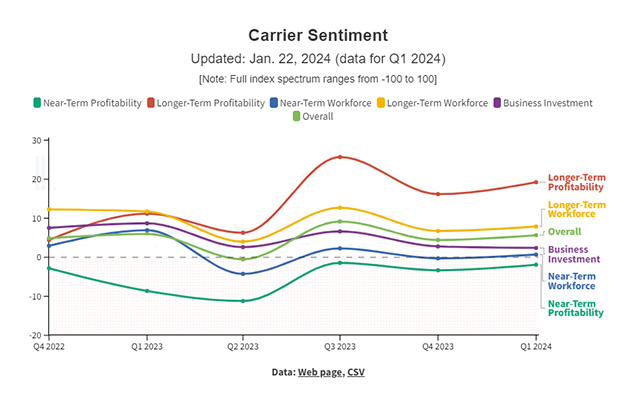

Carrier Sentiment: Gradual Recovery as Market Shift Nears

For Q1 2024, carriers exhibited a mixed sentiment. The sector continues to grapple with the excess capacity that has dampened margins for some 18 months now.

The near-term profitability index improved to -1.91 from -3.34, showing a less pessimistic outlook for carriers. However, they still expect to be less profitable than in Q4 2023 for the sixth consecutive quarter.

Longer-term profitability continued to rise, reaching 19.23 in Q1 2024 compared to 11.16 in Q1 2023. Workforce sentiment also showed improvement, with near-term sentiment at 0.69 and longer-term at 7.88 in Q1 2024, though both figures are lower than Q1 2023's numbers

Business investment sentiment slightly declined to 2.39 in Q1 2024 from 2.77 in Q4 2023, and that’s also a decrease from 8.69 in Q1 2023, reflecting a cautious approach to investment.

The overall sentiment improved to 5.66 in Q1 2024 from 4.41 in Q4 2023, showing a more optimistic outlook compared to the previous quarter. It is somewhat surprisingly a hair lower than at this time last year.

Industry analysts and leaders suggest that 2024 will likely feature a realignment of supply and demand, dependent, of course, on the continuation of current economic and carrier exit trends.

Shipper Sentiment: Optimism That Could Come Back to Haunt

The shipping sector's sentiment has improved significantly in recent quarters, with near and longer-term profitability and workforce outlooks on the rise. This is likely due to improving consumer sentiment and a positive economic outlook. Business investment also looks strong for 2024, boding well for freight demand.

Shippers' heightened optimism can have pitfalls as the economic landscape remains uncertain, which could lead to mistakes in a volatile market, and their advantage in pricing power may only last until 2026 or 2027.

While Q1 2024 showed improvement in sentiment for carriers, brokers/3PLs, and shippers, prudent shippers should focus on building strong relationships with carrier partners and preparing for potential demands from providers.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!