2016 Commercial Roofing Report

A Roofing Contractor editorial study shows that commercial roofing’s immediate future looks good, but issues with labor are preventing the future from looking great.

It wasn’t all that long ago when the biggest crisis facing the roofing industry was not enough business. While that still may hold true for some, business is getting better for most companies. And, according to Roofing Contractor’s Commercial Roofing Trends study, the outlook going forward is positive. Sales are up, allowing companies to start looking at new tools to gain business or run more efficiently. However, as the rule of economics goes, if there’s an increase in demand but the supply isn’t there, then costs go up. Such is the case with labor. But this isn’t 2009 when so much uncertainty clouded the landscape.

Focus on Commercial

The purpose of this editorial study was to take an exclusive look at the commercial side of roofing, even though 13 percent of respondents did have some involvement with the residential market. By far, most of the respondents said that their companies generated the bulk of their revenue through replacement roofs (50 percent), followed by new roofs (21 percent) and repair (17 percent). Allocating work in this manner has been working.

Although 11 percent of respondents expect sales volumes to decrease in 2016 compared to 2015, 20 percent expect sales to remain the same. Fifty-five percent expect a slight increase in sales volume, while 13 percent expect sales to greatly increase when compared to last year. As a whole, commercial roofing expectations are optimistic heading into 2017 and beyond. The percentage of respondents expecting to see a decrease in 2017 sales drops to 4 percent and the number of those who expect sales to stay the same jumps to 28 percent. Respondents who expect to see increases, both slight and great, remain relatively unchanged at 57 percent and 12 percent respectively. Their outlook on the next three years is even more optimistic. Although 5 percent still expect to see a decrease, 14 percent expect sales to remain steady and 59 percent expect to see an increase. However, a whopping 22 percent are expecting to see a great increase in the next three-year stretch.

The Products

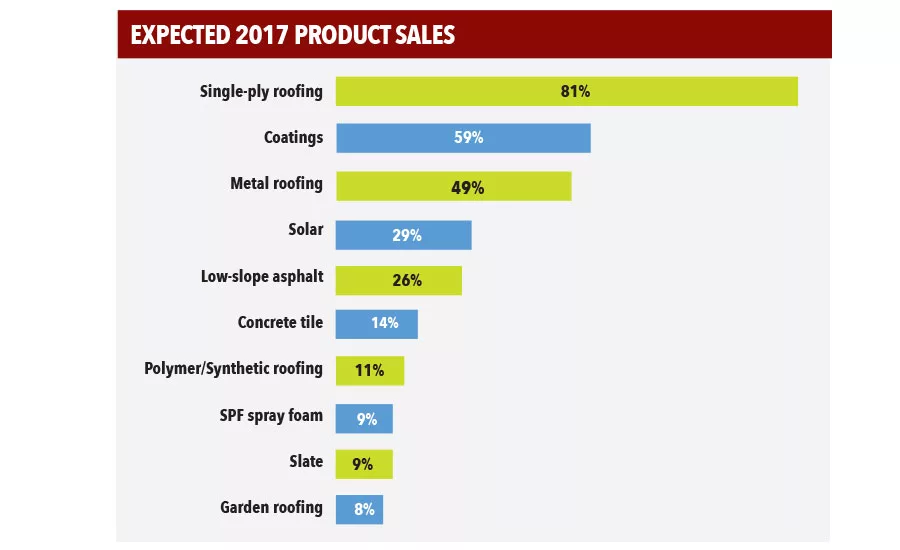

It’s fantastic that so many are expecting sales volumes to increase in the near future. The question now is: Where do they see those increases occurring? To find out, we asked about the products their companies are currently selling to get a benchmark for the future.

Single-ply

On average, the respondent companies are involved with four product types. Unsurprisingly, nearly all (96 percent) are involved with single-ply roofing products, given that this product alone is responsible for more than half of commercial roofing sales (58 percent). TPO is the standout product in the single-ply segment, accounting for half of sales, followed by EPDM (27 percent) and PVC (23 percent). Two-thirds of commercial roofing contractors reported seeing an increase in sales of single-ply roofing products, and 81 percent believe that sales will continue to increase through 2017.

Low-slope Asphalt

More than half of those participating in the survey (60 percent) said their companies were involved with low-slope asphalt roofing. This type of work accounted for far fewer sales than single-ply roofing, but still was second in the survey ahead of metal roofing and coatings. Within the segment, modified bitumen-SBS topped the low-slope asphalt products being sold at 52 percent. Built-up roof and modified bitumen-APP checked in at 30 percent and 17 percent respectively, with other forms rounding out the low-slope asphalt group at 1 percent. According to 33 percent of respondents, sales for this group of products outpaced 2015, and 26 percent expect that trend to continue through 2017.

