Roofing Contractor's State of the Industry Report and Survey 2021

Photo credit: D.C. Taylor Co.

It’s still too fresh. Several weeks into the New Year is not enough time to put proper perspective on the year 2020 was, and what its lasting implications will be. Without a doubt, the last 12 months will be remembered as a watershed moment for the world, and in roofing.

The year started with so much promise: record attendance at regional and international trade shows; surging sales revenue in both residential and commercial sectors; and a bevy of new innovations in technology designed to improve efficiency while on the roof, and company management while contractors are off it.

The COVID-19 pandemic not only slowed that momentum, it brought the roofing industry to a virtual halt — seemingly overnight — until essential-worker status came into play. Even then, contractors and the manufacturers and distributors that serve them needed to adapt quickly to a whole new world where selling, managing workforce, and meeting customer’s health-and-safety expectations all needed redefining.

As Roofing Contractor itself evolved during the crisis, our mission to help the roofing industry transition into this new era endures. Again with the expertise from Clear Seas Research — the survey and research arm of RC’s parent company, BNP Media — RC circulated our annual survey to roofing contractors around the country last fall.

The survey set out to measure the pulse of an industry deemed essential in the face of the worst health crisis in more than a century, yet still challenged for survival amid a lingering economic crisis.

Our key findings are shared below in our annual State of the Industry Report, sponsored by Cotney Attorneys & Consultants. We encourage everyone to learn more with their experts in our exclusive State of the Industry webinar Feb. 18.

Coatings are among the products experiencing growth, with 45% of residential contractors and 44% of commercial contractors expecting sales to increase in 2021.

Coatings are among the products experiencing growth, with 45% of residential contractors and 44% of commercial contractors expecting sales to increase in 2021.

Residential Resiliency

Residential roofing continues to stay strong despite the pandemic and the economic recession it caused. Of those respondents who identified as primarily residential, the median revenue in 2019 was $500,000 to $999,000. A total of 32% had revenue between $250,000 and $999,999.

As a testament to this resiliency, 49% of residential respondents said they expect their 2020 annual sales to increase compared to 2019. Of them, 13% said they expect it to “greatly increase.” This could be attributed to the fact that, due to the pandemic, people were unable to go on vacations and had to work from home. In doing so, they had more time to notice problems with their roofs and sought the help of contractors.

When considering sales for 2021, three-fourths (75%) expect an increase compared to 2020. This optimism is fueled in part by the potential for business to shift toward normalcy with the distribution of the COVID vaccine. For others, it's likely due to 2020 being an unprecedented year that caused major drops in revenue, meaning 2021 can only be better.

However, considering 85% of residential roofers believe their total sales volumes will increase over the next three years, it’s more likely that the roofing industry expects to rebound from the past year and continue to grow from there.

“The way we look at it is you always must adjust to the times. We were fortunate enough to make it through 2008 and it’s looking optimistic that we will get through this COVID-19 situation stronger than ever,” said Cory Varao, general manager of Fraser Construction Company in Mashpee, Mass. “We are constantly learning about new products, new ways to market and making general policy changes to help move the company forward. I think this is one of the keys to success and I look forward to adapting in the future.”

Roof replacements remained the main source of revenue for residential roofing contractors at 31%, compared to repairs and new construction (both at 13%). Drilling into this further shows steep-slope asphalt shingles continue to be the top revenue generator. On average, shingles accounted for 28% of the contractors’ revenue. Around 43% said they saw increases in steep slope sales from 2019 to 2020, while 65% expect those sales to grow in 2021.

When looking ahead to the future, however, residential contractors anticipate that metal roofing will experience the most growth in sales. In 2020, 18% of revenue came from metal roofing for residential roofers. More than half of respondents said they expect metal roofing to grow from 2019 to 2020, and 68% anticipate metal sales to increase in 2021.

As for the types of metal roofs, residential contractors are more likely to install metal shingles, tiles or slate than their commercial counterparts, though architectural standing seam continues to be the most popular metal system.

“Metal roofing, once relegated to barns and sheds, has seen an increase in popularity in recent years,” writes Brian Haraf, vice president of Metal Sales Manufacturing Corporation. “Customers may have some sticker shock when comparing metal to the pricing of traditional roofing, but the benefits far outweigh the costs.”

