The fourth quarter of 2012 was a tumultuous time. The country went through a toughly fought presidential election, and the fragile economy faced the prospect of a combination of tax increases and government spending cuts so onerous that it was dubbed the “fiscal cliff.” It was during this period that Roofing Contractorand BNP Media Market Research conducted the most recent State of the Industry survey, sponsored by GAF.

Now in its fifth year, the survey was designed to get the contractor’s perspective on the residential and commercial roofing markets. Other goals of the survey included identifying trends in annual sales volumes and product categories.

The survey asked contractors about the key challenges facing the industry in the year ahead. It also contained questions about other topics, including their plans for capital expenditures and use of aerial measurements.

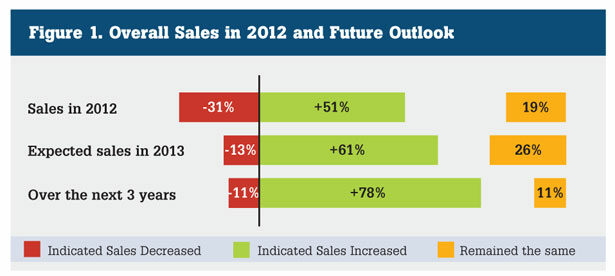

The bottom line: Despite the ongoing political wrangling and economic uncertainty, a majority of contractors surveyed expect to see a gradual increase in sales for the future. Overall, 61 percent of respondents expect sales to increase in 2013, and 78 percent expect sales to increase over the next three years. (See Figure 1.) Contractors whose business focused primarily on residential work had a slightly stronger sales outlook than contractors who focused primarily on commercial projects.

The Survey

The web-based survey was conducted from Oct. 31 through Nov. 14, 2012.

The contractors in the survey included Roofing Contractorsubscribers and contractor partners of Allied Building Products Corp. Consistent with the previous surveys, respondents to the study were typically high-ranking members of their companies. Sixty-three percent listed their title as owner, president, CEO or vice president, while another 26 percent were managers or supervisors. Companies in the survey reflected a wide variety of sizes. Overall, the mean number of full-time employees was 29, and the mean gross annual sales figure for 2012 was $3.7 million.

The companies surveyed perform a variety of residential and commercial work, and the largest share of their revenue is derived from replacement and repair. Taken as a whole, 43 percent of the revenue from contractors surveyed came from residential replacement and 17 percent from commercial replacement. Residential repairs accounted for 13 percent of revenue, while commercial repairs accounted for 9 percent. Residential new construction accounted for 10 percent of revenue, and commercial new construction accounted for 8 percent. Thus 82 percent of total revenue in 2012 came from some sort of remedial work, either re-roofing or repairs.

For many questions, the survey results broke down the data for the commercial and residential markets separately, dividing the sample as follows: respondents with at least 50 percent of their business revenue coming from residential sources were analyzed in the residential group. Respondents with at least 50 percent of revenue from commercial sources were classified in the commercial group. Remember that some contractors in the residential group could do a substantial amount of residential work, and contractors in the commercial group could do a substantial amount of commercial work.

Companies in the residential group averaged $2.2 million in sales in 2012, while companies in the commercial group averaged $6.7 million.

Sales in 2012 and Outlook for 2013

Overall, about half (51 percent) of contractors surveyed had year-over-year increases in sales in 2012. (See Figure 1.) As mentioned above, 61 percent of respondents expect sales to increase in 2013, and 78 percent expect sales to increase over the next three years.

Residential Group:In the residential group, 53 percent of contractors saw an increase in sales last year. (See Figure 2.) Sixty-four percent expect sales to increase this year, while 10 percent expect sales to decline. Twenty-five percent expect sales to remain the same. Over the next three years, 81 percent of residential contractors expect to see sales growth, and only 9 percent expect sales to drop.

