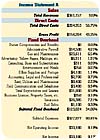

Income Statement A.

I know people get tired of hearing me preach about the importance of knowing your numbers. I laugh when people mistakenly think I am an accounting or financial nerd. I actually am not a detailed accounting type, and that is one of the reasons I left my first job as a cost accountant. I did not want to spend the rest of my life beating on a calculator all day. I do, however, know the financial answers I need, even if I do not compile the information myself. I use this information to make strategic decisions and run my business. Running a business without the numbers is like groping around in a dark room trying to find a black cat.

At a recent convention, I heard a comment from an attendee who said all consultants tell people to raise their prices and asked, "Like, duh, what kind of advice is that?" But for smaller contractors - the majority of the contractors in the United States - I want to take a moment to demonstrate just how important it is to get the numbers in the correct format, and why, for many, raising prices is the best strategy.

Income Statement B.

A Typical Example

The first income statement, Income Statement A, is a hypothetical example, but it is typical of a statement I might receive from a small contractor. The categories are not set up correctly, and it is really difficult to tell what the contractor's true gross profit is. Offering financial advice for such companies can be very difficult. They have little financial data, most do not do job costing and their statements are in a format that is almost impossible to read. Hence the advice - raise your prices.If these companies cannot make a living at their current level, raising prices at least gives them a fighting chance. Since smaller contractors obtain much of their work from repeat and referral business, raising prices does not have the devastating impact many of them believe it will.

For these examples, I am not including an owner's salary under fixed overhead. I do recommend owners draw a salary, but entering an owner's salary makes the math more difficult to follow in this example. So, in this case, we are going to assume the business's profit equals the owner's income.

Income Statement C.

Our final financial statement, Income Statement C, shows what the contractor's income would be with a 10 percent price increase. While I like to see gross profits in the 40 percent range, this increase more than doubles the contractor's bottom line.

While the above statements are fictitious, they are fairly typical of what might be seen with a contractor of this size. For contractors who have poor financial records who are not making enough money, telling them to raise their prices 10 percent at least gives them a fighting chance to make it. Of course, most contractors' problems are much more complicated than this example. Many are inefficient, others are doing the wrong type of work, others make money on certain types of jobs and lose money on others, so this one-size-fits-all approach may be unrealistic, but it can at least get folks pointed in the right direction.

Report Abusive Comment