Following metal roofing and steep-slope asphalt roofing, residential contractors anticipate single-ply roofing to grow in 2021 (56%), followed closely by polymer/synthetic roofing asphalt (55%) and low-slope asphalt (54%). The area residential contractors expect sales to increase the least is spray polyurethane foam (37%), though the survey only gathered a small sample size of contractors that use it.

Single ply roofing was the dominant product preference with 91% of commercial respondents. Among those contractors, 38% reported using TPO, followed by EPDM (30%) and PVC (18%).

Single ply roofing was the dominant product preference with 91% of commercial respondents. Among those contractors, 38% reported using TPO, followed by EPDM (30%) and PVC (18%).

Challenges in Residential Roofing

There are some hurdles residential contractors will need to clear to see sales and revenue grow. In last year’s report, the lack of a qualified workforce topped the list of challenges contractors expected to face in 2020. Thanks in part to the pandemic, other concerns are keeping residential contractors awake at night.

The most common challenge residential respondents expect to face in 2021 is lowball pricing and bidding wars (54%), followed by increases in building material costs (49%). The aforementioned lack of qualified workers is of concern to 45% of residential contractors. Bryce Curtis, director of Yellowhammer Roofing in Alabama, said “Chuck-in-a-Truck” roofers that bid low weren’t as prevalent in 2020 due to the pandemic, but they’re likely to make a comeback.

“What hurts the roofing industry are your competitors. We would rather have a licensed, insured competitor beat us out 10 times out of 10 than somebody that rolls up in there that does roofing in the spring, flooring during the fall and cabinets in the winter,” Curtis said.

The need for qualified workers caused an increase in the use of subcontractors to complete field labor by 17% in 2020. Despite this, residential contractors say that 59% of their jobs are completed by full-time workers versus 29% by subcontractors.

“We have amazing team members that are crucial to our success, but finding them among the less effective employees has been a challenge,” said Johnny Marvin, co-owner of Striker Roofing in Texas. “We’re trying to bring on as many people as we possibly can.”

An increase in labor costs isn’t helping matters either. The majority of residential contractors who responded say they have less than 10 employees in their business, but all respondents reported their labor costs jumped by an average of 16% in 2020.

To try and find good help, residential contractors rely mostly on employee referrals (73%). Paying employees well and providing bonuses are the main methods they use for retention, followed by offering benefits.

When training the employees they do hire and retain, direct training is the preferred method of residential roofing contractors, with 85% saying they train in-house and on the job. Despite this, only 45% of residential contractors have a formal training program. Another 7% say they don’t offer training.

Unlike their commercial counterparts, residential contractors aren’t turning to other sources for training. Just under a quarter (24%) utilize training provided by manufacturers, while 17% use training from industry associations.

When it comes to safety training, 31% of residential contractors hold weekly safety meetings, while 38% prefer it to be a monthly issue. Around 66% of respondents say they supply all safety equipment to workers, while another quarter only provide some of it.

Commercial Conditions

Last year started very strong for commercial roofing contractors in dozens of markets around the country. Roughly half of survey respondents (45%) indicated sales were up over 2019, and only 34% anticipated slight decreases in sales due to the pandemic.

Single ply roofing was the dominant product preference with 91% of respondents. Among those contractors, 38% reported using TPO, followed by EPDM (30%) and PVC (18%). Metal was the second most popular roofing system category at 77%, followed by coatings (68%), low slope asphalt (59%) and steep slope asphalt (50%).

More than half of the roofers using metal said sales remained the same in 2020 and only 18% said sales increased greatly. Coatings appeared to grow the most, as 42% of contractors said sales increased in 2020.

While some relied on existing backlogs and accelerated project timelines because buildings were empty, other roofing contractors characterized their financial performance as strong and encouraging. Davco Roofing & Sheet Metal Inc., in Charlotte, N.C., added two dedicated business development positions and a marketing manager who are focused on opening doors and increasing revenue.

“Although we were crippled by the global pandemic, we were able to maintain growth while increasing overall profit margins because we were able to be more selective about the work that we targeted,” said President Daniel Davis.