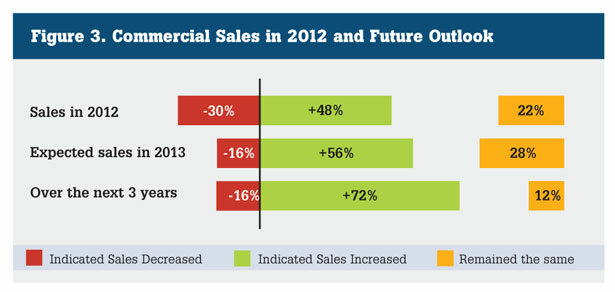

Commercial Group:In the commercial group, 48 percent experienced a sales increase in 2012, while 30 percent saw a decrease. (See Figure 3.) This year, 56 percent of contractors in the commercial group expect sales to go up, and 72 percent expect them to continue to rise over the next three years.

Products Installed

The survey asked contractors about the types of products they offered and the revenue that resulted from each product category.

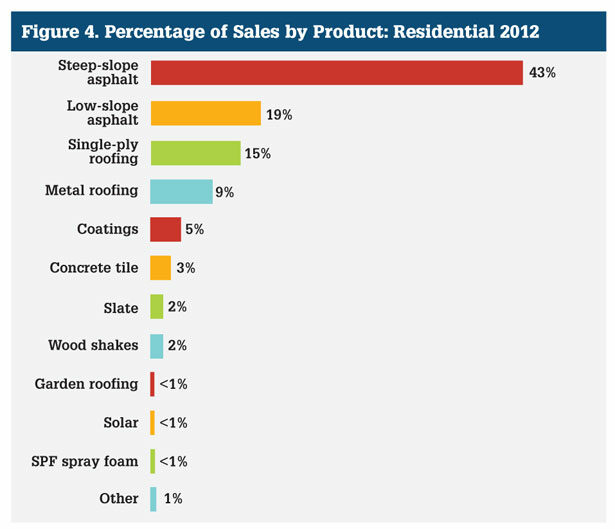

Residential Group:For contractors in the residential group, steep-slope asphalt accounted for the largest chunk of business at 43 percent. (See Figure 4.) Low-slope asphaltic products accounted for 19 percent of revenue and single ply accounted for 15 percent. Metal roofing accounted for 9 percent of revenue and coatings for 5 percent.

We also asked respondents to detail the types of single-ply and low-slope asphalt products they installed and the revenue of each sub-category as a part of the total. Single-ply product sales in the residential group broke down this way: EPDM accounted for 48 percent of single-ply revenue, followed by TPO (29 percent), PVC (12 percent) and other (11 percent).

Modified bitumen products accounted for 62 percent of low-slope asphalt revenue for residential contractors (34 percent for SBS and 28 percent for APP), while built-up roofs (BUR) accounted for 24 percent.

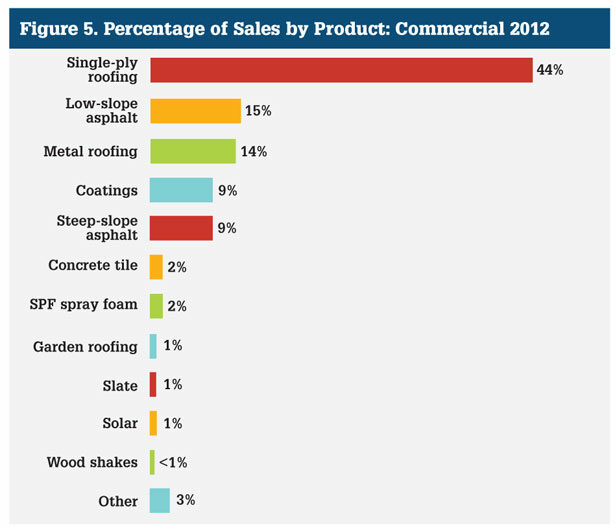

Commercial Group:For contractors in the commercial group, single ply products accounted for the biggest piece of the pie at 44 percent. (See Figure 5.). Low-slope asphaltic products came second, accounting for 15 percent of annual revenue. Metal roofing accounted for 14 percent of revenue for contractors in this group and coatings represented 9 percent. Steep-slope asphalt accounted for 9 percent of revenue.