Metal Roofing

Respondents to the survey believe that metal roofing is on the rise. Fifty-percent of those we asked say that they saw an increase in 2016 sales, and 49 percent expect that to continue through next year. Metal accounts for only 10 percent of sales, on average, for those who offer it. Architectural standing seam and edge metal are the most popular products, followed by structural standing seam, metal architectural shingles/tile/shake and other metal roofing types.

Coatings

Coatings are offered by 70 percent of the businesses surveyed. Interestingly, this segment accounts for only 10 percent of reported sales for the past year, but the potential is obvious. There was an increase in coatings sales by 50 percent in 2016 compared to 2015, and more than half of the companies surveyed expect that trend to continue into 2017.

Remaining Products

Once past the four product types above, a significant drop off or variation among the other types of roofing products being offered by the respondents’ respective companies occurs, according to the survey. Garden roofing, slate, polymer/synthetic roofing, concrete tile, solar, SPF spray foam, and other products, range from 31 percent of companies surveyed selling a product to 6 percent selling a product. It’s reasonable to then assume that these products don’t account for as great a sales volume as the four previously mentioned products because fewer companies are selling them. Because of this, it’s hard to accurately interpret the resulting data regarding the future sales outlook for these products.

However, with regard to garden roofing and other sustainable roofing choices, Matt Barmore, sustainable systems product manager at Firestone Building Products, said the need for creative, energy-efficient solutions in building design will only grow. Companies best suited to meet the expectations of architects and roofing contractors working on complex, customized designs are positioned for success.

“The product portfolio is engineered to meet the growing need for storm water management on the rooftop,” Barmore said. “Firestone Building Products is committed to adapting its green roofing portfolio to offer customers the best solutions for design and function in the industry.”

Workforce Issues

Labor issues facing the roofing industry are no joke. But this next piece of information might make you feel better (or not): The roofing industry alone isn’t suffering from issues related to skilled labor. This is a problem for the HVAC industry1, surveying2, interior construction3 and other industries. While countries like Germany may have found an answer to the question of how to increase the skilled labor force with regard to trades4, the U.S. is still searching. And as the U.S. market as a whole searches for a solution, individual companies are left to find answers on their own.

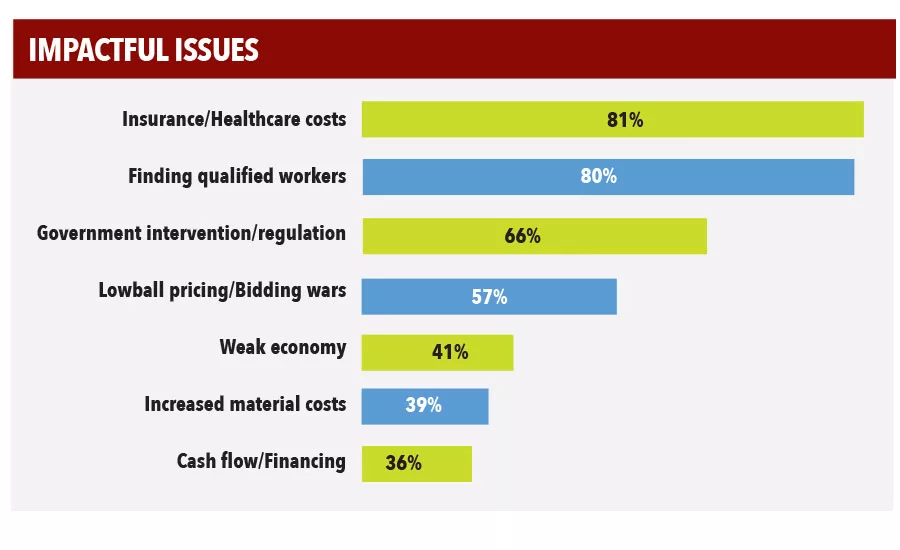

The increasing strain on employers is that the cost for keeping skilled employees is going up. The vast majority of respondents to the survey (88 percent) said costs increased by an average of 12 percent in 2016 compared to 2015, while the remainder expressed that their costs were about the same as the prior year. Insurance and healthcare costs were rated as the number one impact to business in 2017, followed closely by the search for qualified workers as the second-most impactful issue.

