Coatings Special Section

Coatings in a COVID-19 World

Evaluating the state of the roof coatings market in 2020 can’t be done without feeling the pandemic’s impact. Neither can moving forward.

Taking the pulse of the roof coatings market in 2020 means evaluating circumstances before and after the COVID-19 pandemic struck North America. Roofing contractors already in the space spoke of backlogs and the need for seasoned workers; those on the verge of entering the market nudged closer to taking the leap. As it did in several other industries, the pandemic — and ensuing economic crisis — had a way of speeding up critical decisions in roofing.

For contractors, that meant re-evaluating their current operating procedures to be more technologically savvy, engaging with customers, and being conscious of health and safety concerns. For many it also sparked the urgency to broaden and even change business models.

Looking In

Property owners are looking for added value and energy savings with their building envelope decisions, and in terms of roofing, that almost-always involves extending the service life of a roofing system. With manageable investments in training, tools and equipment, product testing and networking, entrepreneurial roofing contractors can add coatings to their repertoire in a hurry.

In particular, new technological advances in product development and applications continue to broaden the access points into the market for roofing contractors. They’re also driving manufacturers to create more environmentally-friendly products that also increase efficiency on the rooftop. That usually spells more jobs and profitability for contractors.

“We always view it as a good time for a roofing contractor to enter the coatings market,” said Dan Quinonez, executive director of the Roof Coatings Manufacturing Association (RCMA). “The ease of entry to the market, the breadth of coating options available, and the substrates that coatings can be installed over … are still benefits now.”

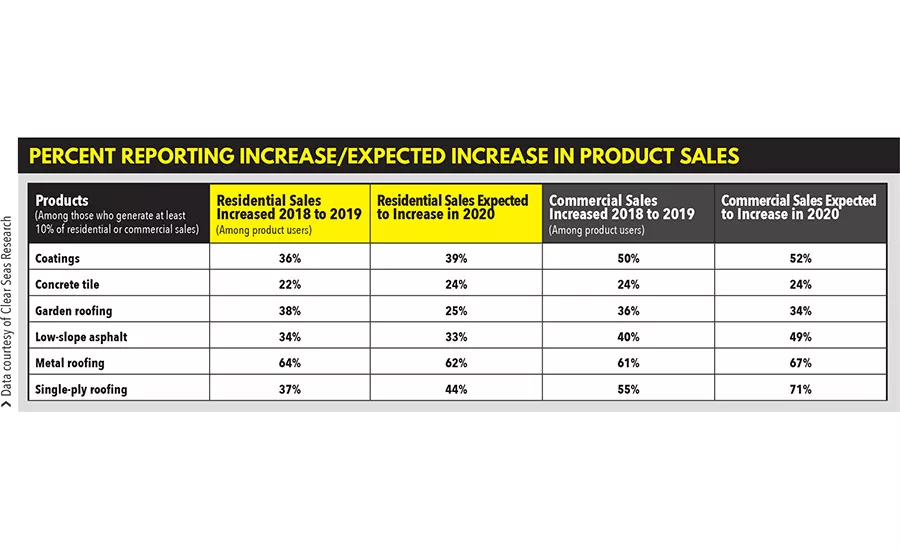

Survey data analyzed for RC’s 2019 State of the Industry Report demonstrated that more roofing contractors in markets across the country incorporated coatings into their service offerings, and those that have been applying them for years are finding opportunities to innovate and expand. Roughly 67% of respondents to RC’s survey said coatings were a part of their business model, and on average said metal roofing and coatings together accounted for a quarter of all sales revenue.

Nearly three-quarters (73%) of respondents said they expected to see single-ply grow in 2019, followed by coatings (45%).

Those projections proved true, according to survey results compiled for RC’s 2020 State of the Industry Report. About half of all of commercial roofers that responded said coatings sales definitively increased from 2018 to 2019, and 52% that they expected coatings sales to increase this year.

Doug Kramer, president, U.S., of Huntsman Building Solutions, oversaw the company’s integration with recently acquired Icynene-Lapolla and Demilec during the pandemic’s onset. He said pivoting quickly will be key to moving forward.

“We believe this is an opportunity to educate on roofing sustainability,” Kramer said. “Building owners and managers are paying closer attention to the value proposition and technologies and materials available to them while cost efficiency is a heightened concern. Coatings offer key solutions in this area.”

Right Timing

All of that momentum put the coatings market on firm footing prior to the COVID-19 pandemic. The economic crisis that ensued has stung in some ways, but opened up opportunities for roofing contractors with the right mindset.

Veteran roofer Richard Brindisi, owner of Arizona-based Heat Guard Today, said he sees shades of 2008. That’s when he entered the roof-coating business after recognizing the shift in priorities from facility owners he knew in the real estate field.

This spring, he designed a company mailer showing the all-too-familiar enlarged image of a coronavirus molecule on the cover, with a message describing how COVID-19 has changed budget priorities. It got the intended response, he said.

“The piece tries to get their attention and to let them know that in the time of COVID-19 their budget is gone or likely to disappear,” Brindisi explained. “I’m hoping that the angle we’re using gives people enough pause to gain a different perspective. Whether they want to believe or not, they’re in this crisis.”

Suppliers and manufacturers are paying attention, too. Different companies have increased their sales communications with contractors and are offering digital solutions — such as webinars and video conferences to address issues like virtual selling, training and product demos.

“A lot of commercial owners are currently struggling to collect rent and are thus reevaluating intended expenditures,” Kramer said. “They are likely going to repair and maintain as much as possible, until they have better visibility toward the future or until a replacement is unavoidable.”

Brindisi said he recognizes roofing contractors are becoming more tech-savvy. He’s also ready for the competition he expects to build their own maintenance programs.

“Welcome to capitalism,” he declared. “That’s just the way of the world. The only way to limit your competition is to raise your standard and that’s what we do.”

INSERT ALL THE HUB STUFF HERE

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!