Within the single-ply category, commercial contractors derived the most revenue from TPO. The amount of revenue in the single-ply category for the contractors in the commercial group broke down this way: TPO (47 percent), EPDM (31 percent), PVC (18 percent) and other (4 percent).

Within the low-slope asphalt category, modified bitumen products accounted for 60 percent of the total (37 percent for SBS and 23 percent for APP), while BUR accounted for 35 percent of the total.

Sales Trends

The survey also asked contractors about sales trends for the types of products they installed. Specifically, questions asked if sales increased, decreased of stayed the same in 2012 for each segment of their business. We also asked about expectations for this year.

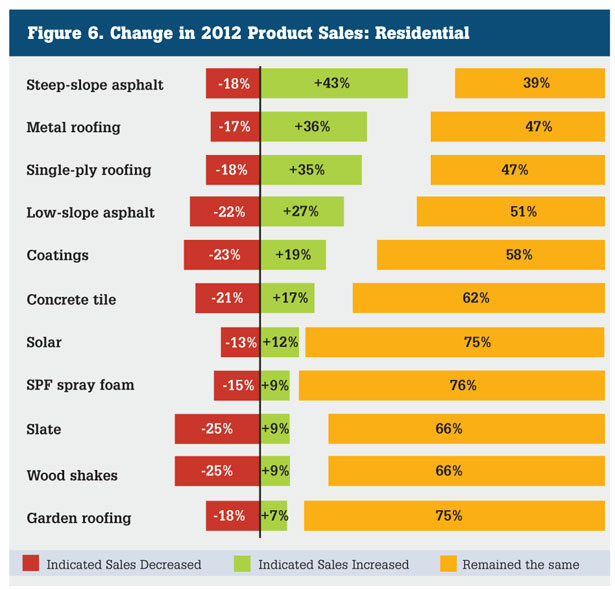

Residential Group:In the residential group, steep-slope asphalt was the category with the greatest number of contractors seeing an increase in sales last year. Forty-three percent of residential contractors saw steep-slop asphalt sales rise, while 18 percent saw sales decline. (See Figure 6). There were other solid performers in the residential group, including metal roofing, with sales increasing for 36 percent of respondents. Single-ply revenue was up for 35 percent of the contractors in this group, and low-slope asphalt revenue was up for 27 percent.

When asked to predict how these products categories would fare this year, contractors in the residential group had the highest expectations for steep-slope asphalt products; 60 percent expected a sales increase in that category. Single-ply sales were also expected to be strong, with more than half (53 percent) expecting an increase in revenue. The outlook was also good for metal, with 46 percent expecting an increase, and low-slope asphalt, with 41 percent expecting an increase.

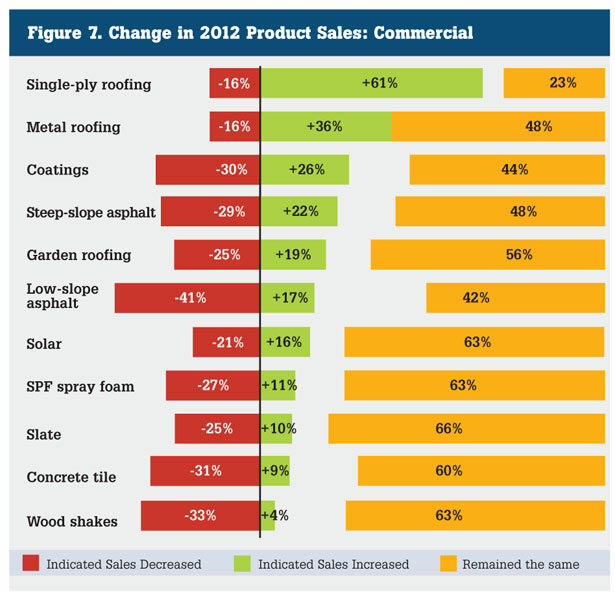

Commercial Group:In the commercial group, single-ply was the category with the most contractors seeing a sales increase in 2012. (See Figure 7.) Sixty-one percent of respondents in the commercial group saw single-ply sales increase last year. Other products seeing the greatest increases in this group included metal roofing (36 percent), coatings (26 percent) and steep-slope asphalt (22 percent).