Government intervention and regulations checked in as the third-most topic of concern for the upcoming year. But, perhaps disturbingly, nearly half of respondents (46 percent) weren’t aware of the new industry standards regarding silica dust exposure that went into effect in June. Full industry compliance is required by June 23, 2017, according to OSHA5. Respirators (27 percent) and surface wetting (23 percent) were the measures currently being used or will be used in the future to mitigate exposure by respondents. Sixty-six percent either didn’t know how they were going to mitigate exposure or didn’t expect the issue to be a concern. Fall protection and concerns for such factors as worker fatigue and heatstroke were of primary importance. Other concerns include fire and exposure to hazardous materials (other than silica), as well as lighting strikes.

(For a more in-depth look at the factors increasing labor costs, and what might increase them in the future, check out Roofing Contractor’s two-part series “Regulations, Executive Orders and Court Rulings” 6 from the Aug. and Sept. 2016 issues.)

Do these factors driving an increase in labor costs mean employers are changing up staffing or how field labor is conducted? Not according to the survey. While 25 percent of our respondents reported an increase in subcontractor use, 67 percent said that their use of subcontractors remained the same. Another 9 percent reported that their use of subcontractors in the field decreased. In total, field labor is still being done mostly by employees (82 percent) rather than subcontractors (18 percent). Specialty work was cited most often as to why subcontractors were being used. Other reasons did extend to lower labor costs and a shortage of qualified labor as well as workload demands.

Business Tools

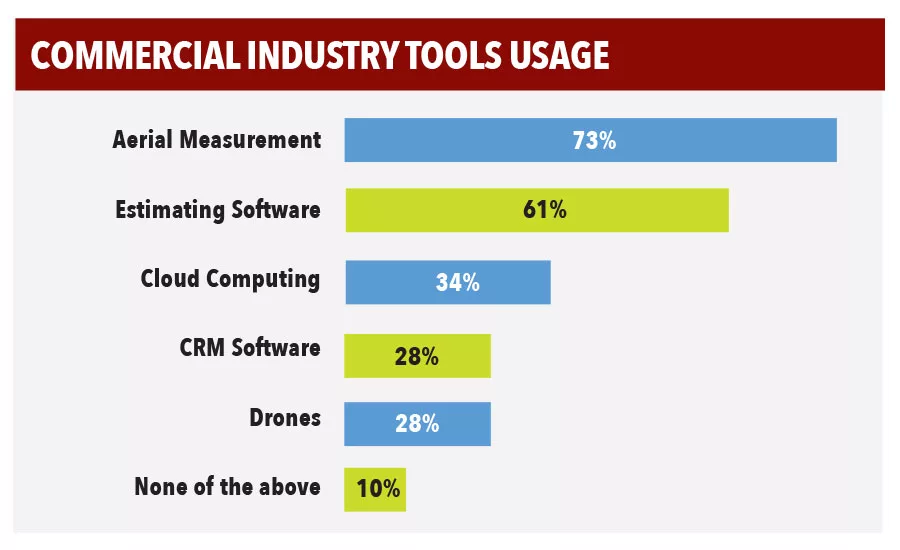

Using the latest technology can be helpful. But, especially with the newest technology, early adopters can experience rough going due to tech-specific learning curves or new rules and regulations popping up to cope with the very latest trends. That said, most people surveyed said that their companies used some form of technology considered to be cutting edge.

Aerial measurement is definitely not the newest to the industry, so it’s no surprise that almost three-quarters of our respondents (73 percent) said it was used by their companies. Checking in as the second-most used piece of tech (61 percent) is estimating software, yet another business tool that’s been around for a longer period of time than some of the others. Cloud computing was third on the survey’s list of products, followed by a tie between customer relations management (CRM) software and drones, which were considered separate from aerial measurement for this study.

For 2017, 35 percent of those surveyed plan on upgrading or making additions to their business software, with estimating software being the most popular response. This was followed by business process software, CRM software and other software not specifically named.

And, of course, giving roofers new and better products can help business, too. “Innovating new commercial building performance solutions is top of mind at Firestone Building Products because we understand and always consider the unique challenges of our contractors, architects and building owners,” said Tim Dunn, president of Firestone Building Products. “Their trust is the reason we can confidently promise that, ‘Nobody Covers You Better.’”

What was Learned

Given the feedback by respondents from the survey, it’s pretty safe to assume that most in the commercial roofing segment feel positive about the direction their businesses are heading. Tried-and-true products are the standard bearers for those good feelings, the profits of which are giving many businesses the confidence to invest in new technology. Others might see this as a chance to embark on a new line of product offerings.

Of course, not everything is coming up roses. Skilled labor and the costs associated with labor are holding back what could very well be a boom for the industry, especially from a cost-certainty standpoint.

So, while we probably wouldn’t consider it to be a golden era for commercial roofers right now (maybe not even a renaissance), it could be far worse. Roofing Contractor will continue to keep its proverbial fingers on the pulse and share our prognosis with you.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!