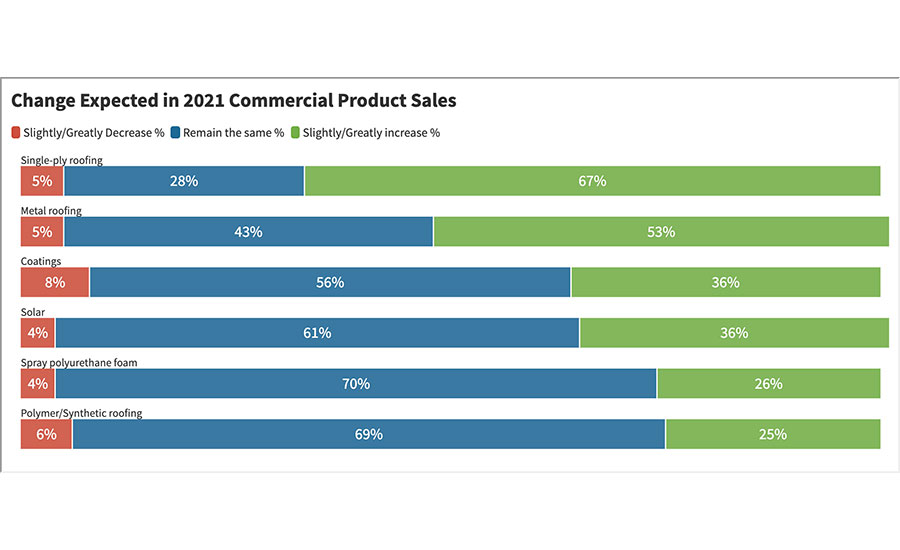

The positive outlook wasn’t isolated. A strong majority of commercial roofers (68%) said they expected sales to increase again this year, with 11% of respondents anticipating sales to increase greatly. Just 14% of contractors felt sales would slightly decrease in 2021, and 7% expected great losses.

Of those expecting sales increases, more than half said it would be in single-ply systems, and 53% anticipated a spike in metal jobs.

In terms of challenges — outside of the pandemic — commercial contractors bucked a trend. Safety enforcement for employees and government regulations were out of the top five of perceived workforce issues, at 20% or less.

Instead, contractors were concerned most with the lack of qualified, skilled labor (61%), and lowball bidding (48%). Increased costs of building materials, the overall weak economy, and insurance and healthcare costs rounded out the top five.

Storms and Supply Struggles

As previously mentioned, an increase in building material costs is one of the top issues commercial and residential contractors expect to face, with nearly half of respondents expecting it to be a factor in 2021. Gleaning from the experiences of 2020, it’s understandable. Lockdowns around the globe caused a ripple effect that slowed product manufacturing and distribution, which coupled with a record-breaking storm season, hit contractors hard right during peak season.

“The supply and demand issues during peak season were particularly challenging this year. We understand and feel the effects of that with our contractors,” said Scott Schumacher, vice president of strategic marketing for Owens Corning Roofing. “Our approach will always be to communicate with contractors honestly and realistically, so they can do the same for their customers.

“Entering 2021, we do not anticipate repeating lost production time due to the pandemic.”

In a virtual town hall hosted by the National Roofing Contractors Association, Asphalt Roofing Manufacturers Association (ARMA) Vice President Reed Hitchcock said as of October, shingle manufacturers reported that they were running at full capacity to help resupply contractors.

“I wish I had the crystal ball on this one,” said Hitchcock. “In talking to our members, there is some anticipated demand slowdown coming with the fourth quarter and the first quarter coming up.”

Single-ply roofing took a hit during the pandemic, according to the Single Ply Roofing Industry, while the Roof Coatings Manufacturers Association (RCMA) reported production of coatings was at an all-time high.

“We always find that the coatings actually can extend the life of the roof, and I think that because of COVID — financial costs on the residential and commercial side — I think owners are looking at more opportunities to save long term,” said RCMA Executive Director Dan Quinonez.

Proactive communication between contractors, distributors and manufacturers proved key in managing product availability, said Mike Jost, chief operating officer at ABC Supply Co.

“The nearly 800 locations within our network have always worked closely together, but it’s been especially advantageous to help contractors get the materials they need,” said Jost. “If one branch doesn’t have the product, we’re able to lean on others to move material around.”

The supply shortage and the level of concern regarding it is largely due to the pandemic, but the blame can also be placed on an unprecedented 2020 storm season.