Looking ahead to this year, expectations are still high for single ply among commercial contractors, with 68 percent of respondents predicting an increase in single-ply sales in 2013. Other categories with strong outlooks for growth include coatings (41 percent), metal roofing (41 percent), steep-slope asphalt (39 percent), and low-slope asphalt (29 percent).

Business Conditions and Hiring

The survey included several questions about the business climate, including whether the number of employees working for the company increased or decreased. We also asked if they believed business conditions had changed and if they were improving or getting worse.

Residential Group:Companies in the residential group averaged 10 employees in 2012. Thirty percent of the companies in the residential group added workers last year, and 46 percent expect to hire additional workers this year.

When asked about overall business conditions in the roofing industry, 22 percent of residential contractors thought things improved in 2012. About 44 percent thought they were worse, and 34 percent thought they stayed about the same. They show more optimism about this year, with 44 percent predicting business conditions would improve in 2013 and only 18 percent expecting them to deteriorate.

Commercial Group:Companies in the commercial group averaged 67 employees. Thirty-four percent of these companies hired more workers in 2012, and 48 percent of them expect to add workers next year.

Twenty-three percent of respondents in the commercial group thought conditions improved in 2012, and 39 percent believe conditions will improve this year.

Manufacturer-Sponsored Certification Programs

The survey asked if contractors were members of any manufacturer-sponsored programs that certified them as expert installers of their products. We also asked how many manufacturers they were certified with and how helpful the programs were in training employees and promoting the business.

Residential Group:Forty-eight percent of contractors who primarily focused on residential work were members of a manufacturer-sponsored certification program. Of those responding yes, they participated with an average of 2.64 manufacturers. Thirty-five percent participated with just one manufacturer, 24 percent with two manufacturers, 33 percent with three to five manufactures, and 8 percent with six to 10 manufacturers.

A vast majority of contractors who participated in manufacturer-sponsored programs found them helpful. Ninety percent found them at least somewhat helpful when it comes to training employees, with 48 percent rating them “very helpful” or “extremely helpful.” Ninety percent of those in the programs also found them helpful in promoting their businesses, with 62 percent rating them as “very important” or “extremely important” in that regard.

Commercial Group:Companies who focused primarily on commercial work were much more likely to be part of a manufacturer-sponsored certification program than those in the residential group. Eighty-one percent of those in the commercial group belonged to at least one such program, and they participated with an average of 5.92 manufacturers. Only 8 percent were certified with just one manufacturer.

The manufacturer-sponsored programs were rated as helpful by a large majority of participants. Ninety percent reported that certification programs were at least somewhat helpful with employee training, with 51 percent rating them “very helpful” or “extremely helpful.” Similarly, 88 percent of respondents in this group said they were at least somewhat important in promoting their businesses, with 62 percent rating them “very helpful” or “extremely helpful.”

Capital Investments

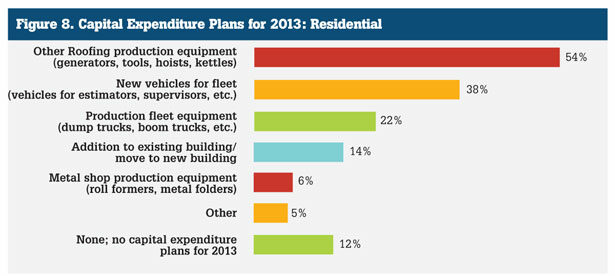

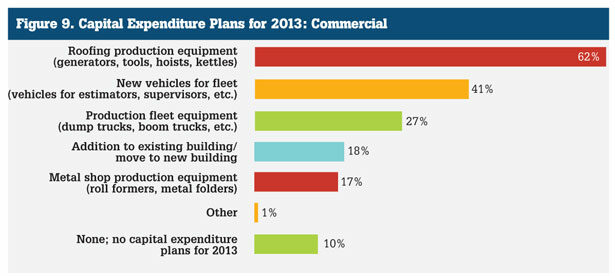

Respondents were asked if their companies planned to make any capital investments this year, including additions to their buildings, new vehicles for their fleets and new roofing production equipment. We also asked if they planned to upgrade their business software in 2013.

Residential Group:Asked about capital expenditures planned for 2013, more than half (54 percent) of respondents in the residential group indicated they would invest in roofing production equipment including tools, generators, hoists and kettles. (See Figure 8.) Thirty-eight percent indicated they would be purchasing new passenger vehicles for their fleets, and 22 percent planned to invest in production vehicles, such as boom trucks and dump trucks. Fourteen percent planned to add on to their existing buildings or move to a new one. Only 12 percent planned on making no such purchases. In a separate question, 36 percent indicated they planned to upgrade their software this year.

Commercial Group:Contractors in the commercial group plan to make even more investments in their companies. (See Figure 9.) Sixty-two percent of them plan to purchase new roofing production equipment. As far as vehicles go, 41 percent expect to add passenger vehicles to their fleets, and 27 percent plan to add production fleet equipment/trucks. Eighteen percent plan to add machines such as roll formers and benders to their metal shops. Seventeen percent plan to upgrade their buildings or move. Thirty-two percent plan to make software upgrades.

Use of Aerial Measurements

We also asked if contractors currently use or plan to use aerial measurements to prepare estimates for customers.

Residential Group:Aerial measurements are currently used by a third of the contractors in the residential group, and another 13 percent plan to begin using them in 2013. Of those who currently use aerial measurements, 56 percent utilize them on 25 percent of their jobs or less. Eighteen percent use them on 26-50 percent of their jobs, and 27 percent use them more than 50 percent of their jobs.

Commercial Group:The percentage of users in the commercial group was a bit larger, with almost half (48 percent) of respondents indicating they currently use aerial measurements. Another 7 percent plan to add them this year. Fifty-seven percent of respondents using them on 25 percent of their jobs or less. Eighteen percent use them on 26-50 percent of their jobs, while 24 percent use them on more than 50 percent of their projects.

Numerous Challenges

The roofing industry faces its share of challenges, and this year is certainly no exception. Contractors were asked to rate a number of issues from 1 to 5 to determine which ones they thought would have the most impact in 2013. Options included the weak economy, increased material costs, government intervention/regulation, insurance/health care costs, lowball pricing/bidding wars, finding qualified workers, and cash flow/financing. In every case, more than half of all respondents in both groups rated each of those challenges a 4 or 5 — that is, “very impactful” or “extremely impactful.”

Residential Group:The top five answers for the residential group are shown below, along with the percentage of respondents who checked the top two responses (“impactful” and “very impactful”).

1. Increased material costs (78 percent)

2. The weak economy (69 percent)

3. Insurance and health care costs (68 percent)

4. Lowball pricing/bidding wars (65 percent)

5. Cash flow/financing (56 percent)

Commercial Group:Contractors in the commercial group rated the top five issues this way:

1. The weak economy (73 percent)

2. Insurance and health care costs (76 percent)

3. Lowball pricing/bidding wars (70 percent)

4. Increased material costs (75 percent)

5. Government intervention/regulation (61 percent)

The survey gave contractors a chance to share their advice on succeeding in today’s environment, and the majority of respondents took advantage of the opportunity. Most focused on the business basics, including doing quality work, knowing your costs, estimating properly and managing cash flow. Many stressed the importance of being honest with customers.

“Do what you say you are going to do and your customers will love (and refer) you forever,” said one contractor.

Another summed it up this way: “Do what you know and keep striving to learn more; that way as the market shifts and changes, you are able to change with it.”

In the face of some daunting challenges, it looks like entrepreneurs in the roofing industry plan to forge ahead. Let’s hope 2013 turns out to be a lucky number.

Report Abusive Comment