The Atlantic hurricane season became the most active on record and the fifth costliest season. A total of 31 depressions were recorded, all but one of which became a named storm. Twelve of the named storms made landfall in the U.S., breaking the record of nine recorded in 1916. In total, the hurricane season caused an estimated $51 billion in damage.

2020 was the fifth consecutive above-average season since 2016, and if the last few years are any indication, contractors should brace themselves for yet another heavy storm season in 2021.

Louisiana was among the hardest hit areas by hurricanes. By the time Hurricane Zeta struck Louisiana in late October, it was the fifth hurricane to tear apart buildings in the state. Even contractors who weren’t working in the hurricane-swept areas were feeling the squeeze on labor and supplies.

“Contractors from all over the country are coming to Louisiana and down to the coast to work, so material has been extremely hard to come by,” said Mike Warren, director of operations for Roof Crafters in Hammond, La.

Though the work proved to be difficult due to jobsite delays and supply issues, it was also plentiful, giving many roofing contractors a boost in what was otherwise going to be a tough year.

During this record-breaking hurricane season, the Midwest experienced a derecho — a straight-line wind storm — in August, with winds hitting 140 mph. The storm caused an estimated $11 billion in damages, flattening entire fields of crops and ripping apart roofs and buildings of every size.

Cedar Rapids, Iowa took the brunt of the storm, causing $7.5 billion in damages from the winds and tornadoes. When snowstorms hit the area in October, contractors were left scrambling to help people recover before winter truly set in, reporting labor shortages and supply line struggles.

Christina Bible, director of operations for Options Exteriors in Minnesota, said they had to ship shingles from South Dakota to use in Iowa. But the silver lining, Bible says, is that between the derecho and supply shortages, multiple customers are now looking into the viability of metal.

“There has been some interest in homeowners transitioning from asphalt roofs to metal roofs,” she said. “The type of devastation down there was just so great the shingles didn’t even matter, it was actually whole roofs being blown off, but we have been doing some more metal roofs.”

Intense weather wasn’t the only hazard roofing contractors had to deal with in 2020. Wildfires across the West Coast affected thousands of families and caused billions in damage. California alone saw $12 billion in damage, leading many roofing contractors to consider more durable options for the future.

“As we witness the horrible destruction wildfires have and are causing, the more we can do as an industry and community to help homeowners protect themselves against these increasing threats, the better,” said Renee Ramey, Metal Roofing Alliance executive director.

Business Climate

If acquisitions are any measure of a prosperous business climate, then roofing is starting off 2021 in positive fashion. Several major moves were formally announced around the New Year:

- Multinational building materials manufacturer LafargeHolcim acquiring Firestone Building Products for $3.4 billion.

- Beacon sold off its interior product business, consisting of 81 branch locations to American Securities Inc. for $850 million.

- Innovative Chemical Products (the ICP Group) announced the acquisition of Leeson Polyurethanes, a leading U.K.-based manufacturer of polyurethane adhesives and coatings used in a variety of sectors and markets.

The climate proved good for contractor acquisitions as well. Tecta America — which celebrated its 20th anniversary in 2020 — continued its growth with a handful of additions throughout the year. Company leaders said the pandemic hasn’t slowed down their acquisition strategy, which is more about finding the right company that fits their model, rather than timing.

“It’s part of who we are, part of our culture, and when we buy companies we buy the best ones out there,” said President and CEO Dave Reginelli. “We’re not looking for turnarounds, we’re looking for solid companies with strong performance with the same features we care about.”

As in any given year, assessing the state of the roofing industry in 2021 will depend on several factors — known and currently unknown. However, it’s clear that this year will be different for three specific reasons regardless of market, business size or service specialty.

COVID-19 Vaccinations: The rollout of multiple COVID-19 vaccines at the end of 2020 was slow and cumbersome, a problem President Joe Biden’s administration pledges to fix — and quickly. They’ll have to if there’s any chance to return to normalcy as infections and death totals surge nationwide.

New Leadership: Vaccinations are just the beginning. The Biden administration already proposed another broad pandemic relief package, and promised a major emphasis on infrastructure and clean energy. While those present opportunities for roofers, the impact on business regulations after four years of a federal scale back remains to be seen.

Wicked Weather: Predicting long-term weather patterns for any particular region of the country is futile. But given the strength and volatility of recent storm seasons, there’s no reason to believe roofing contractors should expect anything less in 2021.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!